Revocation of GST Registration Cancellation

Revocation of GST Registration Cancellation

The GST Act is very comprehensive and covers various situations a taxpayer may face with provision and procedures. In this article, we look at the procedure for revocation of GST registration cancellation order along with the applicable forms. The provision for revocation are contained under rule 23 of the CGST Rules, 2017.

Note: Revocation of GST registration can be initiated if a GST registration certificate has been cancelled by GST authorities.

Know more about GST REG-19 – Order for Cancellation of GST Registration

Time Limit for Revocation

Any registered taxable person can apply for revocation of cancellation of GST registration within a period of 30 days from the date of service of order of cancellation of GST registration. It must be noted that the application for revocation can be done only during the circumstances when the registration has been cancelled by the proper officer on his own motion. Hence, revocation cannot be used when GST registration was cancelled voluntarily by a taxpayer.

Application for Revocation

Application in FORM GST REG-21 needs to be filed by the registered person, for revocation of GST registration, either directly or through a facilitation centre notified by the Commissioner.

Online Revocation Procedure

Following are the steps which a registered person needs to be followed, who wants to apply for revocation online through the GST Portal:

- Access the GST Portal at www.gst.gov.in.

- In order to enter into the account, enter the username and appropriate password.

- In the GST Dashboard, select services, under services select registration and further under registration select application for revocation of cancelled registration option.

- Select the option of applying for revocation of cancelled registration. In the select box, enter the reason for revocation of GST registration cancellation. Further, you need to choose appropriate file to be attached for any supporting documents and you need to select verification checkbox and select name of authorized signatory and fill up the place filed box.

- The final step would be to select SUBMIT WITH DSC OR SUBMIT WITH EVC box.

Processing of Application

If the proper officer satisfied with the reason provided by the taxpayer for revocation of cancellation of registration, then, the officer shall revoke the cancellation of registration.

The time period of revocation, by the proper officer, is 30 days from the date of application. The proper officer is required to pass an order revoking the cancellation of registration in FORM GST REG-22.

Rejection of Application

If a GST officer is not satisfied with the revocation application, the officer would issue a notice in FORM GST REG-23. On receipt of the notice, the applicant is required to furnish a suitable reply in FORM GST REG-24 within a period of 7 working days from the date of service of the notice. On receipt of a suitable reply from the applicant, the officer is required to pass a suitable order in FORM GST REG-05 within a period of 30 days from the date of receipt of a reply from the applicant.

Ineligible Applicants

UIN Holders (i.e. UN Bodies, Embassies and Other Notified Persons), GST Practitioner or in case the registration is cancelled on the request of the taxpayer or legal heir of the taxpayer, cannot apply for revocation of cancelled registration.

Online Application Procedure for Revocation of Cancellation

The taxpayers must follow the below following steps for the Revocation of Cancellation of GST Registration online.

Visit GST Portal

Step 1: Firstly, the taxpayers have to visit the Goods and Services Tax portal for the Revocation of Cancellation of GST Registration.

Login into Portal

Step 2: Click on the ‘Login’ button to access the username and password page.

Step 3: Enter the correct ‘Username’ and ‘Password’ credentials along with the captcha in the required field and click ‘login’.

Application for Revocation

Step 4: You have to click on the Revocation of Cancellation of GST Registration link under the services tab that is visible on the home page.

Step 5: On clicking on the link, the portal shifts to the next page, where you need to enter the reason for revocation of cancellation of registration in the Reason for revocation of cancellation field.

Step 6: Then you have to click the “Choose File” button to attach any supporting documentation.

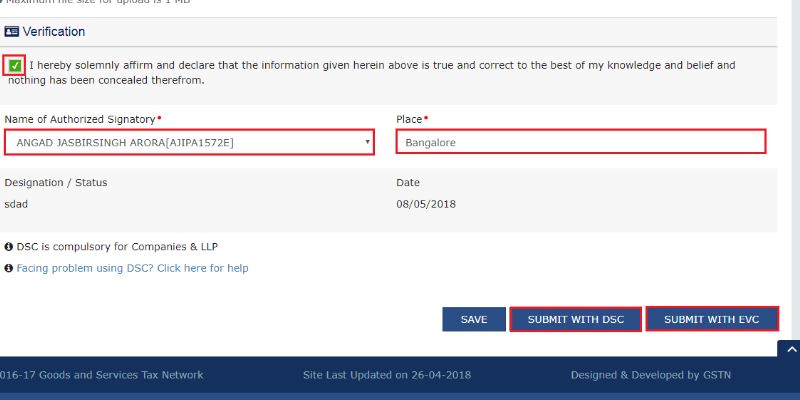

Step 7: Now Select the Verification checkbox.

Step 8: Select the name of the authorised signatory, in the Name of Authorized Signatory drop-down list.

Step 9: You have to enter the place where the application is filed, in the Place field.

Step 10: You can also click the ‘save’ button to save the application form and retrieve it later.

Step 11: Click the Submit with DSC or the Submit with EVC button.

Step 12: Sign the form by using either your Digital Signature Certificate (DSC) or the EVC option. On selecting any of these below options, you will receive an OTP.

Using DSC Option

Step 13: If using a DSC, the taxpayer should select the registered DSC from the emSigner pop-up screen and then proceed from there accordingly.

Using EVC Option

Step 14: Enter the OTP that you have received and then click on the Validate OTP button.

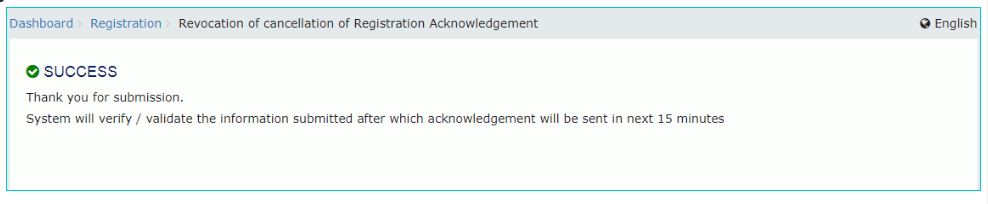

Acknowledgement Message

Step 15: On successfully filing the application for cancellation of registration, the system will generate the ARN and display a confirmation message.

Step 16: GST Portal will also send a confirmation message on your registered mobile phone number and e-mail-ID.

Step 17: After this process, the concerned Tax Official will review the application and take a decision accordingly.

Approval by the Tax Official

Step 18: After receiving all the necessary information and satisfied with the information provided, the proper officer may revoke the cancellation of the GST registration.

Step 19: On approval by the Tax Official, the system generates an approval order and sends the notification to the applicant, Primary Authorized Signatory of the taxpayer via e-mail and SMS, about the same.

Step 20: Consequent to the approval of the Application for Revocation of Cancelled Registration, the GSTIN Status of the taxpayer shall change from Inactive to Active status with effect from the effective date of cancellation.

Rejection by the Tax Official

Step 21: When the Tax Official rejects an application for revocation of cancelled registration then the rejection order will be generated.

Step 22: The GSTIN status will remain “Inactive” on the GST Portal, and the taxpayer shall receive the Primary Authorized Signatory through SMS and email stating the rejection of the application.

Step 24: The taxpayer can view the Rejection Order receipt on the taxpayer’s dashboard.

Offline Application Procedure for Revocation of Cancellation

The registered taxpayer can follow the below steps to submit an application for revocation of cancellation of registration:

Step 1: A registered taxpayer can submit the FORM GST REG-21 application for the Revocation of Cancellation of GST Registration either directly or through a facilitation centre notified by the Commissioner if his registration has been cancelled suo moto by the proper tax official.

Note: You can download this FORM GST REG-21 from the GST portal. (Scroll below for reference)

Step 2: You must submit the application within 30 days from the date of service of the cancellation order at the Common Portal.

Step 3: The authorized officer shall revoke the cancellation of the registration upon proper reasons as deemed through the Act. The officer shall reply through FORM GST REG-22 within 30 days from the date of receipt of the application. The officer must record all the details for revocation or cancellation of registration in writing.

Step 4: The proper officer shall take a decision within 30 days from the date of receipt of clarification from the applicant in FORM GST REG-24.

Step 5: If a concerned GST officer is not satisfied with the revocation application, the officer must issue a notice in FORM GST REG-23 before rejection. The applicant must provide a suitable reply in FORM GST REG-24 within 7 working days from the date of service of the notice. On receipt of a proper response from the applicant, the concerned officer should pass a suitable order in FORM GST REG-05 within 30 days from the date of receipt of a reply from the applicant.