Passport Renewal Online Process

Passport Renewal Online Process & Documents Requirement

It is mandatory for an individual to have a passport in order to visit other countries. Be it a solo trip or family vacation, or even for business or medical purposes, a valid passport is an essential document that one must hold.

A passport need not necessarily guarantee entry into any country. However, it is a prerequisite to travel outside your native country.

Moreover, a passport comes in handy when one needs proof of identification, age or address, and not just for travel purposes. In this article, we dive a bit deeper into Passport Renewal and its various aspects.

Passports and Validity in India

The validity of an Indian passport is for 10 years from its date of issue.

An Indian passport may comprise of 36 or 60 pages according to the wish of the holder. In India, there are generally 3 kinds of passports that a citizen may apply for. They are:

- Regular Passport

- Diplomatic Passport

- Official Passport

A passport holder must ensure that the passport is valid, and has not expired, in order to continue availing the benefits of the same.

When a passport expires, the passport holder may renew the same on the Passport Seva Portal. The portal helps the citizens of India to seamlessly perform any tasks with respect to their passport application online with ease.

Documents Required for Renewal

There are certain documents that are required to be submitted to the Passport Seva along with an application form for the same. The Document Advisor on the Passport Seva Portal will indicate the important documents that one would require for passport renewal. A user would have to choose the option for renewal to view the documents needed. The following documents are required for passport renewal.

- Original old Passport

- Self-attested copies of the first two pages and the last two pages of the passport.

- Self-attested copy of the page of observation, if any, made by the Passport Issuing Authority.

- Self-attested copy of the ECR/ Non-ECR page.

- Proof of documents which eliminate the cause, if any, of issuance of Short Validity Passport (SVP).

- Self-attested copy of the validity extension page, if any, of the Short Validity Passport (SVP).

Online Passport Renewal Process: Full Guide

It is necessary to renew one’s passport if it has expired. Passport Seva offers the public the opportunity to apply online as well as offline. The application process for passports has become comparatively effortless with the rapid innovation in technology and full connectivity.

Online Process

For an online passport application, an individual would have to register themselves on the Passport Seva portal first. Once this is done, the user will be able to complete various tasks with respect to passports efficiently.

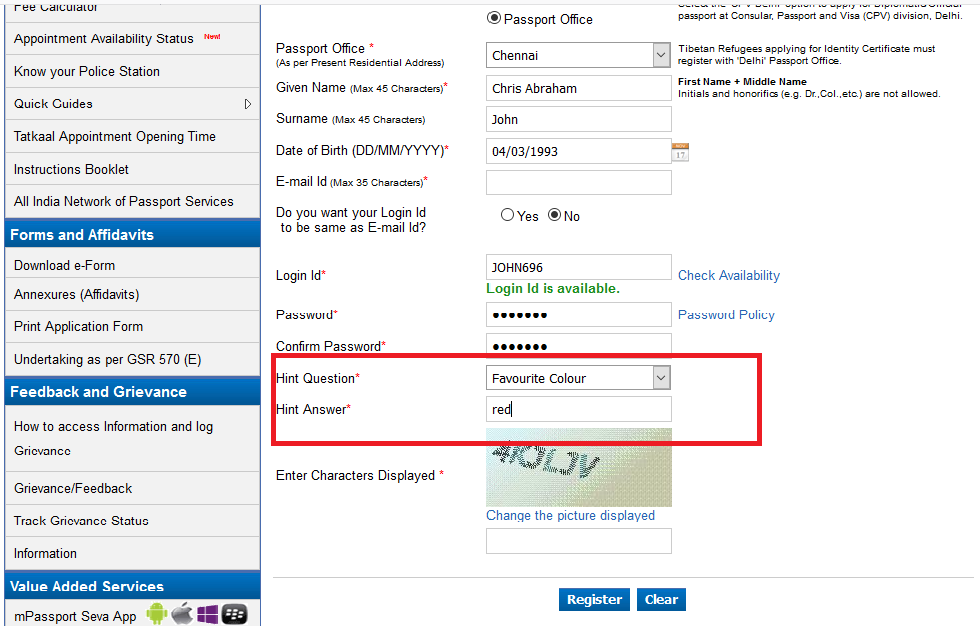

Passport Login Registration

The following steps have to be completed to register yourself on the Passport Seva portal.

Step 1: Visit the official website of Passport Seva.

Step 2: Click on the New User? Register Now tab.

Step 3: Now, select the Passport Office that is closest to your location.

Step 4: Enter the essential personal details, as shown on the page.

Step 5: Create your Login ID and Password as per the portal’s terms and conditions.

Step 6: Select the Hint Question and Answer as you require. This will come in handy your log in details are lost.

Step 7: Click on the Register icon.

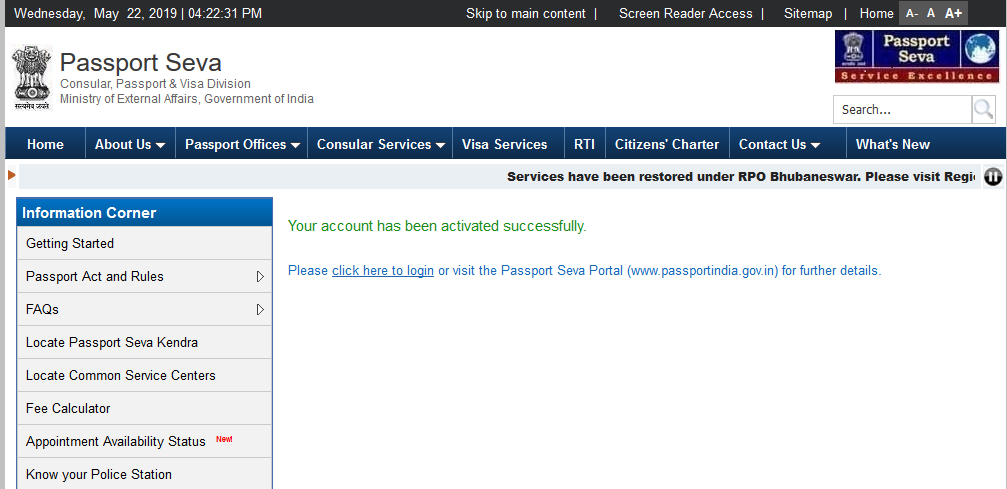

Step 8: Now, you will receive an activation link in your registered email. Click on the link to activate your Passport Seva account.

Step 9: Your account is now activated. You may now proceed with your application to renew your passport.

Online Application for Renewal of Passport: Step by step explanation

Below wen have explained the steps to be followed in order to submit your application for the renewal of your passport on the Passport Seva portal.

Step 1: Visit the official website of Passport Seva.

Step 2: Click on the link Existing User? Login icon.

Step 3: Now, you must click on the Apply for fresh passport/ Re-issue of passport tab.

Step 4: Next, fill the Form available on the portal.

Note: You will have to provide details like current address, of their spouse, amongst other necessary details. You would also be required to provide the details of two local references which could be contacted for police verification. You must click on the Validate option and save the form after you are done entering the city or village. The saved file is then uploaded to the same page from where it was downloaded. By doing so, the details will automatically be entered in the application form. In the end, you need to verify all the information to ensure that there are no mistakes in the application form.

Step 5: Review all the information that you have entered before submitting the Form. These details can not be changed later, and you may need to start again if there are errors.

Step 6: Click on the option to View Saved/ Submitted Application in order to schedule an appointment.

Note: You may schedule an appointment by clicking on the Schedule Appointment tab. Next, you need to select an available slot which is convenient for you. Once this is confirmed, the appointment at the passport office that you opted for at the designated time.

Step 7: Online payment is mandatory for booking appointments at the Passport Seva Kendra.

Step 8: Complete the payment process through any of the accepted modes of payment.

Step 9: If internet banking is not accessible for you, including debit card and credit card, you may print an offline challan and make the payment at any SBI Branch. The bank will take upto 2 days to verify the payment.

Step 10: After you have completed the application process, click on the Print Application Receipt tab. This receipt would contain all the essential details along with the Application Reference Number.

After the appointment is scheduled, the individual must go to the passport office on the designated date and time. One may even show the SMS that they have received as a proof of appointment while visiting the Passport Seva Kendra or the passport office.

Ensure not to miss the appointment as one will have to re-apply for an appointment all over again.

At the Kendra, you will be allotted a specific group number. The number should be mentioned on the application form. When your number is called, you will have to go with the group and start the application process.

Once your application for passport renewal has been accepted, you shall receive the passport at your registered address within a few working days.

You may use your Passport Login credentials and track the status of your passport renewal application online.

Understand when the passport needs to be Reissued and when it is due for Renewal

While the renewal of a passport is carried out when the validity of a current passport has expired, a passport is reissued when either of the following situations occurs:

- Lost passport

- Expired or about to expire passport

- Stolen Passport

- Damaged or soiled passports

- Exhaustion of pages

- Change in personal details

For the renewal of a passport, the current passport is given to you as the renewed passport with the Expiry Date changed. However, a new passport is provided to you when you apply for the reissue of your passport.