UAN Registration – Universal Account Number

UAN Registration – Universal Account Number

UAN or Universal Account Number is an employee identification under the Employees’ Provident Fund. UAN has been introduced to consolidate all matters relating to PF of an employee on the Unified Portal. Prior to the introduction of UAN, employees who had contributed to PF used to be provided with a member id by the employer. Hence, many employees had various member id when they worked with multiple employers. To consolidate the member id and uniquely identify a employee, the concept of Universal Account Number (UAN) was introduced by the EPF.

UAN Registration

Employers having 20 or more employees are required to obtain PF registration and enroll employees with wages of upto 15,000 under the Employee’s Provident Fund Scheme. Employers having less than 20 employees can also register for PF volunatararily.

Once, an employer is registered under PF, all employees in the business with wages of upto Rs.15,000 are required to join the Employee Provident Fund and make contributions each month from their salary. The employer and employee would contribute 12% of the wages earned.

When such deductions are made by an employer from the wages, a UAN is provided by the employer to the employee. The amount deducted is then deposited by the employer while quoting the UAN of the employee. The employee can then withdraw the money accumulated in the PF account along with interest on retirement, resignation, death.

Partial withdrawals of money in the PF account is also permitted for financing life insurance policies; acquiring house or land, marriage of self or dependents, education of children, treatment of illness etc.

Know more about PF withdrawal.

How to Get UAN?

UAN can be obtained by a person through an employer having PF registration. If a person joins an employer having PF registration and his/her wages are upto Rs.15,000, the employer must provide UAN. UAN must be provided by the employer for both regular and contract employees having less than Rs.15,000 in wages. Also, an employer must provide UAN to any employee having wages of more than Rs.15,000, if he/she requests.

In case an employee having UAN joins an employer, the employee can just quote the UAN number and continue to use the same account.

Document Required for UAN Registration

To obtain UAN, the employee must submit the following information to the employer:

- Bank Details with IFSC Code

- PAN

- Aadhar

- Passport (Optional)

- Drivers License (Optional)

- Voters Identity (Optional)

- Ration Card (Optional)

- National Population Registry (Optional)

In addition to the above, the employee must submit the following information to the employer for obtaining UAN:

| Particulars | Mandatory | Remarks |

| Personal Title | Mandatory | Mr. / Ms. / Mrs. /Dr. |

| Name | Yes | |

| Gender | Yes | |

| Date of Birth | Yes | Cannot be born before 1916 |

| Father’s or Husband Name | Yes | |

| Marital Status | Yes | Married, Unmarried, Widow/Widower, Divorcee |

| Mobile Number | No | |

| Date of Joining | Yes | Cannot be before 1952 |

| Monthly wages as on joining date | Yes | |

| International Worker | No | Only if applicable |

| Passport Number | No | Mandatory for international workers |

| PAN | Yes | |

| Aadhar | Yes | |

| Passport | No | |

| Drivers License | No | |

| Election Card | No | |

| Ration Card | No | |

| NPR | No | |

| Bank Details | Yes | |

| IFSC Code | Yes |

Procedure for UAN Generation

If a employees UAN is being generated for the first time, the employer can obtain UAN from EPFO portal on the basis of information furnished by the member in the declaration form. Once, the UAN is generated by the employer, the employer would be able to add the employee on the ECR to while filing PF returns and making PF contributions.

The following steps can be completed by employers through the Unified Portal for UAN generation for employees:

Step 1 – Login to EPFO Employer Portal

The employer must login to the EPFO employer portal or Unified Portal for employers. For registration of member for UAN generation or linking, click on “REGISTER – INDIVIDUAL” under the menu tab “Member”.

Step 2 – Upload Employee Information

Upload the employees information for whom the UAN is to be generated. In this screen, the employer must submit the information as per the list as provided above:

Step 3 – UAN Approval by Employer

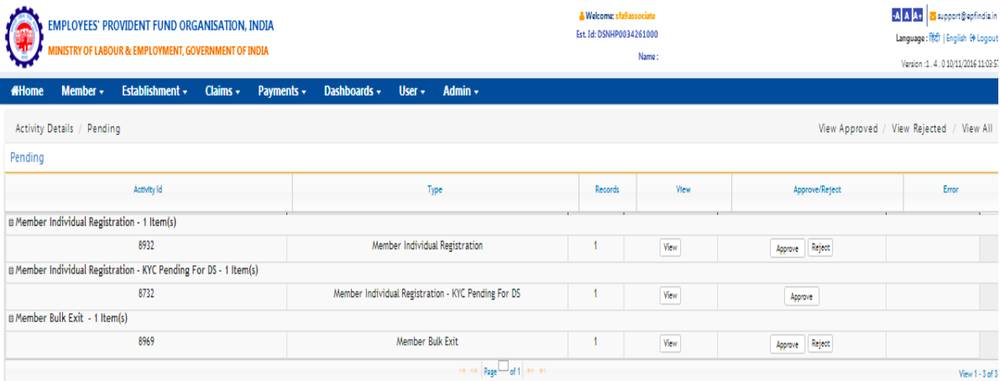

All the UAN registration information submitted in the above screen will be under the approval section. The employer must now access the approval section as provided below:

Step 4 – Approve UAN

In the approval screen, the employer can view the details of employees uploaded, edit, approve or reject. Click on approve to continue.

Step 5 – UAN Generated

Once the submission is approved, UAN will be generated for the employee on the employers EPFO portal as shown below. Now, the employer can begin making contributions on behalf of the employer and employee by filing Electronic Challan cum Return. The employee would use the same UAN for the rest of his employment with any employers.

Contributions for Employees Provident Fund (EPF)

Any member having a UAN is required to make contributions to the provident fund from his/her wages. The contribution to provident fund is normally 12% of the wages earned. The contributions are payable on maximum wage ceiling of Rs. 15000/- for the employers. The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. However, to pay contribution on higher wages, a joint request from employee and employer is to be made on the unified portal.

For some entities as follows, EPF has notified a lower EPF contribution rate of 10%:

- Any establishment in which less than 20 employees are employed.

- Any sick industrial company and which has been declared as such by the Board for Industrial and Financial Reconstruction

- Any establishment which has at the end of any financial year, accumulated losses equal to or exceeding its entire net worth and

- Any establishment in following industries:-

- Jute

- Beedi

- Brick

- Coir

- Guar gum Factories.

Contributions for Employees Pension Scheme (EPS)

For employees pension scheme, contribution of 8.33% is payable out of the employer’s share of PF and no contribution is payable by employee. Also, an employer is not required to make EPS contributions when an employee crosses 58 years of age and is in service (EPS membership ceases on completion of 58 years).

In both the cases the Pension Contribution @8.33% is to be added to the Employer Share of PF. (Pension contribution is not to be diverted and total employer share goes to the PF). In case an employee, who is not existing EPF/EP member joins on or after 01-09-2014 with wages above Rs 15000/- In these cases the pension contribution part will be added to employee share, EPF.

Contributions to Employees Deposit Linked Insurance Scheme (EDLI)

Contribution to EDLI at 0.5% is to be paid on up to maximum wage ceiling of 15000/-. Further, EDLI contribution must be paid even if member has crossed 58 years age and pension contribution is not payable. Hence, EDLI contributions must be paid as long as the member is in service and PF is being paid.