How To Check And Authenticate Income Tax Notice Online

How To Check And Authenticate Income Tax Notice Online

When one receives a notice from the income tax department, it’s natural to feel anxious. However, not every message from the department is a cause for concern. An intimation is typically a notification about the outcome of your tax return processing or the finalization of an assessment. Often, it doesn’t require any immediate action from you, although there can be exceptions. Conversely, a notice is more pressing. It signifies a formal instruction or communication from the department that necessitates your response or a specific action.

The Income Tax Department can send out notices for various reasons under different sections of the tax laws. This guide is dedicated to navigating the process of checking and authenticating income tax notices through the official Income Tax Department’s online portal.

IndiaFilings experts provide seamless assistance in Income Tax Notices.

Get Started!What is an Income Tax Notice

An Income Tax Notice is an official document issued by the Income Tax Department to a taxpayer for various reasons, such as discrepancies in tax filings, incomplete or inaccurate returns, or to request additional information. These notices can serve multiple purposes, including intimating taxpayers about processing their returns, seeking clarification or documentation, and, in some cases, alerting them to potential audits. The notice typically specifies the issue at hand, the relevant tax year, and the action required by the taxpayer, along with a deadline for compliance. Understanding and responding to these notices timely and accurately is crucial for maintaining compliance with tax laws and avoiding further legal implications.

Understanding the Various Income Tax Notices

Before diving into how to verify income tax return (ITR) notices online, it’s crucial to grasp the array of notices the Income Tax Department might send you.

- Intimation under Section 143(1): This is an intimation from the Central Processing Center (CPC) after processing your return. It outlines your reported income, deductions, tax dues, or refunds. It’s dispatched when there’s a mismatch between your return and the tax department’s data.

- Notice under Section 143(2): This notice signals the tax department’s detailed review or scrutiny assessment of your return. You must submit further documents or information to substantiate your return’s claims.

- Notice under Section 148: Issued when the tax department suspects income underreporting or missing tax returns for a certain year, urging the taxpayer to file or rectify their return.

- Notice under Section 139(9): Triggered by discrepancies or errors in your return, like incomplete details or inaccuracies, this notice asks for clarifications or amendments within a set timeline.

- Notice under Section 245: Sent when there’s a pending refund request from you but also outstanding tax demands from previous years. The department may propose to offset your refund against these dues.

Each notice serves a specific purpose and requires a timely and accurate response to ensure compliance and resolve any issues with your tax filings.

Common Reasons for Receiving an Income Tax Notice

The Income Tax Department might send a notice for various reasons, many of which stem from discrepancies or irregularities in tax filings. Here are some of the most frequent causes:

- Missing the ITR Filing Deadline: If you don’t file your Income Tax Return by the prescribed due date, you will likely receive a notice urging you to comply.

- Discrepancies in Reported Income: When there’s a mismatch between the income you’ve reported and the information provided by your employers, banks, or other financial institutions.

- Errors or Inconsistencies in Your ITR: Mistakes such as overlooked income sources, unclaimed deductions, or credits can prompt a notice. This includes inaccuracies in reported income, deductions, and tax credits.

- Suspected Underreporting of Income: If the tax department believes you’ve underreported your income to minimize tax liability, you may receive a notice to clarify or reassess your income.

- Unpaid Taxes: Failure to pay the taxes due according to your declared income and allowable deductions can result in a notice for the outstanding amount.

- TDS/TCS Mismatches: Differences between your reported Tax Deducted at Source (TDS) or Tax Collected at Source (TCS) and the records maintained by the tax department can trigger a notice.

- High-value Transactions: Engaging in significant financial activities, such as hefty cash deposits, property transactions, or international transfers, might attract scrutiny and subsequent notices.

- Assessment or Reassessment Proceedings: If the tax department initiates an assessment or reassessment of your income under specific sections like 143(2) or 148, you’ll be notified through a formal notice.

Awareness of these common reasons can help taxpayers maintain accurate and timely filings, reducing the likelihood of receiving a notice from the Income Tax Department.

What to do After Receiving an IT Notice?

Receiving an income tax notice can be unsettling, but taking methodical steps can help address it effectively. Here’s what you should do:

- Review the Notice Thoroughly: Read it carefully to understand why it was issued. Notices can vary greatly regarding what they require from you, from simple clarifications to detailed document submissions.

- Verify Personal Details: Ensure the notice correctly mentions your name, Permanent Account Number (PAN), and address. This step is crucial to confirm that the notice is intended for you and not sent to you by mistake.

- Identify the Discrepancies: If the notice is about discrepancies in your income tax return, compare the details with your return to understand where the mismatch lies. This could be due to unreported income, incorrect deductions, or misinterpreting your financial information.

- Timely Response: It’s imperative to respond to the notice within the specified timeframe. Ignoring a notice or delaying your response can result in penalties or further legal action from the Income Tax Department.

- Provide Comprehensive Information: When you respond, provide all the requested information and documentation to support your case. Depending on the nature of the notice, this may include bank statements, proof of investments, tax deducted at source (TDS) certificates, and more.

- Utilize the Income Tax Portal: Check the authenticity of the notice and respond to it through the official Income Tax Portal. The portal provides a secure and direct channel to handle notices, ensuring your response is recorded and processed efficiently.

Taking these steps seriously and promptly addressing the notice can help resolve the issue smoothly and avoid potential complications with your tax filings.

Also read – What to Do When You Receive an Income Tax Notice?

If the notice is complex or you are unsure how to proceed, consider consulting with an IndiaFilings tax expert for expert guidance.

Get Started!How to Check Your Income Tax Notice Online?

To verify and review any income tax notice or intimation online, you can utilize the e-filing portal provided by the Income Tax Department. Here’s a step-by-step guide to navigating the portal effectively:

- Step 1: Visit the official e-filing portal of the Income Tax Department and access your Dashboard. The portal serves as a comprehensive platform for all your income tax-related activities.

- Step 2: Log in or sign up to access your account. You can use your Permanent Account Number (PAN), Aadhaar Number, or User ID to log in. Ensure your account is registered on the portal to use these features.

- Step 3: Once logged in, you can check for any notices, intimations, or actions required by following these steps:

- For Filed Returns: Navigate to e-file > Income Tax Returns > View Filed Returns on the menu bar. This section lets you view all your filed returns and any associated notices or communications from the department.

- For Pending Actions (Worklist): Select Pending Actions > Worklist from the menu bar. This area lists any tasks or actions you assign, including responses to notices.

- For e-Proceedings: Choose Pending Actions > e-Proceedings on the menu bar. You can find details on ongoing proceedings, including scrutiny assessments and related notices.

- For Outstanding Demands: Click on Pending Actions > Respond to Outstanding Demand on the menu bar. This option is crucial if you have received a notice regarding any tax demand from the department.

These steps on the e-filing portal ensure that you can efficiently access, review, and respond to any income tax notice or communication.

Authenticating an Income Tax Notice Online

After locating an income tax notice through the e-filing portal, the next crucial step is to authenticate it to ensure its legitimacy. Here’s a straightforward guide to authenticating your income tax notice on the Income Tax Department’s e-filing portal:

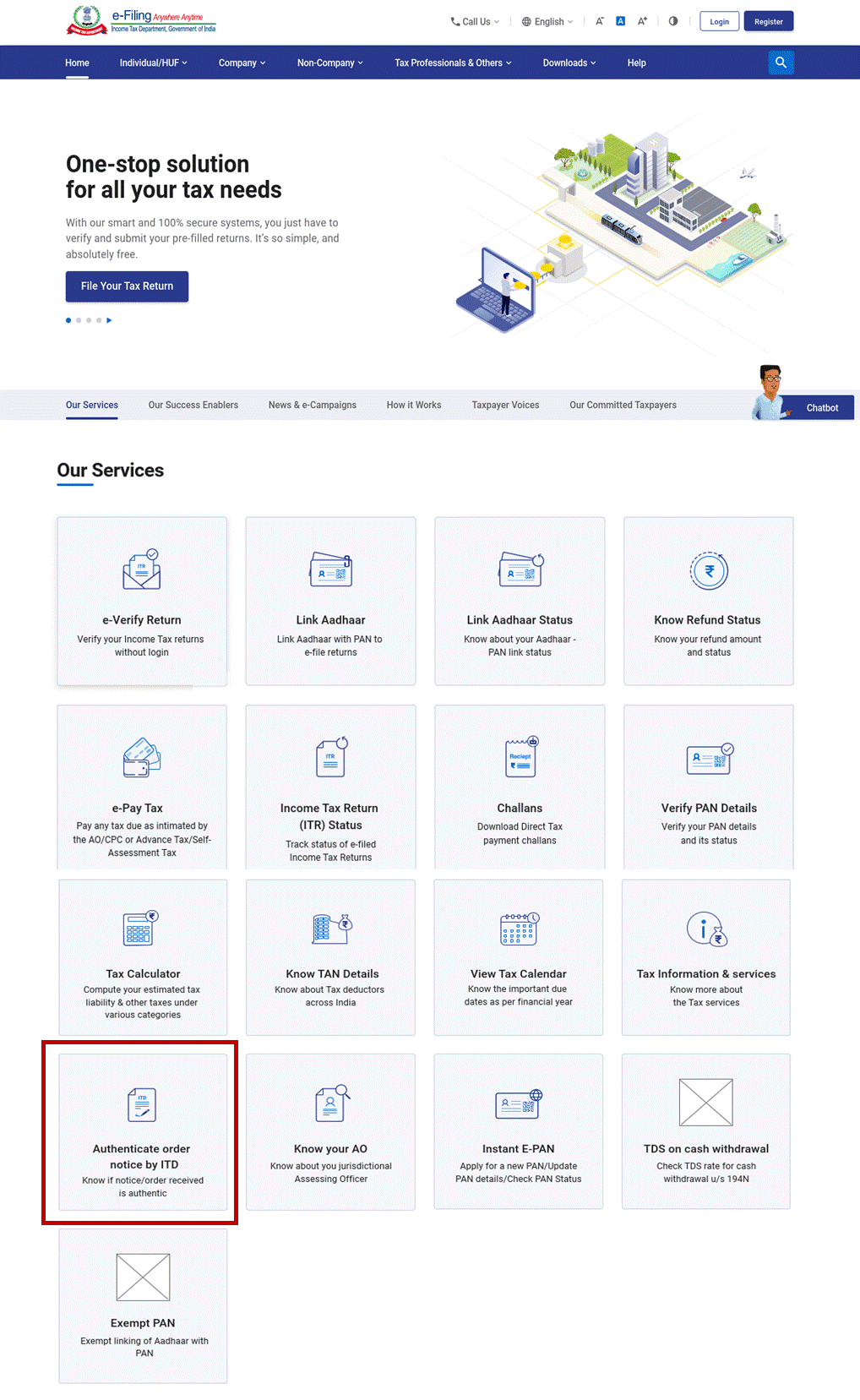

Step 1: Accessing the Authentication Section

- Navigate to the Income Tax Department’s e-filing portal.

- Click on the “Authenticate notice/order issued by ITD” link in the “Quick Links” section on the homepage.

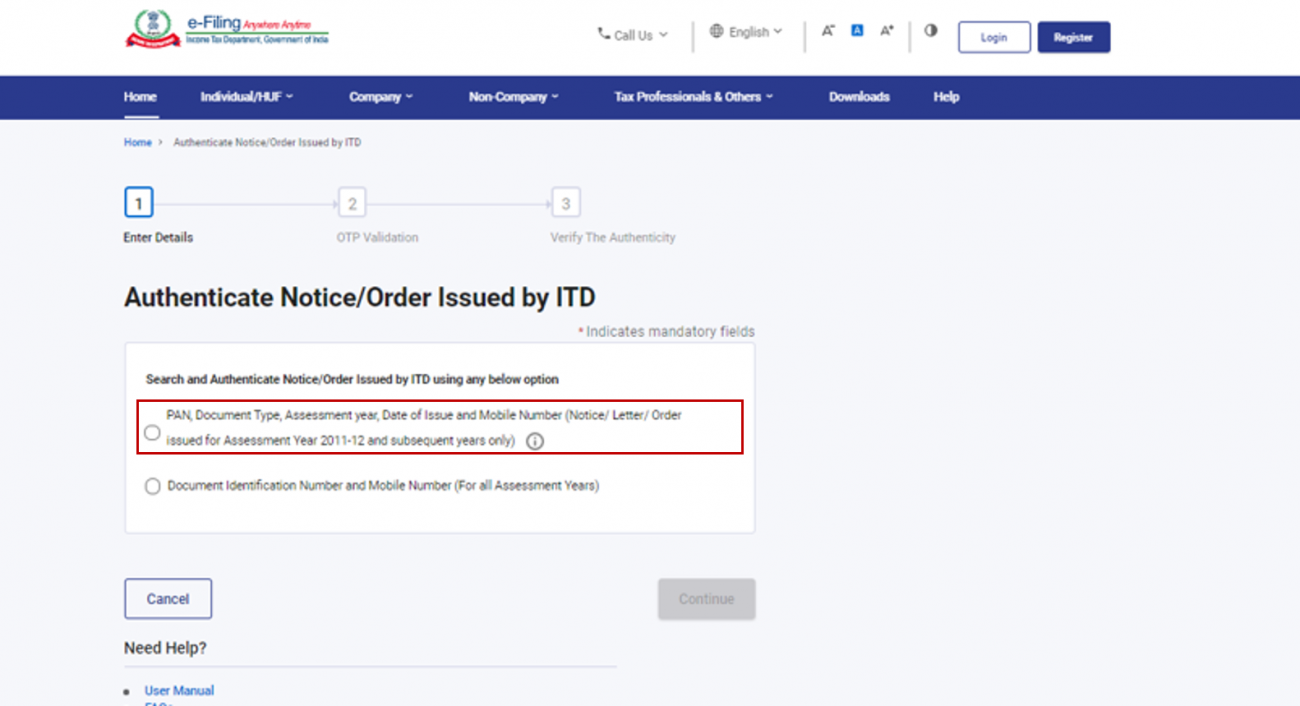

Step 2: Authentication Methods

You have two primary methods to authenticate your notice:

Method 1: Using PAN and Other Details

- Provided details such as your PAN, the assessment year, the type of document, your mobile number, and the notice’s issue date.

- Fill in all the required fields and submit the information.

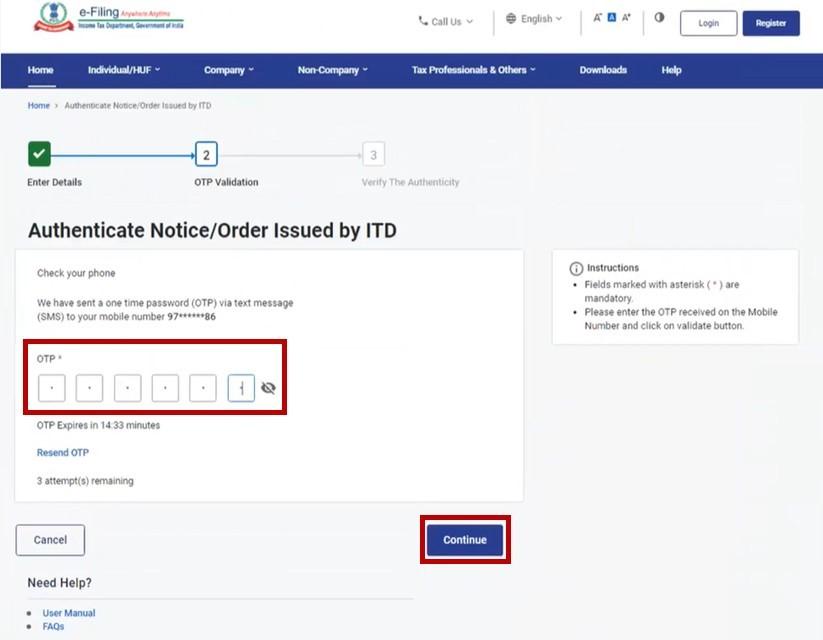

- Enter the OTP sent to your registered mobile number for validation.

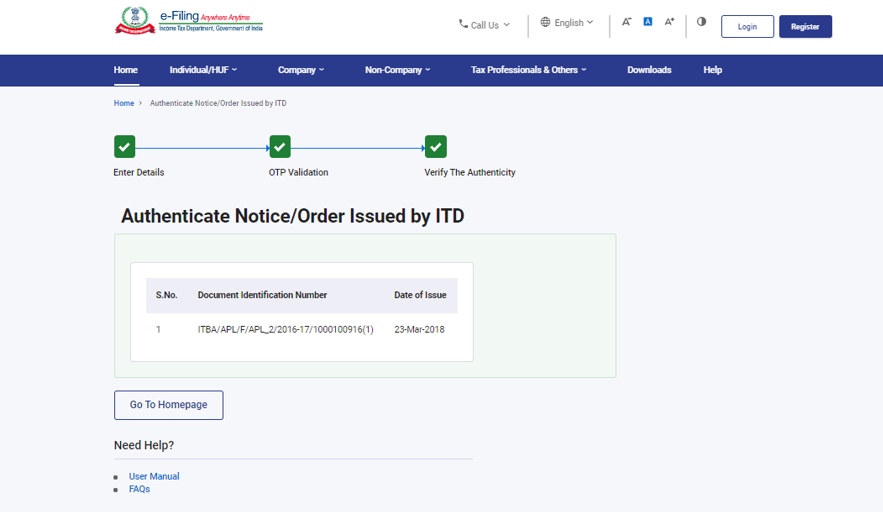

- After successful OTP validation, you will see the issue date and the notice’s Document Identification Number (DIN) if the notice is authentic. If no record is found, a message will indicate, “No record found for the given criteria.”

Method 2: Using DIN and Mobile Number

- Enter your Document Identification Number (DIN) and mobile number.

- Submit these details and validate the request with the OTP sent to your registered mobile number.

If the notice is found, a success message will be displayed confirming its authenticity. If no corresponding notice is found, you’ll see a message stating, “No record found for given document number.”

Step 3: Understanding the Notice

Once you’ve confirmed the notice’s authenticity, carefully read through it to understand what the Income Tax Department is asking for or informing you about.

The notice will detail the reason for issuance, the relevant section of the Income Tax Act, and what is expected from you as a response.

Step 4: Take Necessary Action

Based on the notice type, you may need to submit additional documents, rectify mistakes in your return, or take other specified actions.

Step 5: Keep Records

After submitting your response, ensure you save a copy of the notice, your response, and any acknowledgements from the department for your records.

For complex notices or if you’re uncertain about the next steps, consulting with tax professionals at IndiaFilings can provide clarity and guidance, ensuring that your response is well-crafted and compliant with the Income Tax Department’s requirements.

Get Started!Conclusion

Receiving a notice from the Income Tax Department is not always a cause for concern, but it does require prompt and careful attention. By following the steps to check and authenticate notices online, taxpayers can efficiently manage their interactions with the department. Always respond within the stipulated time frame to avoid penalties or further notices.

If unsure how to proceed, consult an IndiaFilings tax professional for advice. Our experts can guide you in crafting and filing effective responses to Income Tax notices.

Get Started!