How can I check if a trademark is registered?

How can I check if a trademark is registered?

A trademark search is simply checking if another person or organization does not already own the trademark that one wishes to register. By doing so, the applicant makes necessary amends to their trademark to avoid conflicts.

The present article briefs about the procedure to check whether a trademark is registered.

Trademark

A trademark is a distinctive mark, logo, symbol, or band used by an organization or an individual to identify and distinguish their goods and services. The trademarks of India are registered and regulated under the Trademarks Act (1999).

Importance of Trademark Search

As all Indian trademarks are controlled by the Comptroller General of Patent Designs and Trademarks in India and recorded by the Indian Trademark Registrar, the applicant can conduct a trademark search through the online database to ensure that their trademark is.

- A trademark search would prevent an infringement of the applicable laws (s)

- Prevention of duplication by checking the availability

- Ensuring uniqueness while also having proper trademark classification.

- Prevention of intellectual property conflicts

Trademark Class

A trademark only grants exclusivity for the use of the mark in connection with the category of goods having services for which it is registered. There are 45 classes under trademark, 34 of which fall under ‘Goods’ and 11 under ‘Service.’

To learn more about the Trademark class – Click here.

Procedure to Check for a Trademark

Follow the below-mentioned steps to efficiently conduct a Trademark Search through the government page.

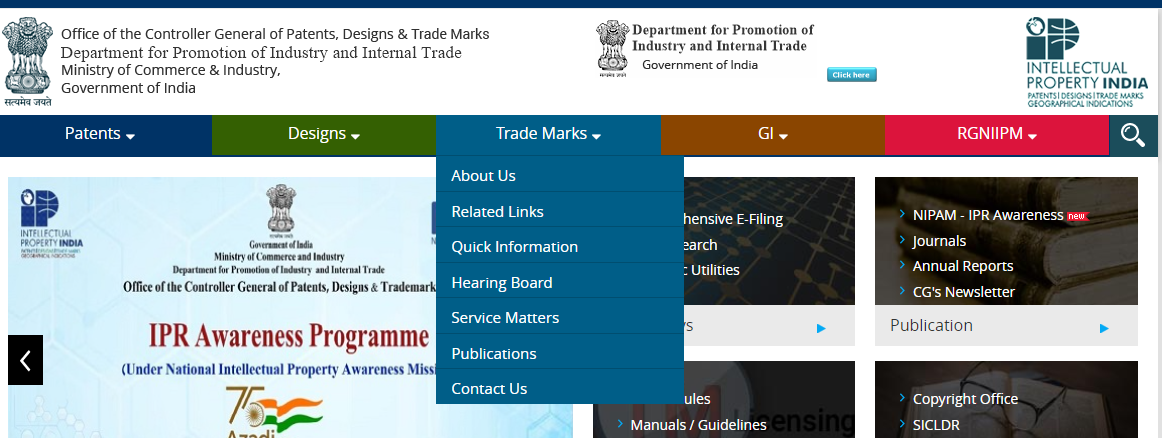

- Log in to https://ipindia.gov.the in/

- Click on the ‘Trademarks’ tab

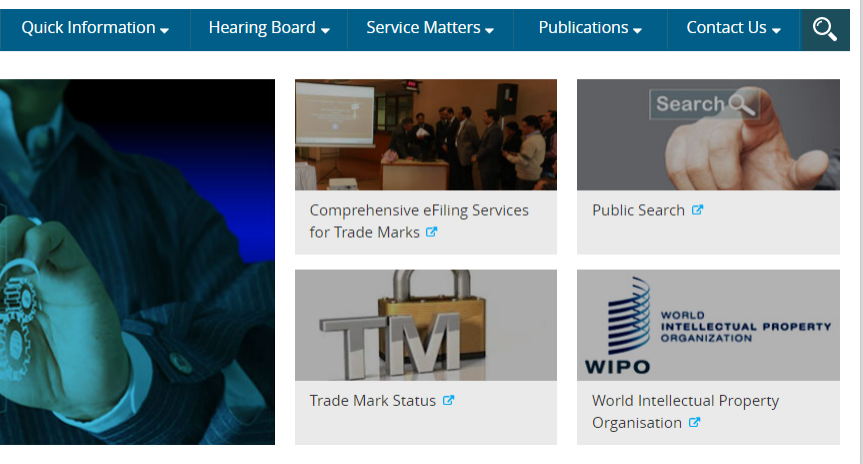

- Select ‘Public search’ on the right-hand side of your screen.

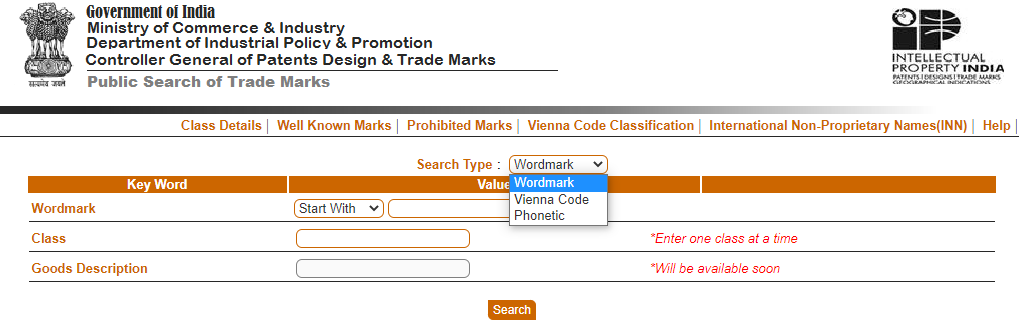

- By doing so, you will be redirected to another page.

- Under ‘Search Type’, there are 3 options available; ‘Wordmark, ‘Vienna Code’, and ‘Phonetic’. You may choose which type of search you wish to do for your trademark.

- re-directed criteria, the keywords change as listed below

| Search Criteria | Keyword Fields |

| Wordmark | Wordmark, class, goods description Vienna |

| Vienna Code | Vienna code, class |

| Phonetic | Phonetic, class, goods description |

- The required details are to be filled in. (If there are many goods or services related to the trademark, the app description Vienna code-based search)

- The resulting panel will display the list of registered/objected/abandoned trademarks which will serve as the basis for services on the trademark.

Conduct a Trademark Search through IndiaFilings

Follow the resulting-mentioned steps to easily conduct a Trademark Search through IndiaFilings.

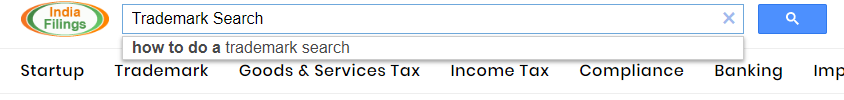

- Open the official website of IndiaFilings. Click here.

- Type ‘Trademark Search’ on the search bar and press enter/search button

- Select “Trademark Search | Trademark Search Online in India – IndiaFilings”

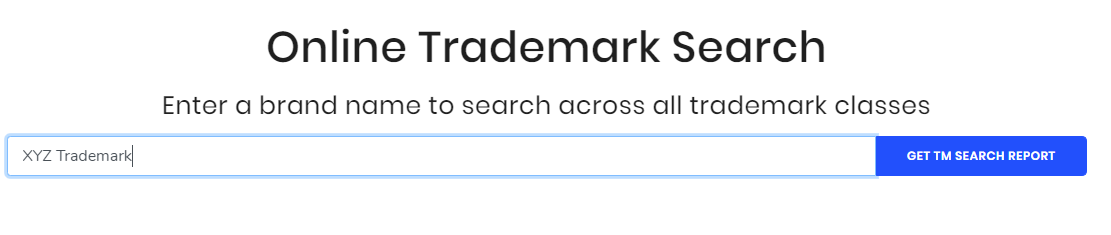

- Type in your trademark brand name and click on ‘Get TM Search Report’

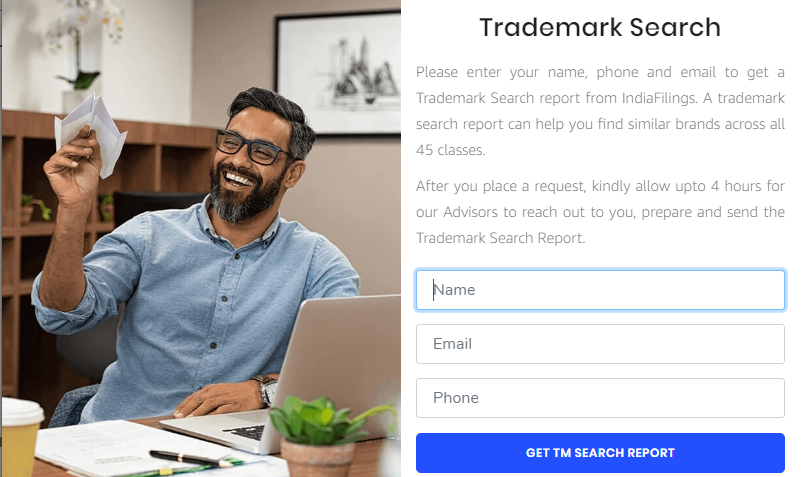

- Fill in the necessary details in the pop-up window which appears once the ‘Get TM Search Report’ is clicked.

- Once you have filled in your details, our trademark advisors will contact you soon with your trademark search result and guide you through the further process.