SBI PPF Account

SBI PPF Account

State Bank of India (SBI) is India’s largest state-owned public sector banking company that offers services with respect to Public Provident Fund Scheme as part of SBI internet banking. Public Provident Fund (PPF) Scheme is a statutory scheme introduced by the Central Government of India to mobilise small savings. SBI’s Provident Fund Account facility enables the investors to gain tax benefits with a reasonable interest over a period of time. A PPF account is a long-term investment option that can be opened by individuals to build an investment corpus with tax benefits. In this article, we look at the procedure for opening of SBI Public Provident Fund Account in detail.

To know more about SBI Current Account

Public Provident Fund Act, 1968

As per the Public Provident Fund Act, 1968, the interest rate is compounded annually and fixed by the Ministry of Finance, Indian Government. Subscription to the Public Provident Fund scheme qualify for deduction from the taxable income of the investor for income tax purpose within limits laid down under section 80-CC of the Income Tax Act. All subscriptions made under section 4 of Public Provident Fund Act shall bear interest at such rate as may be declared by the Central Government in the Official Gazette. The PPF scheme is operated through Nationalized banks and Post Office through its authorised branches as per GOI announcement.

Features of PPF Account

The following are some of the main features and benefits of opening a PFF account with State Bank of India (SBI).

- The PFF Account can be transferred from one bank to another bank as well as within the bank to any branch. This service offered is free of cost.

- Deposits in PPF qualify for rebate under section 80-C of Income Tax Act.

- The interest on deposits is tax-free and also the deposits are exempt from wealth tax.

- The balance amount in PPF account is not subject to attachment under any order or decree of the court in respect of any debt or liability.

- More than one person nomination facility available.

Eligibility Criteria for PPF Account

The Public Provident Fund (PPF) Scheme can be opened by any individual who satisfies the below criteria.

- The minimum annual investment of Rs. 500 is required to open and keep the PPF Account. The maximum amount that can be deposited is Rs. 1,50,000 per annum.

- Any individuals can open the PPF account at any branch on their name as well as on behalf of a minor.

- The PFF account that can be opened either by the mother or father on behalf of a minor. However, both mother and father cannot open the PFF account for the same minor.

- NRIs (Non-Resident Indians) cannot open SBI Bank PPF account. However, if a PPF account was opened before resident Indian becoming NRI such an account may be continued till maturity.

Note:

- As per the extant rules, the investor should not deposit more than Rs. 1,50,000 as the excess amount will not be charged for interest and also the investor will not be eligible for a rebate under the income tax act.

- The joint PFF accounts are not permitted. Also, PFF account cannot be opened by the Hindu Undivided Family (HUF).

- In the case of parents death, the account can be opened by the grandparents as guardians on behalf of a minor.

- The PFF account can be opened by any individual as there is no age limit specified for maintaining the PFF account in SBI bank.

Documents Required for PPF Account

The below listed are the documents that need to be furnished at the time of opening a PPF account in SBI.

- Applicant’s passport size photograph

- Account opening application (FORM A)

- Identity Proof: PAN Card, Aadhar Card, Driving License, Voter ID Card, etc.

- Address Proof: Aadhar Card, Valid Passport, Utility bill, Property tax bill, etc.

- Once all the documents mentioned above are self-attested and valid, you may open the Public Provident Fund Account in SBI.

Procedure for Opening SBI PPF Account

The PPF Account can be opened through online using the bank’s digital channels of the internet and mobile banking. Kindly follow the below procedure to open the SBI PPF Account.

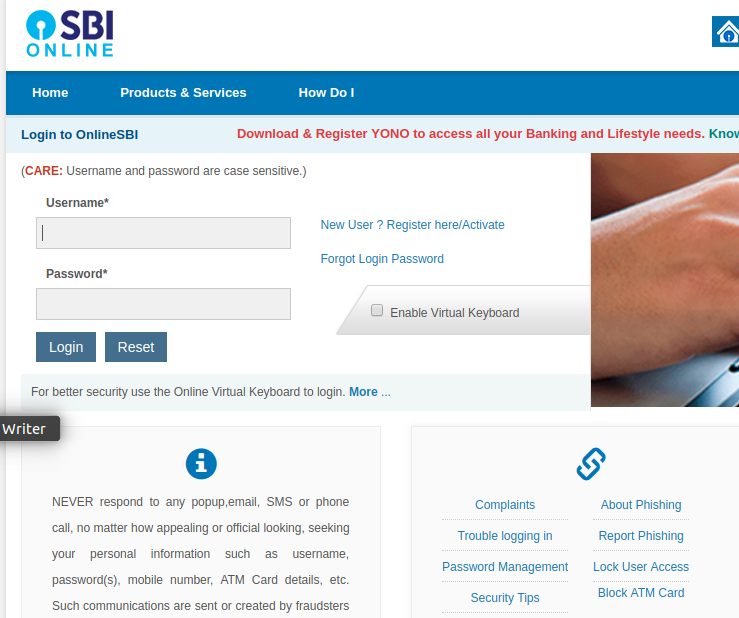

Login to Portal

Step 1: Firstly, you have to log in to the official SBI’s Internet Banking portal.

Step 2: Then click on the “e-services” tab that is visible on the homepage of the portal.

Step 3: Under the e-services tab, you need to select the “New PFF Account” option.

New PPF Account

Step 4: On clicking on the option, that will lead you to the New PPF account page. Now click on the “Apply for PPF Account” tab which displays the account opening application form as shown below:

Fill in the Right Credentials

Step 5: You have to fill the application form by entering the following details.

- Branch code (five-digit code)

- Branch Name

- Nominee details

- Personal details

- Communication Address

- Permanent Address

- Know Your Customer Document

- Submit the Application Form

Step 6: Once you have entered all the requested details in the form, proceed further by clicking on the “submit” button.

Acknowledgement Number

Step 7: After the successful completion, the SBI portal issues an acknowledgement number.

Print Reference Number and Visit Branch

Step 8: Now you need to take a print of the reference number and visit the nearby branch with the all the original KYC documents and a photograph within 30 days from the date of application.

Offline Procedure for Opening SBI PPF Account

To open an SBI PPF account with the SBI Bank offline the applicant can apply either by visiting the nearest branch or by filling up a form on its official website. However in certain cases such as if your opening a pff account on behalf of a minor child or in case if you don’t have an online activated account, you will have to visit the branch for the account opening.

Approach the SBI Branch

Step 1: You have to approach the nearest SBI Bank Branch in your locality for opening a PFF account.

Get Application Form

Step 2: Then you need to get the application form from the bank office and have to fill out the PFF account opening application form in a prescribed format.

Note: You may also download the PFF account opening application form from the official website.

The PFF account opening application form is reproduced below in PDF format for your ready reference.

Provide Details

Step 3: You have to fill the PFF account application form with appropriate details without any mistakes.

Submit the Application Form

Step 4: You have to submit the PFF account form in the prescribed format to the concerned bank official along with all the supporting certificates mentioned above.

Attach Required Documents

Step 5: After applying, you have to attach the specified KYC proofs along with the PFF account application form.

Note: Please carry originals of all relevant KYC documents such as PAN, Aadhaar, etc. for verification purposes.

Loan Against PPF Account from SBI Bank

If an individual has an SBI Bank Public Provident Fund (PFF) account in good standing, then he may be eligible to avail a loan against their PPF account balance. The loan against PPF facility from the bank can currently be availed from the 3rd to 6th year of the PPF account operation computed from the date of account opening.

Withdrawals from the Funds

One withdrawal during any one year at any time after 6 years. The withdrawal amount is limited to 50% of the balance amount at credit at the end of the 4th year directly preceding the year in which the amount is withdrawn or at the end of the previous year whichever is lower.