Who is eligible for Udyog Aadhar?

Who is eligible for Udyog Aadhar?

Udyog Aadhar was a registration provided to micro, small, and medium-sized businesses in India under the Micro, Small, and Medium Enterprise Development Act, 2006 (MSMED). Since July 2020, Udyog Aadhaar registration has become Udyam registration. Udyam Registration is more accessible than registration for Udyog Aadhaar.

Udyog Aadhar Registration for MSME

The Ministry of MSME has notified a one-page Udyog Aadhar Memorandum (UAM) through the Gazette of India on 18.09.2015 as part of an initiative to ease the Registration of MSMEs.

The process for obtaining MSME registration has been simplified by introducing the Udyog Aadhar for MSME in India. Before the Udyog Aadhaar, two filings, namely Entrepreneur Memorandum-I (EM-I) and Entrepreneur Memorandum-II (EM-II), had to be filed to obtain MSME or SSI Registration. With Udyog Aadhaar, obtaining SSI or MSME registration has been drastically simplified.

In addition to simplifying the registration process, the MSME registration form has also been simplified. Udyog Aadhaar registration form was made in a self-declaration format under which the MSME self-certifies its existence, bank account details, promoter/owners’ Aadhar, and other essential information required. Based on the simple form submitted, the business would be issued online, at a minimum, a unique identifier or Udyog Aadhaar, making the unit formally registered as an SSI or MSME.

Click here to learn more about MSME Clarification on New Udyam Registration

Udyam Registration

Udyam registration is the new process for registering MSMEs launched by the Ministry of Micro, Small, and Medium Enterprises on July 1, 2020. To make registration with the government portal easier for MSMEs, the government of India introduced Udyam registration in place of Udyog Aadhaar.

Who is eligible for Udyog Aadhar?

Anyone wishing to establish a micro, small, or medium enterprise can apply for Udyam Registration.

- Partnership Firm

- One Person Company

- Proprietorships

- Private Limited Company

- Limited Company

- Producer Company

- Limited Liability Partnership

- any association of persons

- co-operative societies

- Hindu Undivided Family (HUF)

Note: As per the Revised Guidelines for MSME, retail and wholesale trades will be allowed to register on Udyam Registration Portal.

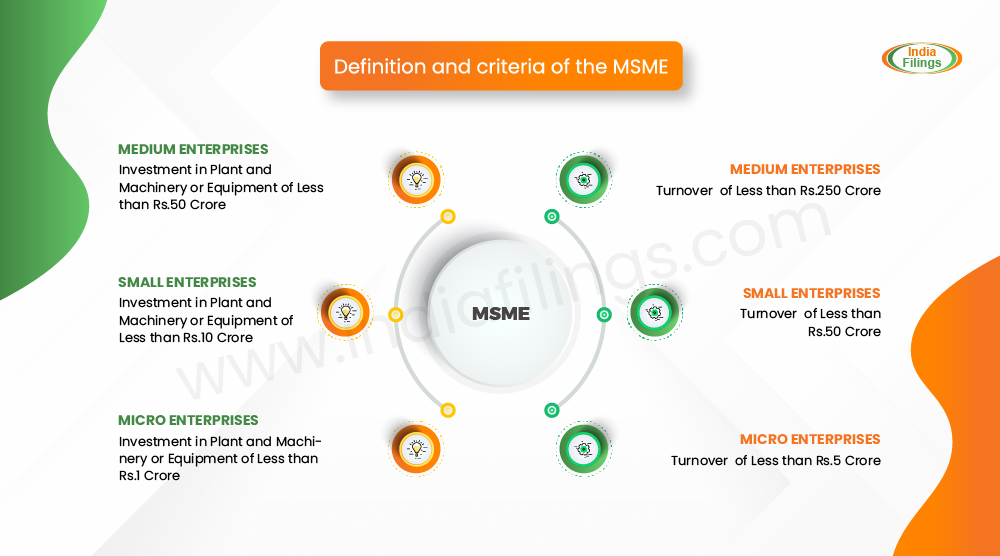

Eligibility Criteria for Udyog Aadhar/Udyam Registration – Revised MSME Definition

A revision to the MSME definition was announced in the Atmnirbhar Bharat package on May 13, 2020, to bring more units under the purview of the schemes. According to this scheme, the criteria for classifying MSME are investment and turnover. The limit has been revised upwards. The difference between the service and the manufacturing sector has also been eliminated.

| Composite Criteria: Investment in Plant or Machinery and Turnover | |||

| Sl.No | Type of Enterprises | Investment | Turnover |

| 1 | Micro enterprises | Less than Rs.1 Crore | Less than Rs.5 Crore |

| 2 | Small enterprises | Less than Rs.10 Crore | Less than Rs.50 Crore |

| 3 | Medium enterprises | Less than Rs.20 Crore | Less than Rs.100 Crore |

IndiaFilings can help you get UDYAM/ Udyog Aadhar registration.