India Post Mobile Banking Application

India Post Mobile Banking Application

Indian Postal Department has recently launched a new India Post Mobile Banking Application to facilitate the post offices customers. This application enables the PO account holders to transfer funds that include deposits into PPF accounts and other post office schemes online. In order to make transactions through the Department of Post’s new app, the customers must hold a post office savings account in a Core Banking Solution (CBS)-enabled post office. Let us look in detail about the features, benefits and application procedure of India Post Mobile Banking App in this article.

To download the India Post Mobile Banking App, visit the Google Play Store.

Eligibility Criteria

The customers must meet the following criteria to avail the mobile banking facility are as follows:

- The customers must hold PO savings account in CBS post office.

- The customers must have a valid login id and transaction credentials for the Internet banking Process.

- If the net banking is not enabled, mobile should be enabled after enabling the net banking option at CIF (customer ID) level by the SOL (service outlet).

- In the case, net banking is not enabled, then the mobile to be accessed after the authorization of net banking at CIF (customer ID) level by the service outlet (SOL).

- Either single or Joint ‘B’ account type customers are eligible

- The customers who hold either single or joint ‘B’ account type are eligible.

- The joint ‘A’ account holders, minor, Illiterate, branch office accounts will not be eligible to avail the mobile banking facility.

Pre-requisites

The following pre-requisites to be fulfilled by the savings account holder to avail the mobile banking facility that is as follows:

- The customer should have the valid email address, PAN card and registered mobile number.

- CIF ID or customer ID to be printed on the first page of the bank passbook. The passbook details to be updated with the correct details such as name, date of birth, father’s name, gender, identity and address proof.

To know about the India Post Payments Bank Scheme (IPPBS)

Features & Benefits of India Post Mobile Banking App

Following are the list of features and benefits of India Post Mobile Banking App.

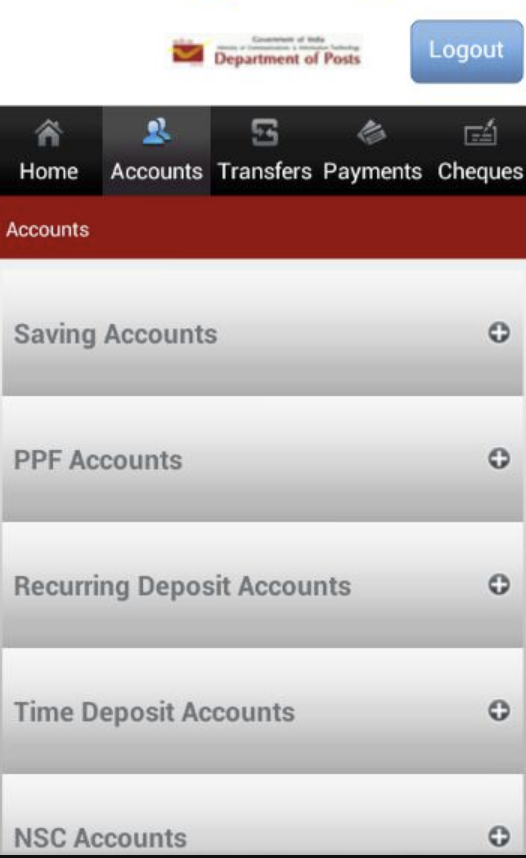

- A mini statement of savings account and PPF accounts can be viewed with the mobile banking app.

- The users can check for the balance of savings account, Recurring Deposit (RD), Public Provident Fund (PPF) and other accounts with the complete details of transactions.

- This mobile banking app enables the users to take a photo of their bill and the application will immediately upload all the important billing details due to which the users can set up a one-time or recurring payment.

- The users can transfer funds to other users’ PO savings account. The users can also transfer fund from savings accounts to own linked PPF accounts.

- The service request for opening the RD account and stop cheques can also be raised through this app.

- The users can view a list of their most frequent actions and accordingly, it allows to customize the dashboard, menu or interface as per the needs.

Application Process of India Post Mobile Banking App

The India Post Mobile Banking App provides a simpler and convenient way to handle all the accounts with a safe and secure banking process. All eligible users as per above criteria can register for the India Post Mobile Banking at any CBS head or sub-post office but not in the branch offices. The savings account holder has to submit the duly-filled application form (Post office savings bank (POSB) ATM card/Mobile/Internet/SMS banking service request form) available with the post office.

The KYC of the said account holder to be completed. If the KYC process is not completed, then the user has to undergo the KYC process at the time of submitting their request application form. The application form to be submitted only in the CBS post office where the savings bank account is held. Once the form is submitted at the branch, the user mobile banking facility will be enabled after 24 hours.

Account Activation Process

- Step 1: After enabling mobile banking facility, the user can install the mobile banking app from the Google Play Store.

- Step 2: Install the Mobile Banking app and click on the “Activate Mobile Banking” button.

- Step 3: The user will have to enter all the security credentials that they have registered with the Department of Post.

- Step 4: Now the user will receive an OTP to their registered mobile number.

- Step 5: Once OTP is validated, then set a four-digit MPIN for the future logins.

- Step 6: Enter the Username and MPIN to login to the App.

- Step 7: Now the user can check their Savings account, PPF, Recurring Deposit and other Accounts balances and also the transfer of funds to other PO savings accounts can be made through this mobile app.

- Step 8: The user can submit the service request to open the Post office RD accounts.

Note: For certain security reasons, the application form cannot be run from a Rooted Device. The Department of Post would never ask for the users’ MPIN, Transaction Password, User ID and OTP. All the PO bank account holders are advised to be aware of such phishing by fraudulent. To ensure security, it is expedient to not use the same PIN for mobile banking as well as ATM transactions.

Department of Posts Help Desk

In the of facing any difficulty or have any queries, the people can contact the customer care number – 18004252440.