Complete Guide on Director Identification Number – DIN

Complete Guide on Director Identification Number – DIN

In business, directors have a particular number like their unique signature– a Director Identification Number or DIN. This number acts as a secret code that helps figure out who’s in charge of a company. But it’s not just a bunch of random numbers; it plays a significant role in ensuring fair and transparent business dealings. This article will delve into what exactly a Director Identification Number is, explain how to get one, and highlight why this unique number is so significant.

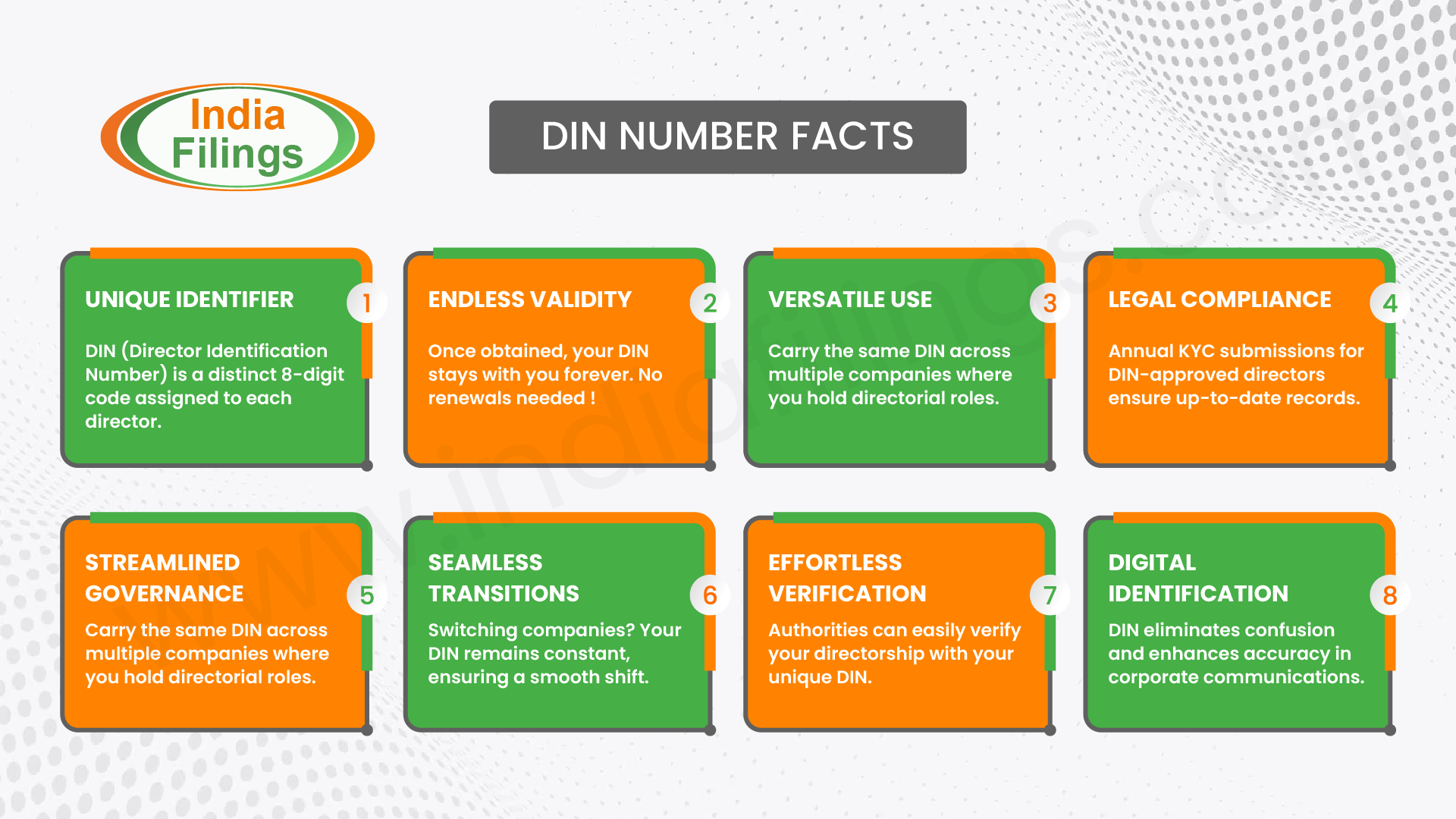

If you are a director with an officially approved DIN status. In that case, you must provide your KYC details to the Ministry of Corporate Affairs (MCA) using Form DIR-3 KYC annually. We are here to guide you seamlessly through these processes, ensuring a hassle-free experience that saves you time and effort.

Get Started Now!What is a Director Identification Number – DIN?

A Director Identification Number (DIN) is an exclusive identification number allocated by the Central Government to individuals who aspire to become directors or are currently serving as directors within a company.

Comprising eight digits, this unique identification number possesses lifelong validity. The DIN system is a repository for maintaining director-related information within a database.

Notably, a DIN is linked to an individual, indicating that even if that person holds directorial roles in multiple companies, they must possess only one DIN. Moreover, if an individual transitions from one company to another, the same DIN applies to the new company.

Click here to learn more about CIN Number of a Company: Everything You Need to Know

Law Governing

Sections 153 and 154 of the Companies Act, 2013, along with Rule 9 of the Companies (Appointment and Qualification of Directors) Rules, 2014, clearly outline the procedures for securing the Director Identification Number (DIN).

Significance of Director Identification Number (DIN)

The Director Identification Number (DIN) holds vital importance due to the following reasons:

- Legal Director Identification: A DIN is mandatory to establish an individual as a legally recognized company director in India.

- Comprehensive Director Database: The DIN facilitates access to a comprehensive database of directors, enabling easy identification and verification.

- Integral for Official Communications: Any interactions between the company and regulatory authorities like MCA/ROC, including submissions like annual returns, ROC filings, applications, and KYC information, necessitate the signature of the Directors accompanied by their respective DINs.

- Avoidance of Non-Compliance: Failure to adhere to DIN regulations can lead to fines and penalties imposed by the ROC. Moreover, directors might risk losing their DIN number altogether.

- Holistic Director Identity: The Director Identification Number not only serves to establish the identity of a director but also offers insights into their involvement with other companies, both past and present.

In essence, the Director Identification Number (DIN) serves as a means of identification and a critical factor in ensuring legal compliance and maintaining transparency in directorship across different companies.

How is DIN Used?

Whenever a company needs to send something important to the government, like a report, an application, or any information, the director who signs it will write down their DIN under their signature. It’s a unique way of showing they are the director and responsible for what’s being sent.

Methods for Acquiring Director Identification Numbers and Relevant Forms

Director Identification Number (DIN) can be acquired through the following procedures:

- When an individual establishes a new company, they can request a DIN by submitting an Incorporation Form known as SPICe+.

- Requirement: The incorporation form allows three Director Identification Numbers (DINs) applications.

- If an individual is offered a position within an existing company.

- Requirement: The Company must pass a board resolution endorsing the individual’s DIN application, which needs to be appended in the e-form DIR-3.

Other Forms Associated with DIN besides Form SPICe

Here are some forms that are related to DIN but not the same as Form SPICe:

- Form DIR-3C: Companies use this form to let the Registrar know about the DIN of a director.

- Form DIR-5: If someone wants to give up their DIN, they fill out this form.

- Form DIR-6: When there are changes in the information given in Form DIR-3, this form is used to apply for those changes.

Required Documents for Acquiring DIN

To apply for a Director Identification Number (DIN) before company incorporation, the following documents are essential:

For SPICe Form:

When submitting the SPICe plus form, you must attach documents proving your identity and address. Once the form is approved, the Director Identification Number (DIN) will only be given to you.

For Form DIR-3:

- Photograph

- Proof of identity

- Proof of residence

- Verification details (like name, father’s name, address, date of birth, declaration text, and your signature)

- Foreign nationals need to provide their passport as proof of identity.

Documents to be Attested by Professionals:

- A Chartered Accountant, Company Secretary, or Cost Accountant in full-time practice should attest your photograph, identity proof, and residence proof.

- For foreign nationals, the documents can be attested by the Consulate of the Indian Embassy or a Foreign Public Notary.

How to Apply for a DIN Number: Step-by-Step Guide

Acquiring a Director Identification Number (DIN) is a straightforward process. Here’s a simple rundown of how to do it:

SPICe + Form

For individuals seeking DINs as proposed first directors of new companies, the application must be completed using the SPICe plus Form. This comprehensive web-based form serves the purpose of both DIN allotment and company incorporation.

Effortlessly secure your Director Identification Number (DIN) with IndiaFilings and streamline your Company Incorporation process.

Register Now!DIR-3 Form

Aspiring directors of existing companies need to submit a DIN application via the eForm DIR-3. This form is specifically designed for this purpose. All the forms mentioned above must be submitted electronically. They must be digitally signed before submission on the MCA (Ministry of Corporate Affairs) portal.

To file Form DIR-3, follow the below-mentioned steps:

- Access the MCA Website: Visit the MCA website.

- Navigate to E-Filing: Go to the “MCA Services” section on the homepage.

- Download Form DIR-3: In the “E-Filing” section, find and download Form DIR-3 under the DIN Forms category.

- Complete the Form: Fill in Form DIR-3 with accurate details. Attach the required documents:

- Sign with DSC: Digitally sign the required documents using your Digital Signature Certificate (DSC).

- Director/Company Verification: Have the documents digitally verified by a director, Company Secretary, Manager, and CEO/CFO.

- Make Payment: You will proceed to the payment step after uploading Form DIR-3 and supporting documents. The fee can be paid using net banking, credit card, or NEFT.

Please note that manual (offline) payments are not accepted. This process completes your application for a DIN.

DIN Generation Process:

The system will give you an application number after you pay the application fee and submit the form. The Central Government will review your application and decide whether to approve or reject it.

If your DIN application is approved, the government will send you your DIN within a month.

By adhering to these procedures, individuals can successfully apply for a Director Identification Number (DIN), either for new companies through the SPICe Plus Form or for existing companies via the DIR-3 Form. Ensuring accurate documentation and completing the necessary forms is imperative for a seamless process.

What If Your DIN Application Is Rejected?

If your DIN application is rejected due to incorrect or misleading information, you have 15 days to rectify the mistakes. You must submit a fresh form within this timeframe with the correct details. You are failing to do so results in the invalidation of the application and forfeiture of the fee.

Informing Companies about Your DIN:

- Once you receive your DIN from the central government, you have one month to tell all the companies where you’re a director about it.

- The company then has 15 days from when you inform them to tell the Registrar of Companies (RoC) about your DIN.

- Not telling the company about your DIN or the company not telling RoC about your DIN can lead to penalties. It’s essential to keep everything to avoid any issues.

How DIN Numbers are allotted:

As mentioned above, The government and its authorized bodies process Form DIR-3. They consider the guidelines laid out in Section 154 of the Companies Act, 2013, and Rule 10 of the Companies Rules 2014 (Appointment and Qualification of Director) to decide whether to allow a DIN number to an applicant.

The form is reviewed based on these rules and provisions, and the DIN number is typically assigned within a month. The central government communicates the allotted DIN number to the applicant within this timeframe.

Making Changes to the DIR-3 Form:

If there are changes in the details provided in Form DIR-3, you must use Form DIR-6 to inform the central government. Here’s how:

- Download and fill out Form DIR-6.

- Verify the form with your Digital Signature Certificate (DSC).

- Get the form digitally signed by a practicing CA, CS, or CMA.

- Submit the state as per the provided instructions.

Reasons for Cancelling or Surrendering a DIN

The Central Government can cancel a Director Identification Number (DIN) for various reasons, including:

- Duplicate DIN Issued: If a director is given more than one DIN by mistake.

- Fraudulent Obtaining: If the DIN was acquired through dishonest methods.

- Deceased Person: In case the individual with the DIN has passed away.

- Declared Unsound Mind: If a court determines that the person is not of sound mind.

- Adjudicated Insolvent: If the person has been declared insolvent by a court.

Directors can also give up their DIN using Form DIR-5. They must declare that they’ve never been a director in any company and that the DIN hasn’t been used for official filings. After checking electronic records, the government will deactivate the DIN.

Remember, once someone becomes a director under the Companies Act 2013, they can’t later decide to give up their DIN. Even if they stop being directors in any company, their DIN will remain unchanged.

Annual KYC Compliance for Directors: A Vital Requirement

All directors holding a Director Identification Number (DIN) must furnish their Know Your Customer (KYC) information annually through the e-Form DIR 3 KYC. As per recent notifications by the Ministry of Corporate Affairs (MCA), directors falling within specific criteria must adhere to this process.

Specifically, directors whose DIN was allotted on or before March 31, 2018, and whose DIN status is officially approved must submit their KYC particulars to the MCA. This measure ensures up-to-date and accurate records of directorial profiles.

For a hassle-free filing experience, IndiaFilings offers comprehensive assistance in smoothly completing the DIR-KYC procedure.

Get Started Now!