How Franchise Business Works

How Franchise Business Works

Franchising is the running of a business using some or all aspects of another successful business in partnership. In the past, businesses would provide the right to sell a product in a particular market known as distribution deals or distributorship. More recently, however, the concept of franchising has evolved wherein a business allows grants another business the license to operate under the same name and use the expertise of the parent company for establishing a successful business. Some of the most well-known franchise business in the world is Domino’s Pizza and McDonald’s restaurants. In this article, we look at how to franchise business works in India.

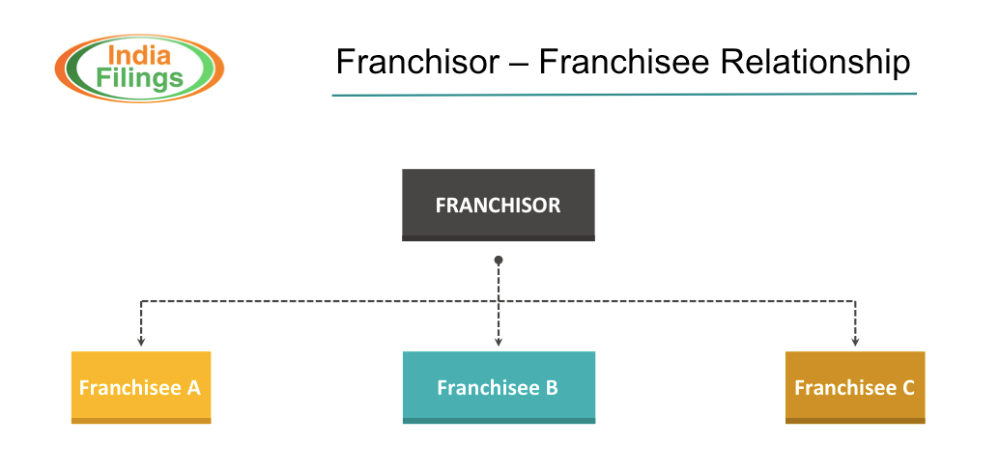

Franchisor – Franchisee Relationship

The franchisor is the parent business that allows franchisees to operate using the same products or services, trademarks, techniques, etc., in return for an agreed-upon fee. A franchisor usually has a number of franchisees. A franchisee can have only one franchisor. The relationship between the franchisor and franchisee is governed by the franchise agreement.

Franchise Agreement

The franchise agreement is a written legal document between the franchisor and franchisee. The franchise agreement is the fundamental document upon which the franchisor-franchisee relationship is based on. The franchisor and franchisee must both sign the agreement. The following are some of the major aspects covered in a franchise agreement:

- Details about the franchisor and franchisee

- Appointment of franchisee and grant of a license

- Location of the franchisee

- Development of the franchisee location

- Maintenance of the franchisee location

- Proprietary marks or trademarks the franchisee can use

- Licenses or permissions the franchisee must obtain or can use from the franchisor

- Operation standards

- Quality standards

- Training and assistance from the franchisor, if any

- Consideration for granting franchisee

- Franchisee license fee, if any

- Marketing assistance from Franchisor, if any

- Products or Services that can be offered by the Franchisee

- Franchisee obligations

- Franchisor obligations

- Terms of the franchise agreement

- Tenure of the franchise agreement

- Renewal of the franchise agreement

- Termination of the franchise agreement

Benefits for Franchisor

The franchising business model affords a number of advantages for both the franchisor and franchisee. The following are the advantages of Franchisor from creating a franchising business model.

Low Capital

Franchisors typically collect a franchising fee from individual franchise owners at no interest. This money collected from franchisees can be used by the Franchisor to grow the business and brand.

Rapid expansion

Fast expansion is necessary to quickly capture market share in a developing country like India. Franchising business model can help a business quickly expand and garner market share.

Partnering with Entrepreneurs

In a franchising business model, the franchisor partners with Entrepreneurs or Business Owners – who are motivated by their ownership, profits and capital invested by them in the business. This will immensely help the franchisee and franchising model succeed.

Greater buying power

Brand Building

Benefits for Franchisee

Franchisee enjoys a number of advantage by starting a franchising business than starting an independent business. Some of the advantages of starting a franchising business for a franchisee are:

Expertise

To start and manage a franchise business, the promoter does not need any experience or expertise. The franchisor will provide the training and expertise to successfully operate the business.

Higher chance of success

Franchise business usually has a higher rate of success than independent business due to a number of reasons. Franchise businesses have well experience professionals backing the business, lower branding cost, higher brand reputation, etc., – increasing the chances of success.

Independence

Franchise business offers the business owner a chance to operate an independent business while enjoying many of the benefits of big business.

Easier access to capital

Franchisors typically have a number of tie-ups with banks to provide loans for setting up a franchise business. Therefore, franchise owners can have easier access to bank loan through the franchisor.

Franchising Cost for Famous Brands

The following are the estimated cost for obtaining a franchisee of the brand. They are just indicative figures and can vary:

Fab India Franchising Cost

Selling of garments, home products, personal care products, etc.,

Investment: 30- 50 lakhs. ; Annual Brand Fee: 2 – 5 lakhs.

Snap Fitness Franchising Cost

High-end health and fitness centre.

Investment: Rs.100 – 200 lakhs; Annual Brand Fee: Rs.15 – 20 lakhs.

Naturals Salon Franchising Cost

Health and beauty salon.

Investment: Rs. 30 – 50 lakhs; Annual Brand Fee: Rs. 3 – 7 lakhs.

Sunglass Hut Franchising Cost

Eyewear and accessories retailing.

Investment: Rs.30 – 50 lakhs; Annual Brand Fee: Rs.2 – 5 lakhs.

Classic Polo Franchising Cost

Men’s fashion and clothing retailing.

Investment: Rs.5 – 25 lakhs; Annual Brand Fee: NIL – 2 lakhs.