Importer Exporter Code (IEC)

Importer Exporter Code (IEC)

An Importer Exporter Code (IEC) is a crucial business identification number which mandatory for export from India or Import to India. Unless specifically exempted, any person shall make no export or import without obtaining an IEC. For services exports, however, IEC shall not be necessary except when the service provider is taking benefits under the Foreign Trade Policy. Consequent to the introduction of GST, IEC being issued is the same as the PAN of the Firm. However, the IEC will still be separately published by DGFT based on an application. This article looks at the procedure for making an IE Code application in detail.

Import Export Code (IE Code)

Import & Export Code is to be obtained by the business entity for import into or export from India. Import & Export Code is popularly known as the IEC number. Import & Export Code is a ten-digit unique number issued by the Directorate General of Foreign Trade (DGFT).

IEC registration certificate is mandatory for a business involved in import and export. Hence, before initiating an import of goods into India, an importer must ensure that the importing entity has GST registration and IE code – both of which are required to clear customs.

If an importer does not have both IE code and GST Registration, the goods will be stuck at the port and start incurring demurrage charges or could be destroyed.

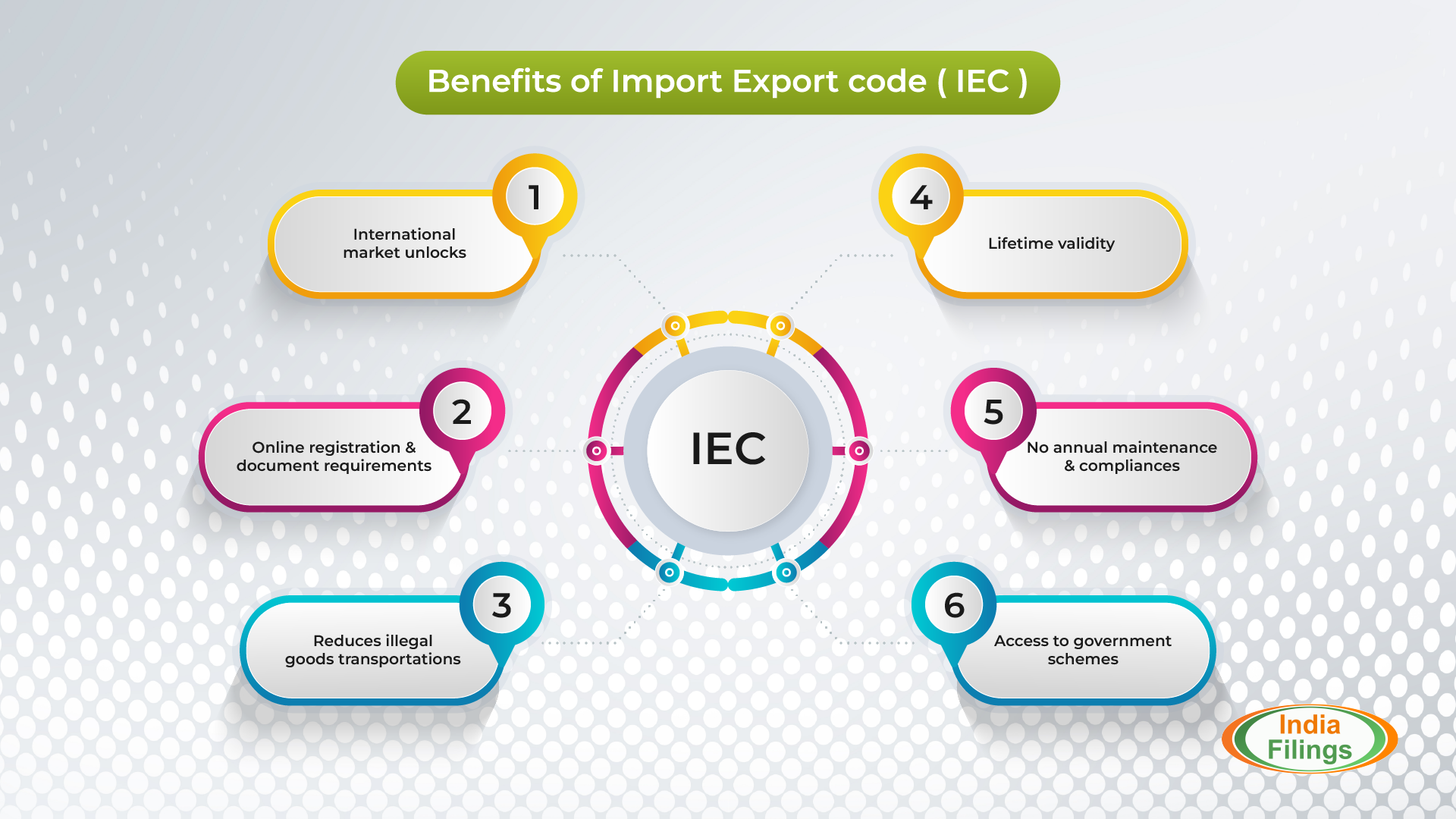

Importance of Import Export Code

Businesses have a great option to enter the international market with the export and import of the products and the services they are involved in. The IE code is an essential requirement while entering the global market as it supports the growth and development of the business to a certain extent. There are various advantages of getting an Import Export Code.

Here we have listed a few of them:

- International market unlocks: As the IE Code is a requirement for the import and export business, they allow the products to reach the global market. IE code makes the entry of the international Indian company smoother and opens doors for growth and expansion.

- Online registration: The process to find the IE Code is entirely online and hassle-free with short document submission.

- Less document requirement: It is not required to submit many documents to obtain an IEC.

- Lifetime Validity: IE Code is a lifetime registration valid as long as the business exists. Hence, there are no issues with updating, filing, and renewing Import Export Code registration. The IE registration is valid until the company exists or the registration is not revoked or surrendered.

- Reduces illegal goods transportation: The most basic requirement for the Import-Export code is that you need to provide authentic information. Without giving proper information, IE code cannot be obtained. This criterion makes the transportation of illegal goods impossible.

- Availing Several Benefits: IE code has enormous benefits for importers and exporters. The registered business entities can get help through subsidies from the Customs, Export Promotion Council or other authorities. With LUT filing under GST, the exporters can make exports without paying taxes. If the exports are made with tax payment, the exporter can claim the refunds of the paid tax amount.

- Compliances: Unlike other tax registration, the person carrying import or export does not require to fulfill any specific compliance requirements such as the annual filing or the return filings.

Validity of IE Code

As mentioned above, IE Code registration is permanent and valid for a lifetime. Hence, there will be no hassles with updating, filing, and renewing the IEC registration. It is valid till the business exists or the registration is not revoked or surrendered. Further, unlike tax registrations like GST registration or PF registration, the importer or exporter does not require to file any filings or follow any other compliance requirements like annual filing.

As IE code registration is one-time and requires no additional compliance, it is recommended for all exporters & importers to obtain IE code after incorporation.

Nature of the Firm obtaining an IEC

The nature of the Firm obtaining an IEC may be any of the follows:

- Proprietorship Firm

- Partnership Firm

- Limited Liability Partnership

- Limited Company

- Trust

- Hindu Undivided Family (HUF)

- Society

Pre-Requisites for Applying for IEC

- Valid Login Credentials to DGFT Portal (After Registering on DGFT Portal)

- IEC may be applied on behalf of a firm which may be a Proprietorship, Partnership, LLP, Limited Company, Trust, HUF, and Society.

- The Firm must have an active Firm’s Permanent Account Number (PAN) and details like Name as per Pan, Date of Birth, or Incorporation.

- The Firm must also have a bank account in the Name of the Firm and a valid address before applying.

Note: These details will be validated with the Income Tax Department site.

Documents required for IEC Code registration

The list of scanned documents required for IEC Registration is listed as follows:

- Proof of establishment/incorporation/registration: The following type of Firm needs to submit the establishment/incorporation/registration certificate:

- Partnership

- Registered Society

- Trust

- HUF

- Other

- Proof of Address: Proof of Address can be any one of the following documents:

- Sale Deed

- Rent agreement

- Lease deed

- Electricity bill

- Telephone landline bill

- Mobile, post-paid bill

- MoU

- Partnership deed

- Other acceptable documents (for proprietorship only):

- Aadhar card

- Passport

- Voter id

Note: In case the address proof is not in the Name of the applicant firm, a no objection certificate (NOC) by the firm premises owner in favor of the Firm, along with the address proof, is to be submitted as a single PDF document.

- Proof of Firm’s Bank Account

- Canceled Cheque

- Bank Certificate

- User should have an active DSC or Aadhaar of the Firm’s member for submission.

- Active Firm’s Bank accounts for entering its details in the Application and making online payment of the application fee.

Application Fee for IEC

The User must pay Rs.500 as the Application fee to get the IEC certificate.

Procedure to submit IE Code Application

The procedure to get the Importer Exporter Code Certificate is explained in detail below:

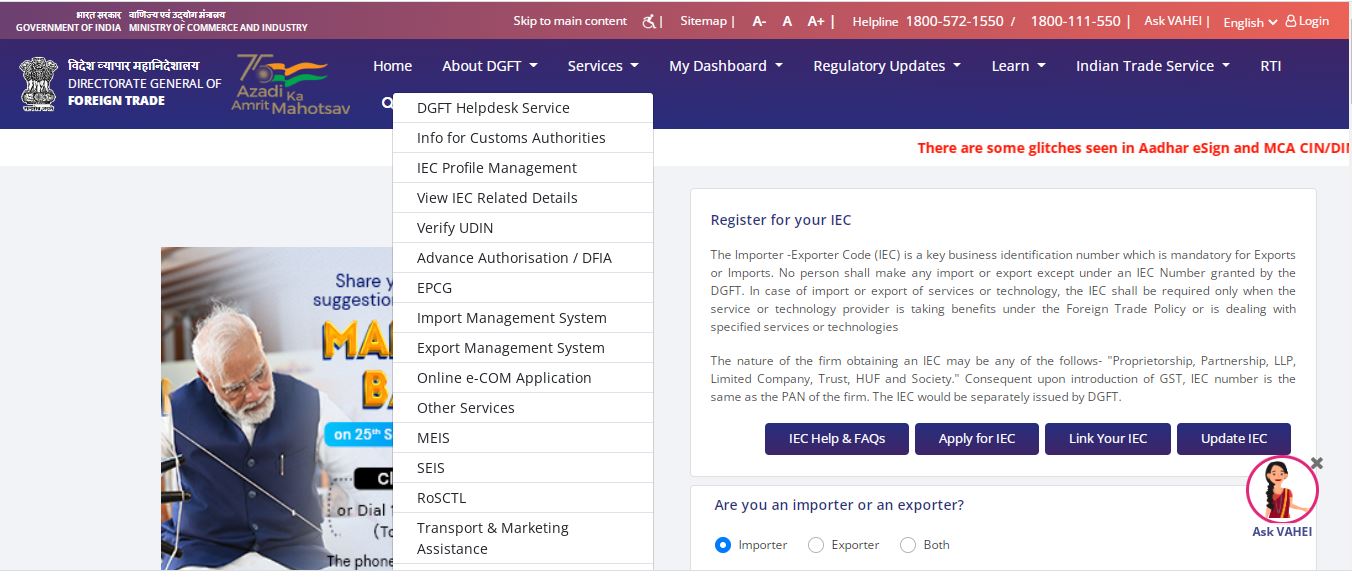

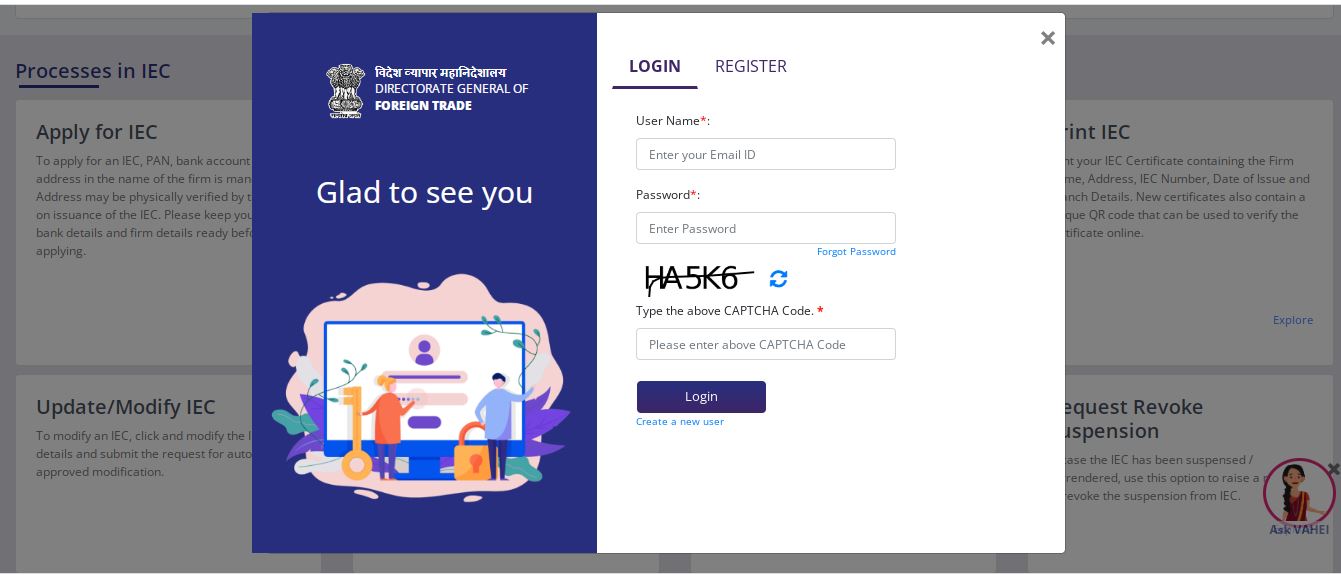

Visit the official DGFT website. Click on the ‘Services’ tab on the homepage and Select the ‘IEC Profile Management’ option from the drop-down list.

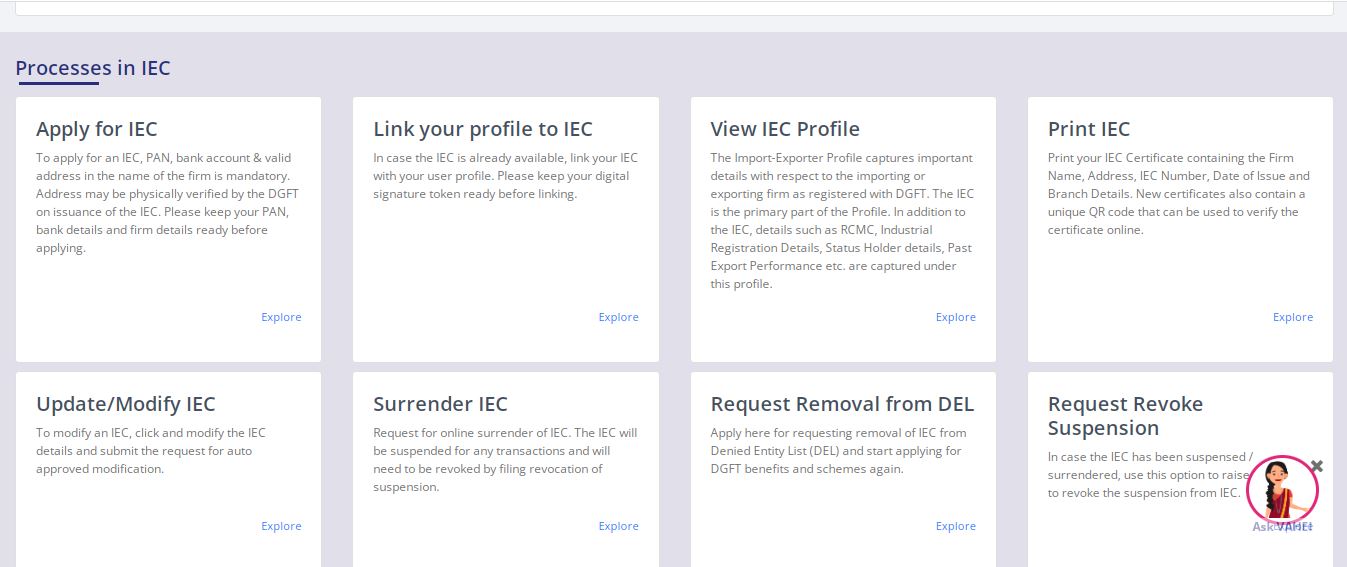

A new page will open. Click on the ‘Apply for IEC’ option on the Page.

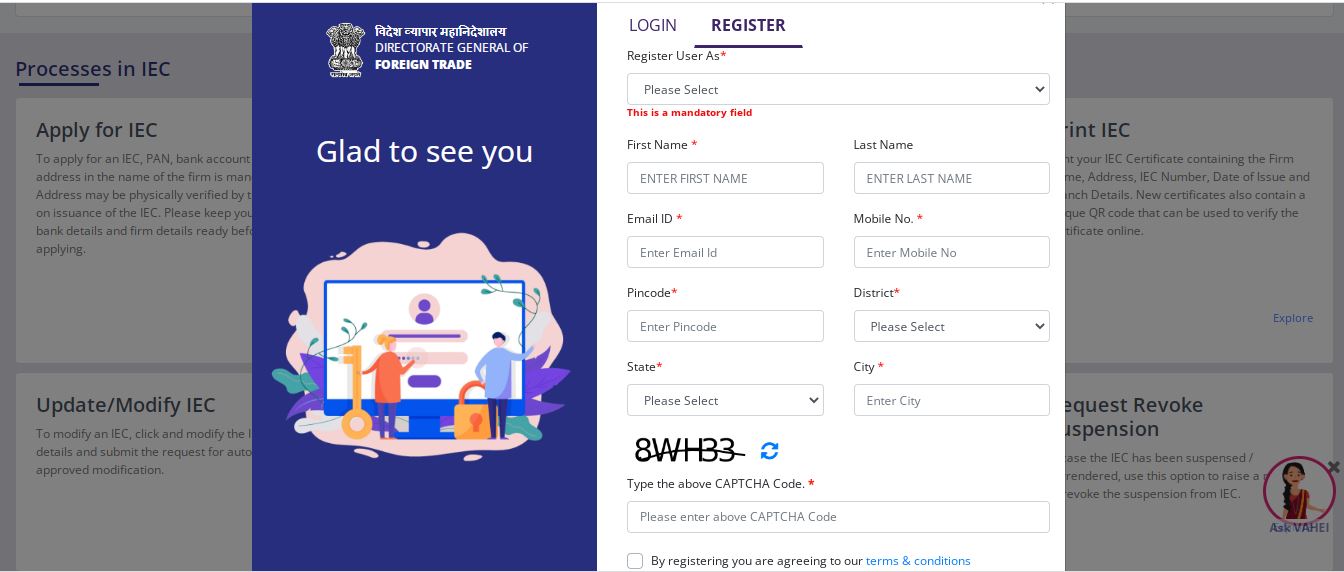

DGFT User Registration

- Click on the ‘Register’ option. Enter the required details and click on the ‘Sent OTP’ button.

- Enter the OTP and click on the ‘Register’ button.

- Upon successfully validating the OTP, the User will receive a notification containing the temporary password, which can change after logging into the DGFT website.

- After registering on the DGFT website, log in to the website by entering the user name and password.

Apply for IEC

- Post login, click on “Apply for IEC” on the Dashboard. Click on the “Start Fresh Application” button or the “Proceed with Existing Application” button if the User has already saved a draft application.

- Fill out the application form (ANF 2A format), and Enter the details in the General Information Section:

- Select nature of Concern/Firm

- Enter Firm Name

- PAN Details

- Select Preferred Activities

- Enter corporate entity number (CIN)

- Enter GSTIN Number of Concern/Firm

- Enter Firm Mobile Number

- Firm Mail ID

- Enter firm address

- Attach address proof of the Firm

- Enter the details in the “Details of Proprietor/Partner/Director/Karta/Managing Trustee” Section

- Enter the details in the “Bank Account Details” Section

- Enter the details in the “Other Details (Exports Sectors preferred)” Section

- Under the declaration, accept the terms and conditions by clicking on the check box.

- Check the Application Summary and click on the Sign button to sign the Application using a digital signature certificate or Aadhaar.

Note: These details will be verified in real-time from the CBDT database

Make Payment

- Confirm and proceed to make the payment against the Application.

- After Successful Payment, the Page shall be redirected to the DGFT Website, and the receipt shall be displayed; the User can also download the ticket.

Get Importer Exporter Code Certificate

The User shall receive the IEC Certificate in the email (used while applying for IEC). If required, the User can download the IEC Certificate after login into the DGFT Website and using the “Print Certificate” feature in “Manage IEC.”

The IEC shall be transmitted to CBIC, and the transmission status can be seen by Navigating to “My IEC” and checking the IEC Status bar with “CBIC Transmission Status.”

The Import Export Code is a primary document that is necessary for commencing Import-export activities. For exporting or importing any goods or services the IE code is to be obtained.IEC has numerous benefits for the growth of the business. Certainly, you cannot ignore the necessity of IE code registration as it is mandatory. You can apply for an Import Export code through IndiaFilings and obtain it within 6 to 7 days.