Is Digital Signature Required for GST?

Is Digital Signature Required for GST?

A Digital Signature Certificate (DSC) is a safe digital key issued by the Government authorized certifying authorities to authenticate the certificate holder’s identity. DSC under GST is a necessary term for the taxpayer’s identification in every GST form.

DSC is required for GST registration and GST filing in India. The DSC is stored digitally in a pen drive. Thus, it can be used to digitally sign online applications, GST returns, and other GST forms. The present article will help you understand the importance of the DSC Requirement for GST and the procedure to register DSC on the GST Portal.

Digital Signature Certificate

As mentioned above, A Digital Signature Certificate is a safe digital key issued by the certifying authorities to authenticate the certificate holder’s identity. DSC is like physical certificates, and the difference is DSC is in digital or electronic form, and Physical certificate is in paper form.

Importance of DSC Requirement for GST

As per the Information Technology Act 2000, all corporate entities and LLPs must use DSC. Under GST, all documents submitted to the Government, including GST registration applications or documents uploaded to the GST common portal, must be digitally signed.

Hence under Goods and Services Tax (GST), the taxpayer must attach a valid for performing the following activities on the GST portal:

- Using DSC, a taxpayer can make online payments secure and authentic

- Submission of various applications such as GST registration application requires DSC

- DSC is mandatory for uploading documents to the GST portal

- Taxpayer requires DSC to reply to GST notices

- For Claiming GST refunds, etc.

Class 3 DSC

Class 3 Digital Signature Certificate is the highest level of DSC where a Registration Authority verifies a person’s identity. From the year 2021 onwards, usage of Class 2 DSC has been stopped. Class 3 Digital signatures have been made mandatory for all the use-cases involving both individuals and organizations. Now taxpayers can buy a Class 3 Digital Signature Certificate and use it for all signature needs across the GST.

IndiaFilings can help you get a Class 3 Digital Signature certificate with a validity of 2 years and a secure USB token.

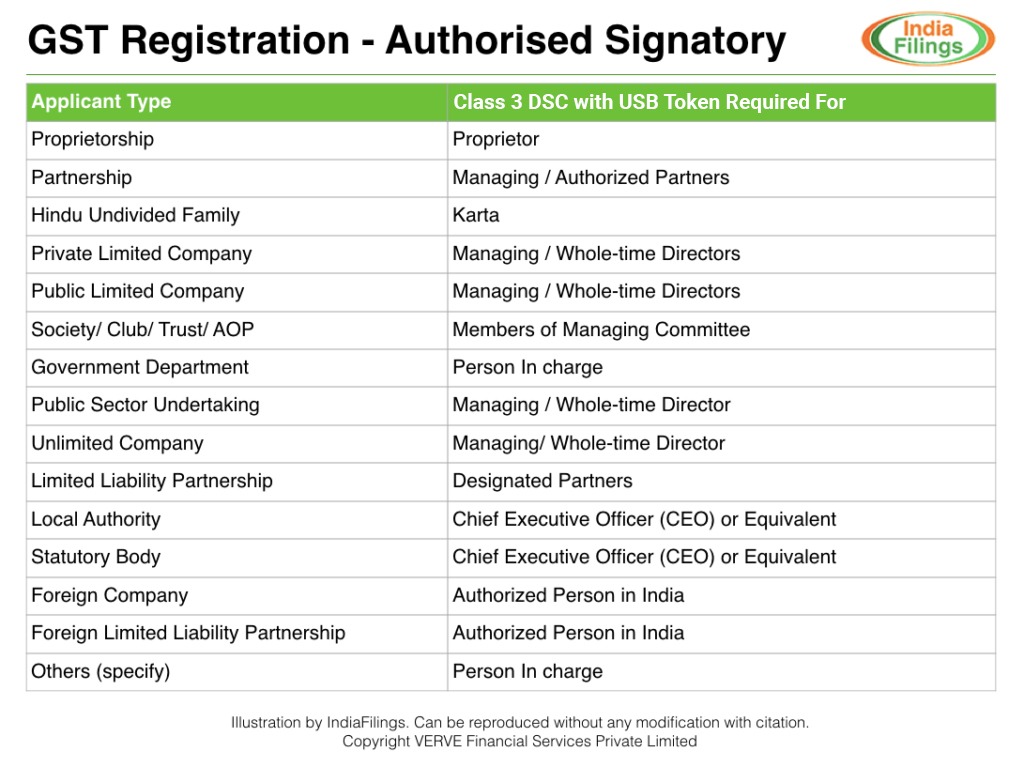

Who can use a digital signature on the GST portal?

Class 3 digital signatures with USB tokens must obtain for the person who is authorized. The list of a person authorized to sign or verify a GST document is as below:

Proprietorship and Individuals

The authorized Signatory is the Proprietor or the individual himself. If he is absent from India, someone duly authorized by him on this behalf can be the Authorized Signatory.

If the individual is mentally incapacitated from attending to his affairs, his guardian or any other person competent to act on his behalf will be the Authorized Signatory.

Hindu Undivided Family (HUF)

Hindu Undivided Family (HUF) Authorized Signatory is Karta. Suppose they are not physically present in India or mentally incapacitated from attending to the affairs. In that case, any other adult member of such family will be authorized Signatory of such Karta.

Private Limited Company, One Person Company, or Other Types of Company

For a private limited company or one-person company, the chief executive officer, Managing Director, or authorized Signatory will be nominated by the Board of Directors.

Limited Liability Partnership

The chief executive officer is the Designated Partner or authorized Signatory.

In the case of the Partnership Firm, a Partner will be an authorized Signatory or anyone nominated by the Partnership Firm, but they will not be a minor.

Governmental Agency

In the case of the Government agency or local authority, an officer authorized by the agency will be charged as Signatory.

Association of Members

In the case of the Association of Members, any member of the association will be an Authorized Signatory.

Trusts

In the case of a trust, the trustee or any trustee nominated will be an Authorized Signatory.

For all Others

In the case of any other person, including non-resident taxable persons under GST, by some person competent to act on his behalf, or by a person authorized by the taxable person under GST.

Register DSC in GST Portal

Any individual registered as an authorized signatory of an organization on the GST portal can sign and file the Good and Service Tax returns using a digital signature certificate. To avail of the GST e-filing services, taxpayers must register their DSC on the GST portal.

Pre-requisites to register DSC on GST Portal

- Valid Class 3 DSC along with USB Token

- Installed DSC software

- User ID and password to log in

emSigner Utility

Before registering DSC on GST Portal, you must install the emSigner utility. The emSigner utility can download from the Register DSC page.

Procedure to Register DSC on the GST Portal

- Access the official web portal of GST and log in to the GST Portal. Click on the username on the top right of the post-login landing page.

- Select My Profile from the dropdown list and On the My Profile landing page, click on the Register/Update DSC link under the Quick Links section.

- Attach your DSC dongle and open the emSigner utility.

- The Register/Update DSC landing page will have a dropdown with the PANs of all the authorized signatories. Select the PAN number from the dropdown list

- Select the appropriate option from the emSigner utility. Before registering, the system will ask you to enter the password to authorize the DSC registration on the GST Portal.

- On submission of the correct password, the DSC registration on the GST portal will complete.

- With the completion of the steps mentioned above, you have managed to complete the task of registering your Digital Signature Certificate on the GST portal.

Note: The same procedure can follow for updating the DSC on the GST Portal.

Click here to know more about the Register DSC in GST Portal

Procedure to file GST Return with DSC

DSC is compulsory for all Public & Private Limited Companies, Limited Liability Partnerships (LLPs), and Foreign Limited Liability Partnerships (LLPs) to file GST Returns.

Benefits offered by DSC for GST Filing

Some of the significant benefits offered by DSCs that will make the GST filling work easy and smooth:

- Make online transactions secure and authentic

- Establish ownership of a domain

- Safety from any fraud or foreign activities

- Fast and reduced time at the check post and help reduce tax evasions

Pre-requisites to register DSC on GST Portal

Before proceeding to file GST Return with the digital signature, kindly ensure the following:

- emSigner installed on the computer

- Having a valid class 3 DSC with a USB token

- The applicant should have access to the password of the DSC

- The digital signature stick must connect to the computer

- Desktop Browser must have Internet Explorer 10+/ Chrome 49+ or Firefox 45+

Procedure to file GST Return with DSC

- After filing all necessary details in GST Returns on the GST portal, click on PROCEED TO FILE option.

- On clicking the proceed to file, details will display on the screen. Select the checkbox to accept the declaration.

- From the Authorized Signatory dropdown list, select the Authorized Signatory.

- Click on the FILE GSTR 3B WITH DSC button or the Type of GST Return button (E.g., GSTR 1, GSTR 2, GSTR 3, etc.).

Note: If an error message is showing, Kindly Restart the Emsigner,”; click on this error link to resolve the issue.

- Click on the proceed button, select the certificate, and click the SIGN button.

- On successful submission, the success message will display. Click the OK button.

Now the taxpayer can view the status of the return by visiting the return dashboard and then selecting the particular period. Click on the VIEW GST return to download the PDF copy of the return already filed.

For GST registration, click here.