Uttar Pradesh Property Tax

Uttar Pradesh Property Tax

Property tax is a primary source of revenue for the Uttar Pradesh Municipal Corporation. This form of tax is to be paid annually by the property owners to the municipal corporation of the jurisdiction in which the property/ land is located. The system of taxation has been made mandatory by the Government for anybody who owns property in Uttar Pradesh. In this article, we review the various aspects of Uttar Pradesh property tax in detail.

Uttar Pradesh Municipal Corporation Act, 1959

The regulations under this act apply to serves the assessment of tax collected from the Municipal Corporation. Taxes would be payable in according to the rates fixed under Section 148 of the Act on the basis of annual value. According to this Act, the taxes are payable with the rates fixed under section 148 of the Act based on the yearly amount. Rebates shall be admissible in annual value and payable taxes in according with the provisions prescribed in the Act. Following the provisions in this Act, the deductions shall be admissible in annual value and payable taxes.

Eligibility Criteria

- A person whose age is above 18 years of age.

- An individual who is a permanent resident in the state of Uttar Pradesh.

- Any person who owns a property in Uttar Pradesh is entitled to pay a property tax.

Calculation of Property Tax

Property taxes are determined from a percentage of the assessed value of the property. Property taxes are calculated using the amount and location of the property or land by a local government. The tax assessors will value the property or land and charge an appropriate rate from the landowners using the standards set by the government authorities.

Documents Required

The applicant will have to submit a copy of the assessment order or receipt of the latest property tax paid payment while making the payment of property tax.

Procedure for Paying Property Tax – Online Method

The applicants of Uttar Pradesh must follow the below steps to make the Property Tax payment online.

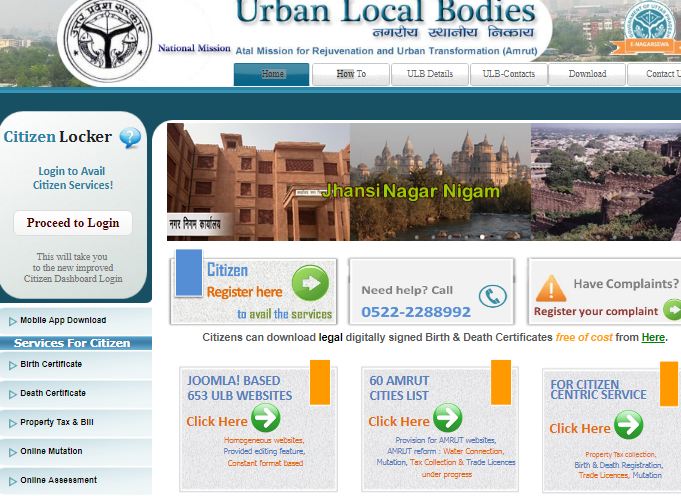

Visit the e-NagarSewa Portal

Step 1: The applicant must visit the official website of e-NagarSewa portal of Uttar Pradesh Municipal Corporation to make the property tax payment.

Step 2: After which, the user must click on the ‘Property Tax & Bill’ tab to navigate to the online property tax payment portal.

Login to portal

Step 3: After that, the citizen log in page will be displayed.

Step 4: Once you got registered with the portal, log in to the portal using your user id and user password.

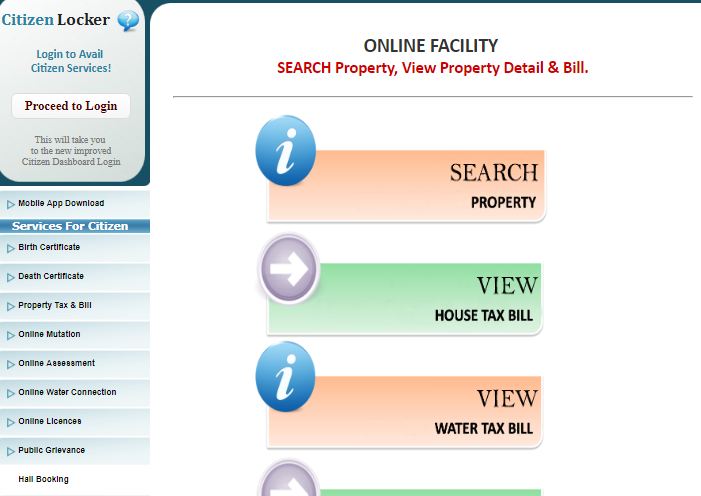

Search your Property

Step 5: Now you can search for the property by entering the following details such as City, house number, owner name, and address. Then you need to enter the property ID and click on the submit button.

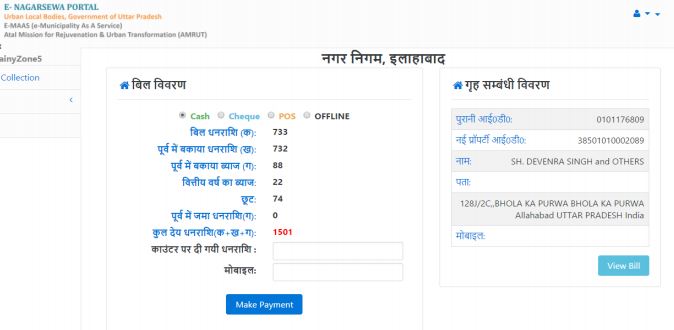

Step 6: After that, the property details will be displayed along with the bill details.

Make Payment

Step 7: Now, check the checkbox against the quarter bill or arrear bill for which the payment can be made. Then you need to click on the “Pay Now” button.

The money can be redeemed in three ways:

- Full Payment: In total, it is deposited in one whole year.

- Partially Payment: This can be tested in the cart – Half-an-a-half.

- Advance Payment: It can be credited to the student in his or her second language.

Step 8: The user will be redirected to the payment gateway, upon which he/she has to choose the desired payment option (debit card, credit card, internet banking).

Step 9: The following details to must be filled prior to making the payment.

• UBL name

• Collection date

• Collection centre

• Payment mode

• Bank details

Step 10: Then, the user needs to fill out all the necessary payment details.

Step 11: Click on the “Make Payment” button to make the payment online.

Step 12: After making payment, a receipt of the same will be generated as an acknowledgement slip for the amount made.

Penalty for Non-Payment of Property Tax

Non-payment of property tax can impose a hefty penalty in the hands of the landowner. Late payments towards property tax may attract interest at the rate of 5 to 20 per cent on the payable sum, depending upon the relevant policies.