Kisan Anudan Yojana

Kisan Anudan Yojana

The Madhya Pradesh Government has introduced the Kisan Anudan Yojana for farmers in the state. Kisan Anudan Yojana scheme provides subsidy on farming tools. Under this scheme, all the farmers of Madhya Pradesh can apply for an online to get any farming equipment. In this article, we look at the procedure to apply for Kisan Anudan Yojana in detail.

The Scheme

Under the Kisan Anudan Yojana scheme, farmers will get a subsidy for buying farm tools or machines. All farmers are eligible to get a subsidy for the following equipment:

- Zero Till Seed Less Fertilizer Drill

- Paddy Rice Transplanter

- Raidbed Planner

- Raidbed Planner with Inclined Plate and Shaper

- Happy Cedar

- Laser Land Leveler

- Rotavator, Mallchur

- Shredder, automatic reaper

- Straw Reaper

- Tractor-driven riper low binder and irrigation equipment (pump, sprinkler, drip system, pipeline, Rengan)

Eligibility Criteria

Farmers who want to get benefits of Kisan Anudan scheme needs to satisfy the below-listed criteria:

Tractor Subsidy

- All categories of farmers in the state can apply.

- Farmer applicant must not have availed any tractor subsidy for past 7 years.

- Farmer applicant can get a subsidy on a tractor or power tiller.

Automatic Tools

- All categories of farmers in the state can apply.

- Farmer applicant must not have availed any tractor subsidy for past 5 years.

Tractor Tools Subsidy

- All categories of farmers in the state can apply.

- Farmer applicant must not have availed similar benefit for past 5 years.

Sprinkler, Drip System, Rain Gun, Diesel/Electric Pump Subsidy

- All categories of farmers in the state who have their own land can apply.

- Farmer applicant must not have availed similar benefit earlier.

- For an electric pump, it is mandatory that the applicant has an electrical connection.

Benefits of the Scheme

With the help of a grant scheme for the farmers, farmers can get a grant from Madhya Pradesh state government, the importance of this scheme is as follows:

- There will be a development in the agricultural world and also Farmers life will grow in Madhya Pradesh state.

- Farmers will get subsidy benefits like the purchase of farming equipment.

- All the expensive equipment will be cheaper than before.

- The female farmers will get a grant of up to 50 per cent.

- Under this scheme, a subsidy of Rs. 30 to 40 thousand on agricultural machinery and Rs.63,000 for some agricultural machinery and Rs. 1 lakh for the big combine, etc. will be given by the government to the farmers in the state.

- Farmers can buy proper equipment for the purpose of farming.

Note: The Farmer applicants can also calculate their subsidy form by using this link in the official website of Madhya Pradesh.

Terms & Conditions of the scheme

The below-listed points are the terms and conditions of the Kisan Anudan Yojana:

- Within 10 days from the date of application, you must submit the gift application through selected or else it will be cancelled.

- If the application that you have applied got cancelled, then you cannot apply again within a month.

- You have to accept all the conditions to avail all the benefits of the scheme.

- Farmers can file their records and content details through the online portal on the selected dealer. Once the dealer is chosen, then you cannot change the dealer after that.

- If the farmer who is not eligible under this scheme and does not qualify for the material, the department will not be responsible for it, so only after ensuring your eligibility, spend money on the material you want, only then you may get the benefit of the grand under this scheme.

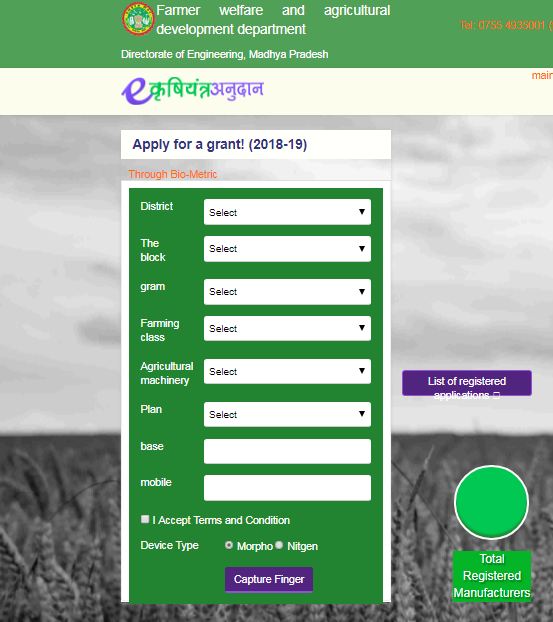

Online Application Procedure

Farmer applicant who wants to get benefits of this scheme can fill the Madhya Pradesh Kisaan Anudan Yojana application form online on its official website by following the steps given below:

Step 1: First, the applicant has to visit the official website of Madhya Pradesh government using this link.

Step 2: You have to click on the “apply” button depending on your choice.

Step 3: Then you need to select “Through biometric” or “Without biometric” of your choice and fill out all the required information online.

Step 4: The application form will be displayed as per you have selected. Now you can apply for the grant.

Step 5: Enter your Aadhar number and Mobile number to verify your details through OTP and click on the “Submit” button.

Step 6: After completing the application form successfully, the system will generate the application number. You may also take a print of the application number for future use.

Application Form Processing

Within 7 days of this application, you must upload the following records online, on which basis the purchase order will be issued, and you will be able to purchase the material. The following documents are listed below:

- Copy of Aadhaar card

- Copy of the bank passbook

- Caste certificate issued by competent authority (only for Scheduled Castes and Scheduled Tribes)

- B1 copy

- Proof of electricity connection (in the case of irrigation equipment)

On the basis of records submitted online by the farmer, the online purchase approval order will be issued by the District Officer. By purchasing the material within 20 days of the purchase approval order, it will be necessary for the producer to be transmitted through a case dealer.

Check Application Status

To know the status of your application form, go to the official web portal of Madhya Pradesh. You have to select the Application Status link available on the site. Then you need to enter your application number or base number and click on the Search button to view the current status of your application form of the scheme.