RBL Bank – Secured Small Business Loan

RBL Bank – Secured Small Business Loan

RBL Bank initiated a new venture called ‘Secured Small Business Loan’ to assist small-scale entrepreneurs. Under the scheme, the bank offers working capital and term loan for Small Enterprises engaged in the manufacturing and service sectors. In this article, we look at the Small Enterprise Loans from RBL Bank in detail.

To know about RBL Bank Current Account

Purpose of the Loan

- The Secured Small business Loan is a drop-line overdraft facility offered to the business units engaged in manufacturing or service activities. This business loan can be taken to build fixed assets and current assets of the business.

- The loan amount provided under Secured Small business loan by RBL Bank is up to INR 20 Lakhs.

- The convenient loan repayment tenure is stated to be 12 to 84 months

- Both the residential and commercial property accepted as collateral

- The rate of interest is applicable as per recent banking notifications.

- Quick and simplified process

- Assessment will be based on the Kachha Pukka Bills, ITR, VAT and Bank Statements.

Eligibility Criteria

Below-specified applicants can apply for the Secured Small Business Loan in RBL Bank.

- Customer segment- Individual/ Proprietor/ Proprietorship firm

- Minimum age at application – 25 years and maximum age at loan maturity is 65 years

- Residential and Business stability- 3 years in the current residence and business place

- Minimum experience – 3 years in the current business

- Property ownership- Self/ blood relative/ co-borrower

- Property age- Less than 50 years

- Property should be approved by the appropriate authority

- Urban – Approved by Development Authority

- Rural – Approved by Gram Panchayat

Documents Required

The below listed are the documents/records that need to be furnished at the time of applying for business loans in RBL Bank.

- PAN Card – For Individual / Partnership Firm

- Identity Proof: PAN Card, Driving License, Aadhar Card, Voter ID Card, Proprietor, partner of Director (if a company), Registered Lease Deed, Sale Agreement, Bank Statement, etc.

- Address Proof: Legal Passport, Utility bill, Property tax bill, etc.

- Business Continuity Proof – Any one document dated 3 years old (Bank Statement / Sales Tax Challans / IT Returns / Shop and Establishment Certificate / Partnership Deed)

- Copy of Income Certificate

- ITR with financials for at least one year filed at least 4 months prior to the date of application

- VAT returns

- Bank credits for last 6 months validated through the original statement

- Kachha Bills / Purchase Bills / Purchase or Sales registers

- Complete Collateral Documents for secured loans including EC wherever applicable

Business Loan Application Procedure

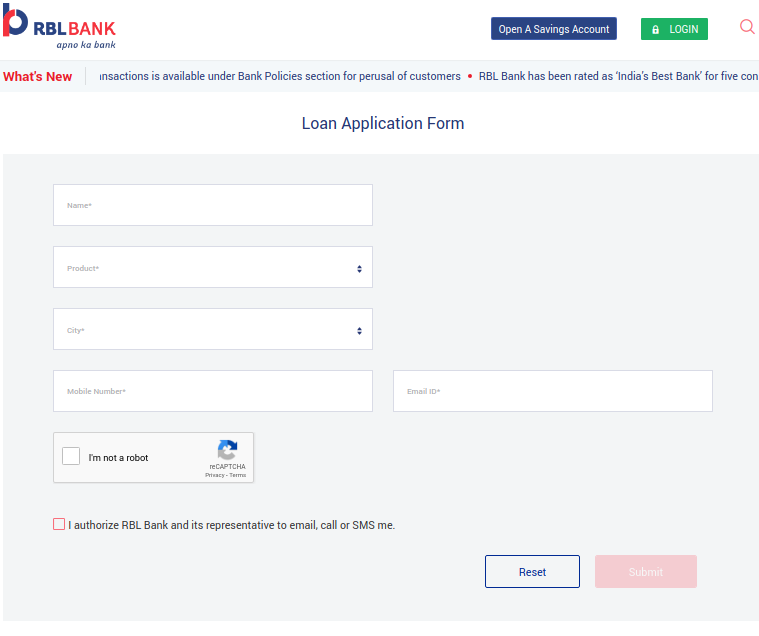

Kindly follow the given steps to apply for the Secured Small Business Loan online.

Step 1: To apply for this business loan with the RBL Bank, the applicant will have to go to the official site.

Step 2: Then, the applicant will have to click on the “Small Business Laon” link on the homepage.

Step 3: Now, click on the “Apply” button, and that leads to the new application form page.

Step 4: Here, the applicant has to fill out the business loan application form in a prescribed format.

Step 5: Submit the application business loan form along with all the supporting certificates mentioned above.

Note: Please carry originals of all relevant KYC documents such as PAN, Aadhaar, etc. for the verification purposes.