Formation of Limited Liability Partnership (LLP)

Limited Liability Partnership (LLP) – All You Need to Know

In this article, we look at some of the advantages and features of a LLP registration, which is a new type of business structure in India, introduced to provide limited liability to the owners while at the same time being simple to start and manage.

Limited Liability

Separate Entity

Capacity to Sue and be Sued

Simplicity

Perpetual Existence

Minimum Number of Partners

Maximum Number of Partners

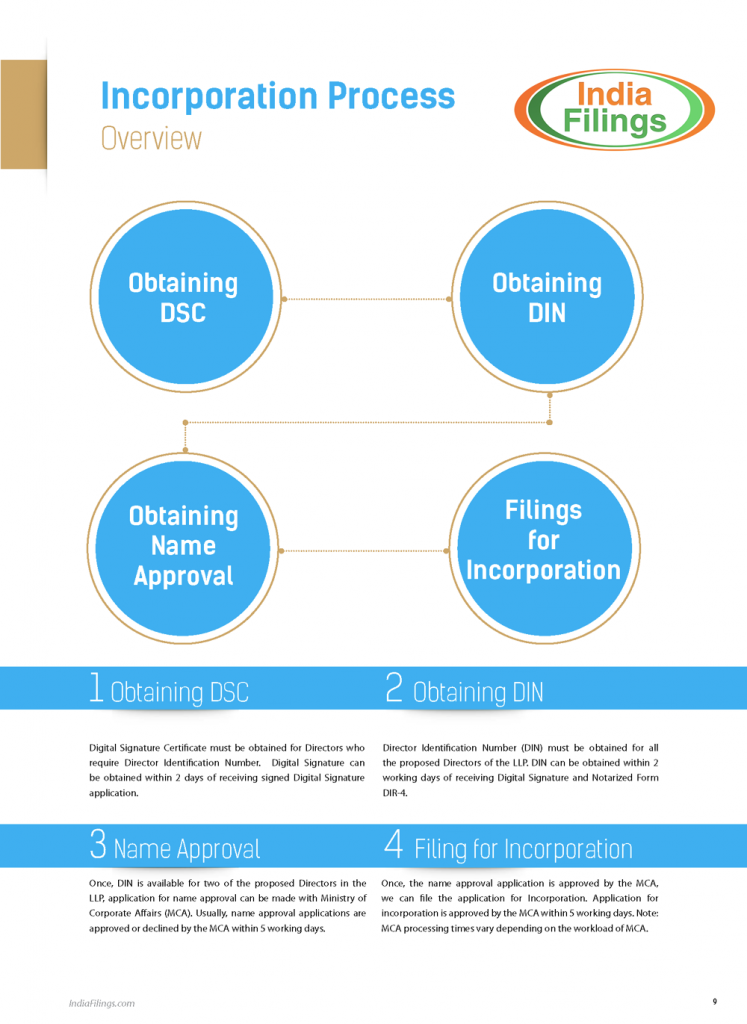

Formation of Limited Liability Partnership (LLP)

- Individuals

- Limited Liability Partnerships

- Companies

- Foreign Limited Liability Partnerships

- Foreign Companies