Incorporation of Private Limited Company

Incorporation of a Private Limited Company

A Private Limited Company is one of the most popular type of business entity to conduct business in India. Private Limited Company offers limited liability for its members, easy to maintain and offers greater flexibility while expanding allowing for easier access to bank loans, private equity, etc., In this blog, we look at the steps involved in the formation of a Private Limited Company.

Basic requirements

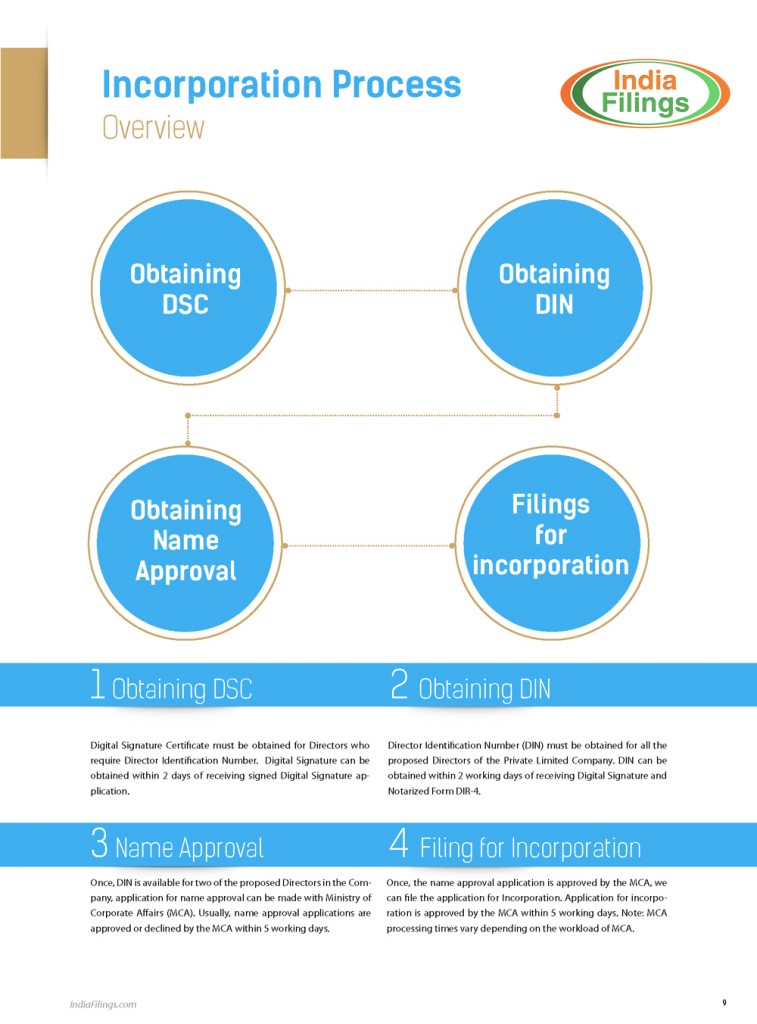

Process for Incorporation of Private Limited Company

Obtaining Director Identification Number (DIN) & Digital Signature

Applying for the name

Filing for Incorporation of Private Limited Company

- Memorandum of Association

- Articles of Association, if any

- Declaration from Directors

- Affidavits of the Directors

- A declaration that the requirements of the Act and the rules framed there under have been compiled with. This declaration is required to be signed by an advocate of the Supreme Court or High Court or an attorney or a pleader having the right to appear before High Court or a secretary, or a Chartered Accountant in whole time practice in India who is engaged in the formation of a company, or by a person named in the Articles as a Director, Manager or Secretary of the Company.

Besides the aforementioned documents, the company must give a notice regarding the situation of its registered office within 15 days of registration or during filing of incorporation documents.