Private Limited Company Annual Return Filing

Private Limited Company Annual Return Filing

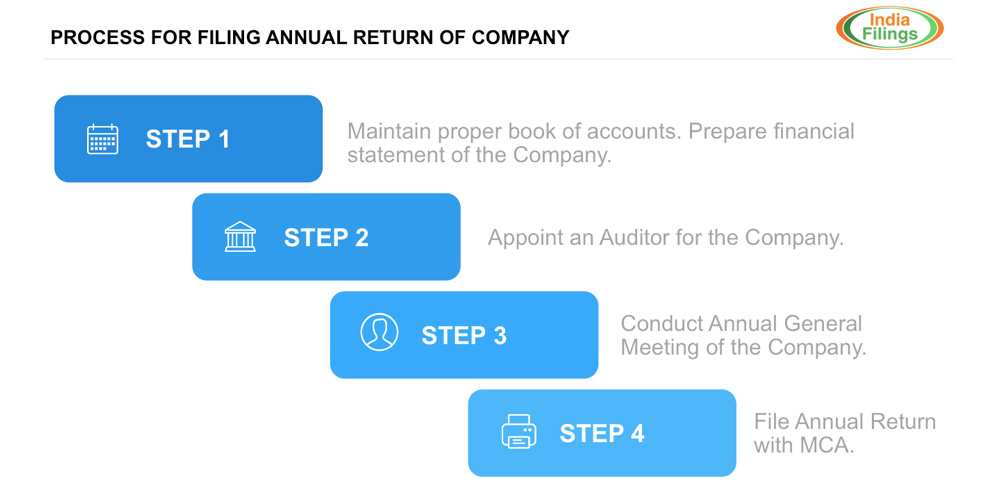

All Companies (Private Limited Company, Limited Company, One Person Company) are required to file annual return after the end of each financial year. The procedure for filing annual return for a private limited company is simple and can be easily completed by a financial. In this article, we look at the procedure for filing annual return for a private limited company.

Maintaining Book of Accounts

It is important for all companies to maintain Book of Accounts not only to comply with the law but also to have control over the business. The Companies Act, 2013 makes it mandatory for all companies to maintain book of accounts in the specified format. Further, in the absence of book of accounts and effective accounting systems, the Directors may not even know as to whether the company is incurring losses or profits. Filing regulatory filings such as service tax return, VAT return, TDS return, etc., would also be difficult without proper book of accounts. Therefore, it is imperative that the Company maintain proper Book of Accounts with the following information:

- Details of all the monies received and expended by the company and the matter in respect of which the transaction took place;

- All sales and purchases of the company;

- All the assets and liabilities of the company;

- All other financial or business transactions.

Accounting softwares such as Tally or QuickBooks can help easily maintain book of accounts for a business.

Preparing Financial Statements of the Company

All companies are required to prepare financial statements of the company based on the Book of Accounts. Financial statements means any statement to provide information about the financial position, performance and changes in the financial position of an assessee and includes balance sheet, profit and loss account and other statements and explanatory notes forming part thereof.

Appointing Auditor for the Company

Every Company must appoint its first Auditor within one month of the registration of the company. Any person who is a qualified Chartered Accountant in practice, or a firm of Chartered Accountants can be appointed as the Auditors of the Company. However, the following persons / entities cannot be appointed as Auditor of a Company:

- A body corporate;

- An officer or employee of the company (irrespective of if he/she is a qualified Chartered Accountant);

- a person who is a Partner or Director of the company;

- A person who is indebted to the company;

- A person who is in whole time employment elsewhere;

It is important to remember that the Auditor of the Company must be independent and not having bias towards the company.

The term of an Auditors appointment would end at the conclusion of the Annual General Meeting of the Company, the company may re-appoint the same Auditor or may decide to replace the Auditor.

Auditing the Financial Statement of the Company

Audit plays an important role in the management of the Company. As per Companies Act, 2013 every company should appoint an Auditor to audit the accounts of the company and present their report on the accounts. The Auditor after being appointed by the Company would audit the financial statements of the Company and submit his/her report on the accounts of the Company to the members. The Auditor is also required to state in his report whether the accounts of the Company give a true and fair view of the state of affairs of the Company.

If the Auditor is not satisfied with the information / clarification provided in the financial statements of the Company, or if the Auditor has any reservation in respect of the account or book of accounts maintained by the Company, then he/she can bring the facts to the attention of the stakeholders by Qualifying the Audit report.

Conducting Annual General Meeting

An Annual General Meeting is a meeting of the shareholders of a Company held every year. Companies Act, 2013 mandates that all company except One Person Company hold one Annual General Meeting every year. No company is exempt from this requirement. The date of any Annual General Meeting must be within 15 months from the date of immediately preceding Annual General Meeting. However, for a newly incorporated company, the first Annual General Meeting must be held within 18 months from the date of incorporation of the Company.

At the Annual General Meeting, the audited financial statements of the Company with the Auditor’s Report and Directors Report are placed before the members of the Company. The members of the Company on being satisfied about the financial statements of the Company can adopt the Annual Accounts of the company after due consideration. The financial statements of a company are considered final only after it is approved by the Shareholders of the company in the Meeting.

Private Limited Company Annual Return Filing

Once, the Annual General Meeting is completed and the audited financial statements are adopted by the Company, it must be filed with the Registrar. The filing of the audited financial statements of the company in the prescribed format to the Ministry of Corporate Affairs is called as filing of annual return of a company. The annual return of the company must be filed within 60 days of the date on which the annual general meeting of the company was held.

To file private limited company annual return, visit IndiaFilings.com