CIN Number of a Company: Everything You Need to Know

CIN Number of a Company: Everything You Need to Know

A company registration number, also called a Corporate Identity Number or Company Identification Number (CIN), is an exclusive identification code provided by the Registrar of Company (ROC) to Indian companies after the Company Incorporation. When a company receives its Registration Certificate, the ROC assigns a CIN. In straightforward terms, the CIN is a unique code containing the company’s identification and additional organizational details.

This ID holds immense significance because every company must include its unique CIN in the forms submitted to the Ministry of Corporate Affairs (MCA), particularly for audits and reports. This article will closely examine the importance and features of the Corporate Identification Number (CIN).

What is a CIN Number/ CIN Code?

A CIN Number, or Corporate Identification Number, is a unique code used to monitor a company’s activities once registered with the ROC. This code not only represents the company’s identity but also holds extra details about the company’s registration under the ROC.

A Corporate Identification Number (CIN) is a 21-character code of letters and numbers. Using CIN, the ROC can access the company’s specific information.

The CIN includes essential details like:

- Year of Incorporation (e.g., 2023)

- State Code (e.g., DL for Delhi)

- Company Type (e.g., PLC for Public Limited Company)

- Listing Status (e.g., L for Listed)

This crucial information is also found in the Certificate of Incorporation.

Entities Eligible for a Corporate Identification Number (CIN)

CIN is provided to various types of companies registered in India, including:

- Private Limited Companies (PLCs)

- One-Person Companies (OPCs)

- Companies owned by the Government of India

- State Government Companies

- Not-for-Profit Section 8 Companies

- Nidhi Companies and more

However, Limited Liability Partnerships (LLPs) registered in India do not receive a CIN. Instead, they are given an LLPIN (Limited Liability Partnership Identification Number), which is a unique 7-digit identification code for the LLP.

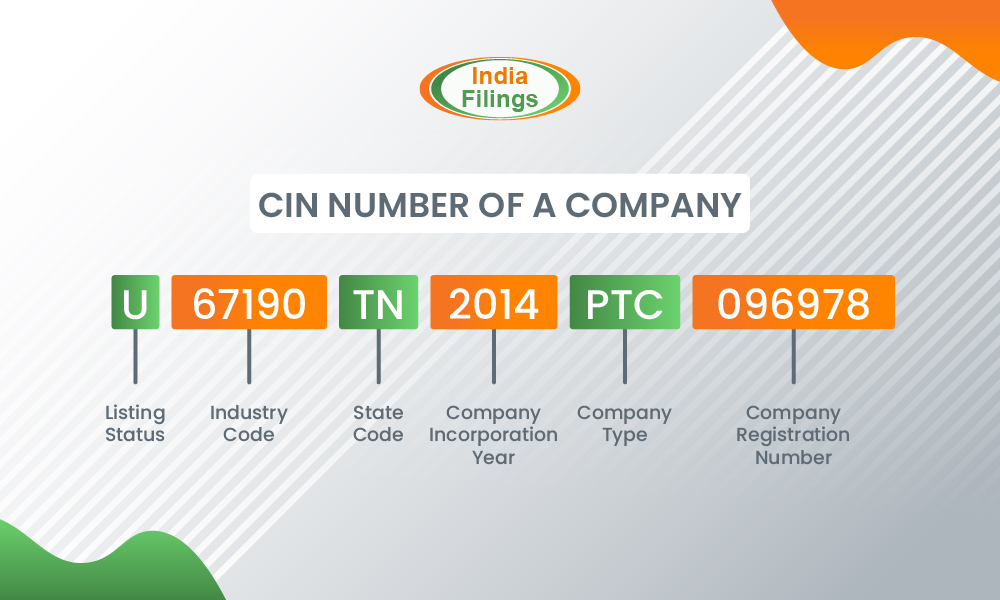

Components of a CIN

Delving deeper into a company’s Corporate Identification Number (CIN), it’s clear that this 21-digit mix of letters and numbers can be broken down into six distinctive sections:

Stock Market Listing Status

The initial character in the code signifies whether the company is ‘Listed’ or ‘Unlisted’ in the stock market. This is denoted by ‘L’ for listed and ‘U’ for unlisted.

Categorizing Economic Activity

The subsequent five numeric digits classify the company’s economic activity, dependent on the establishment’s particular undertakings.

Categorization follows this pattern: Section → Division → Group → Class → Sub-class

Standard industry codes used in CINs are as follows:

- Hospitals: 85110 Retail sales of construction

- materials: 52341

- Dairy and cattle farming: 01211

- Manufacture of mineral water: 15543

- Manufacture of textile garments and clothing accessories: 18101

- Real estate activities on a fee or contractual basis: 70200

- Freight transport by motor vehicles: 60231

For industry codes not listed here, contact our experts for assistance.

State Code

The subsequent two letters represent the state code of the company’s registered office according to the ROC.

Year of Incorporation

The following four numeric digits signify the year of incorporation.

Company Type

The following three letters denote the company type, whether public or private. Common abbreviations include:

- Private Limited Company – PTC

- Public Limited Company – PLC

- Companies owned by the Government of India – GOI

- Companies owned by State Government – SGC

- Financial Lease Company (as Public Limited) – FLC

- General Association Public – GAP

- General Association Private – GAT

- Not For Profit License Company – NPL

- Public Limited Company (unlimited liability) – ULL

- Private Limited Company ((unlimited liability) – ULT

- Subsidiary of a Foreign Company – FTC

Company Registration Number

The final six digits reveal the company’s registration number, including the ROC code of the registered entity.

Decoding these sections, a CIN provides comprehensive information about a company’s attributes and background.

Significance of the Corporate Identification Number (CIN)

Once a business is officially established, the relevant Registrar of Companies (ROC) assigns a certificate containing the Corporate Identification Number (CIN No. or CIN Code).

Each company needs to use its distinct Company CIN No. When communicating with the Ministry of Corporate Affairs (MCA), particularly when filling out forms, conducting audits, and preparing reports.

Moreover, the CIN No. Should be prominently displayed on the company’s letterheads, memos, invoices, notices, and official documents for easy reference. This number is a crucial identifier and facilitates smooth interactions with regulatory authorities.

Documents Requiring CIN Number Mention

A company’s CIN number needs to be included in various significant documents, such as:

- Receipts

- Invoices

- Letterheads

- Notices

- Annual Reports

- All e-forms are available on the Ministry of Corporate Affairs portal

- Emails to external parties not within the company

- Published materials like journals, books, periodicals, financial results, etc.

- Billheads

- Business letters

Ensuring the presence of the CIN number in these documents enhances accurate identification and facilitates efficient communication by regulatory standards.

Importance of CIN Number

The Corporate Identification Number (CIN) holds significant importance for companies in India, driven by several key reasons:

Legal Compliance

A paramount reason for possessing a CIN number is to adhere to legal requirements. As the Companies Act 2013 outlines, every registered Indian company must have a unique CIN number. Non-compliance can lead to penalties and fines, impacting the company’s financial well-being.

Business Identification

The CIN number is a distinct identifier for a company, setting it apart from other businesses. The CIN number contributes to brand building and reputation in today’s competitive landscape, where multiple companies operate within the same sector. It simplifies identification for customers and stakeholders, fostering business relationships.

Access to Credit

Access to credit from financial institutions like banks and NBFCs hinges on a company’s possession of a CIN number. Lenders typically require the CIN number during the loan application process. The absence of a CIN number can hinder credit acquisition, potentially impeding growth and expansion plans.

Compliance with Tax Regulations

Companies in India must adhere to diverse tax regulations, including GST, income tax, and TDS. The CIN number plays a pivotal role in ensuring compliance with these regulations. It facilitates tracking of transactions related to taxes, preventing non-compliance penalties.

Corporate Governance

Beyond its legal and financial aspects, the CIN number contributes to corporate governance. It upholds transparency and accountability in a company’s interactions with stakeholders. The CIN number is in official documents such as invoices, letterheads, and annual reports. This practice ensures accurate record-keeping and easy traceability in case of discrepancies.

The CIN number is a cornerstone for legal conformity, business recognition, credit access, tax compliance, and corporate governance, collectively bolstering a company’s integrity and growth prospects.

Obtaining a CIN: Step-by-Step Process

When you successfully register your company with the Registrar of Companies, issuing a Corporate Identification Number (CIN) is automatic. Obtaining a CIN number involves a variety of procedures.

To break it down, here’s how it works:

Step 1: Choose a Name

Select a unique name for your company that follows government rules.

Step 2: Decide Company Type

Pick the company that suits your business – Private Limited, Public Limited, LLP, or OPC.

Step 3: Get DIN and DSC

Obtain a Director Identification Number (DIN) and digital signature certificates for secure online processes.

Step 4: Reserve Your Chosen Name

Reserve your selected name with the government to ensure exclusivity.

Step 5: Create Important Documents

Draft the Memorandum of Association (MOA) and Articles of Association (AOA) that outline your company’s goals and rules.

Step 6: Apply and Pay

Submit your application to the Registrar of Companies (RoC) and pay the required fees.

Step 7: Get CIN

RoC reviews your application. Once approved, you’ll get a Certificate of Incorporation (COI) that confirms your company’s establishment and includes your CIN number. When you’ve determined the type of company you wish to establish, here’s the sequence of actions to obtain a Corporate Identification Number (CIN):

Penalty for Non-Compliance

For both public and private limited companies in India, compliance demands the inclusion of their Company Identification Number on various documents, such as:

- Receipts and invoices

- Notices

- Letterheads

- Annual reports

- All e-forms accessible on the MCA portal

- Any other published materials

Adherence to these requirements results in consequences. The defaulting company is subject to a daily penalty of INR 1,000, with each officer sharing responsibility for the default duration. Nevertheless, the maximum penalty for this lapse is set at INR 100,000.

Changing Your Company’s CIN

Your company’s Corporate Identification Number (CIN) needs to be updated under the following circumstances:

- Change in Stock Market Listing Status: If your company transitions between being listed (L) and unlisted (U) on the stock market.

- Relocation of Registered Office: When your company’s registered office shifts to a different state.

- Alteration in Industry Focus: If your company has been engaged in a shift in the industry since its establishment.

- Change in Ownership Structure: When ownership transforms from a sole proprietorship to a private limited company, for instance.

- Registrar of Companies Change: If the Registrar oversees your company’s affairs changes.

In these situations, updating your CIN is necessary to ensure accurate and up-to-date identification of your company’s key attributes.

How to Track Your Company’s CIN

To locate your company’s CIN number, follow these steps on the official Ministry of Corporate Affairs website:

- Visit the MCA Services section.

- Opt for the “Find CIN” option.

- Select whether your organization is a company or a limited liability partnership on the website.

- Choose one of the following options for the search:

- Registration number

- Existing Company name or Limited Liability Partnership name

- Inactive CIN

- Name of the old company or Limited Liability Partnership

- Fill in the required details.

- Enter the provided captcha code.

- Click the “Search” button.

Following these steps, you can effortlessly trace your company’s CIN number using the Ministry of Corporate Affairs’ official platform.

Quickly Obtain Your Company CIN with IndiaFilings

Acquiring your Company Identification Number (CIN) has never been simpler. With IndiaFilings, you can navigate the process effortlessly. Our experts ensure a seamless journey from Company registration to receiving your CIN, allowing you to focus on your business while we handle the intricacies of the process. Trust IndiaFilings to simplify the path to obtaining your CIN, making compliance hassle-free and efficient.

Register Now!