LLP Registration Process

LLP Registration Process

Limited Liability Partnership (LLP) is a business structure that has gained significant popularity among entrepreneurs in India due to its unique advantages. Combining the benefits of a partnership firm and the limited liability feature of a company, an LLP offers flexibility, credibility, and protection to its partners. In this comprehensive guide, we will explore the process of LLP registration in India, the eligibility criteria, and the essential documents required to establish your LLP with ease. Understanding the intricacies of LLP registration will empower you to confidently embark on your entrepreneurial journey and secure your business’s future.

What is LLP?

A Limited Liability Partnership (LLP) is a unique business organization that combines the features of a partnership firm and a company. In an LLP Firm, the partners have limited liability, similar to shareholders in a company, while also enjoying the flexibility and simplicity of a partnership. This business structure provides a separate legal entity status, allowing the LLP to sue and be sued in its name, distinct from its partners.

LLPs have gained popularity among entrepreneurs in various industries due to the protection they offer to partners’ assets and the ease of compliance compared to traditional companies. The concept of LLP was introduced in India in 2008, and it is regulated by the Limited Liability Partnership Act, providing a credible and versatile option for businesses of all scales.

LLP Registration Requirements and Eligibility Criteria

To be eligible for LLP registration process in India, you should meet the following criteria:

- Minimum Two Partners: At least two partners are required to form a Limited Liability Partnership in India, with no upper limit on the maximum number of partners.

- Designated Partners: Within the partnership, a minimum of two designated partners are mandated, and they must be natural persons. Furthermore, at least one of these designated partners should reside in India.

- Nomination for Body Corporate Partner: If a body corporate becomes a partner, a natural person must be nominated to represent it.

- Agreed Contribution: Each partner must contribute towards the shared capital of the LLP as agreed upon.

- Minimum Authorized Capital: The LLP should have an authorized capital of at least ₹1 lakh.

- Indian Resident Designated Partner: At least one designated partner of the LLP must be a resident of India.

By fulfilling these requirements, you can proceed with LLP registration in India and enjoy the benefits of this business structure.

Features of LLP

The features of a Limited Liability Partnership (LLP) are listed as follows:

- Separate Legal Entity: Similar to companies, a Limited Liability Partnership (LLP) is a separate legal entity. This distinct identity gives the LLP rights and liabilities independent of its partners.

- Minimum Two Partners: To establish an LLP, two individuals must collaborate. This allows for flexibility and collaboration in setting up the business.

- No Maximum Partner Limit: Unlike other specific business structures, an upper limit exists on the maximum number of partners an LLP can have. This enables scalability and the inclusion of multiple partners as the business grows.

- Minimum Two Designated Partners: A minimum of two designated partners are required within the LLP. These designated partners must be natural persons, and at least one must be a resident of India.

- Limited Liability: One of the critical advantages of an LLP is that the liability of each partner is limited to the amount of their respective contribution to the LLP. This protects their assets from business liabilities.

- Cost-Effective Formation: Forming an LLP is relatively cost-effective compared to setting up a company, making it an attractive option for small and medium-sized businesses.

- Less Compliance and Regulations: LLPs are subject to fewer regulatory requirements and compliance obligations than companies, reducing administrative burdens.

- No Minimum Capital Contribution: Unlike companies, there is no requirement for a minimum capital contribution to establish an LLP. Partners can contribute as per their business needs and financial capabilities.

Benefits of LLP Registration

The advantages of LLP Limited Liability Partnership Firm are explained in detail below:

Separate Legal Entity

Like companies, an LLP possesses a separate legal entity. This distinction lends credibility and trust to the business as it can sue and be sued in its name. Stakeholders, customers, and suppliers gain confidence knowing they deal with a recognized legal entity.

Limited Liability of Partners

LLP partners enjoy limited liability, limiting their personal risk to the extent of their contributions. They are not personally liable for the LLP’s debts or losses, enhancing their credibility as business operators.

Low Cost and Less Compliance

LLP formation incurs lower costs than public or private limited companies. Moreover, LLPs have reduced compliance obligations, with only two annual filings – Annual Return and Statement of Accounts and Solvency.

No Minimum Capital Contribution

LLPs can be established without minimum capital requirements. Partners can contribute any capital to form the LLP, providing flexibility in business funding.

Disadvantages of LLP

Indeed, Limited Liability Partnerships (LLPs) offer numerous advantages despite having a few disadvantages:

Penalty on Non-Compliance

Although LLP compliance is minimal, failure to meet the obligations on time results in hefty penalties. Even if an LLP has no activity during a year, it must file returns with the Ministry of Corporate Affairs annually or face penalties.

Winding Up and Dissolution

An LLP requires a minimum of two partners to exist. The LLP is dissolved if the number of partners falls below two for six months. It may also face dissolution if unable to clear its debts.

Difficulty in Raise Capital

LLPs must have the concept of equity or shareholders. Angel investors and venture capitalists cannot invest in LLPs as shareholders, as they would need to assume partner responsibilities. This makes it challenging for LLPs to attract external capital compared to companies.

LLP Company Registration Cost in India

The cost of LLP company registration in India is contingent on the capital commitment. The MCA has outlined specific fee slabs as follows:

- Rs.500 to establish a limited liability partnership with a capital commitment of less than 1 lakh.

- Rs.2000 for forming a limited liability partnership with a capital commitment exceeding one lakh but less than five lakhs.

- Rs.4000 for establishing a limited liability partnership with a capital commitment surpassing five lakhs but less than ten lakhs.

- Rs5000 for founding a limited liability partnership with a capital commitment exceeding ten lakhs.

Documents Required for LLP Registration

To register an LLP, partners need to provide the following documents:

- PAN Card/ ID Proof of Partners

- Address Proof of Partners: Partners can submit any of the following: Voter’s ID, Passport, Driver’s license, or Aadhar Card.

- Residence Proof of Partners: Partners must submit a recent bank statement, telephone bill, mobile bill, electricity bill, or gas bill at most 2-3 months.

- Partners should provide a passport-size photograph with a white background.

- Foreign nationals and NRIs wishing to partner in an Indian LLP must submit their passport.

- Foreign nationals or NRIs must also submit proof of address, such as a driving license, bank statement, residence card, or any government-issued identity proof containing the address.

- Proof of Registered Office Address: Provide the rent agreement and landlord’s no-objection certificate if rented. Submit a recent utility bill (gas, electricity, or telephone) with the complete address and owner’s name (2 months or older).

- Digital Signature Certificate (DSC): One designated partner should have a DSC for digitally signing documents.

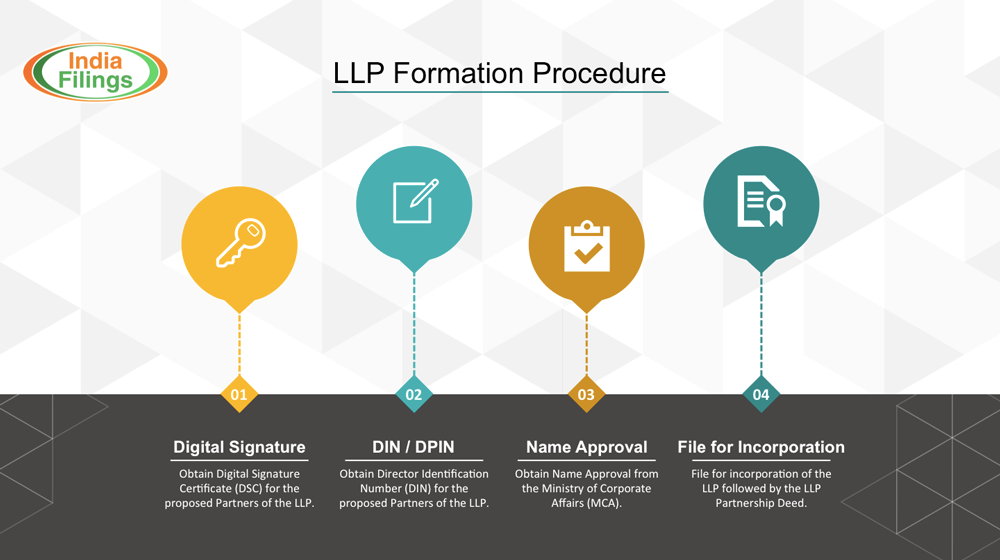

LLP Registration Process

LLP Registration Process involves several essential steps. Here’s a step-by-step guide to incorporating your LLP:

Obtain a Digital Signature Certificate (DSC)

The first step of LLP incorporation is to obtain a Digital Signature Certificate (DSC) for all the proposed partners of the LLP. This is necessary as all the documents filed with the government for LLP incorporation need to be digitally signed.

Obtain Director Identification Number (DIN)

Next, partners who do not have a DIN need to apply for one. The Director Identification Number (DIN) is an exclusive identification number designated to individuals aspiring to serve as directors in companies or designated partners in Limited Liability Partnerships (LLPs).

Choose a Name for the LLP

Select a unique and suitable name for your LLP. Ensure that the name adheres to the Ministry of Corporate Affairs guidelines to avoid rejection during the application process.

Form for Incorporation of LLP (FiLLiP)

The Form for Incorporation of LLP, commonly known as FiLLiP, is a crucial document required for registering a Limited Liability Partnership (LLP) in India. This form collects essential information related to the LLP’s establishment, such as the proposed name of the LLP, details of the partners involved, the LLP agreement, and the registered office address. Moreover, it includes a declaration from the partners consenting to act as designated partners and comply with the LLP regulations.

Draft LLP Agreement

Prepare the LLP Agreement, which defines the rights, duties, and obligations of the partners and the LLP. This agreement must be notarized and filed with the Ministry of Corporate Affairs (MCA) within 30 days of incorporation.

Obtain a Certificate of Incorporation

Once all the necessary forms and documents are filed and verified, the Registrar of Companies (RoC) will issue the Certificate of Incorporation. This certificate officially recognizes the existence of your LLP.

Apply for PAN and TAN

After obtaining the Certificate of Incorporation, apply for the Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for your LLP.

Following the steps mentioned, you can successfully incorporate your LLP and confidently embark on your entrepreneurial journey.

Are you looking to register your LLP hassle-free?

IndiaFilings is your reliable partner for LLP registration. With our expert assistance, you can smoothly navigate the registration process and enjoy the benefits of limited liability, separate legal entities, and more. Don’t let complexities hold you back. Talk to our experts at IndiaFilings today and embark on your journey to establish a successful LLP with confidence!