How do I pay my Tax Demand online?

How do I pay my Tax Demand online?

Paying taxes online is a convenient and secure way to stay on top of your tax payments in India. With the help of the government’s e-filing portal, you can quickly and easily pay your tax demand online. In this article, we will explain the process step-by-step, so you can easily understand how to pay your tax demand online in India. So, if you’re looking for a guide on paying your tax demand online in India, you’ve come to the right place.

Benefits of paying Tax Demand online

Convenience

Paying taxes online is a convenient way to ensure your taxes are paid on time. You don’t need to leave your home or office to make a payment, as you can do it from the comfort of your computer.

Speed

Paying taxes online is a much faster way to make payments. You can make payments within minutes and transfer the amount to the government in seconds.

Accuracy

When you pay taxes online, you can be sure that your payment is accurate and up-to-date. This eliminates the possibility of making mistakes while filling out tax forms.

Security

Paying taxes online is a secure way to make payments. All payments are encrypted with bank-level security measures, so you can ensure your data is safe and secure.

Record Keeping

When you pay taxes online, you can easily keep track of your payments. Once the payment is made, you will also receive a receipt or receipt number that can be used to keep a record of your payment.

Steps to pay Tax Demand Online

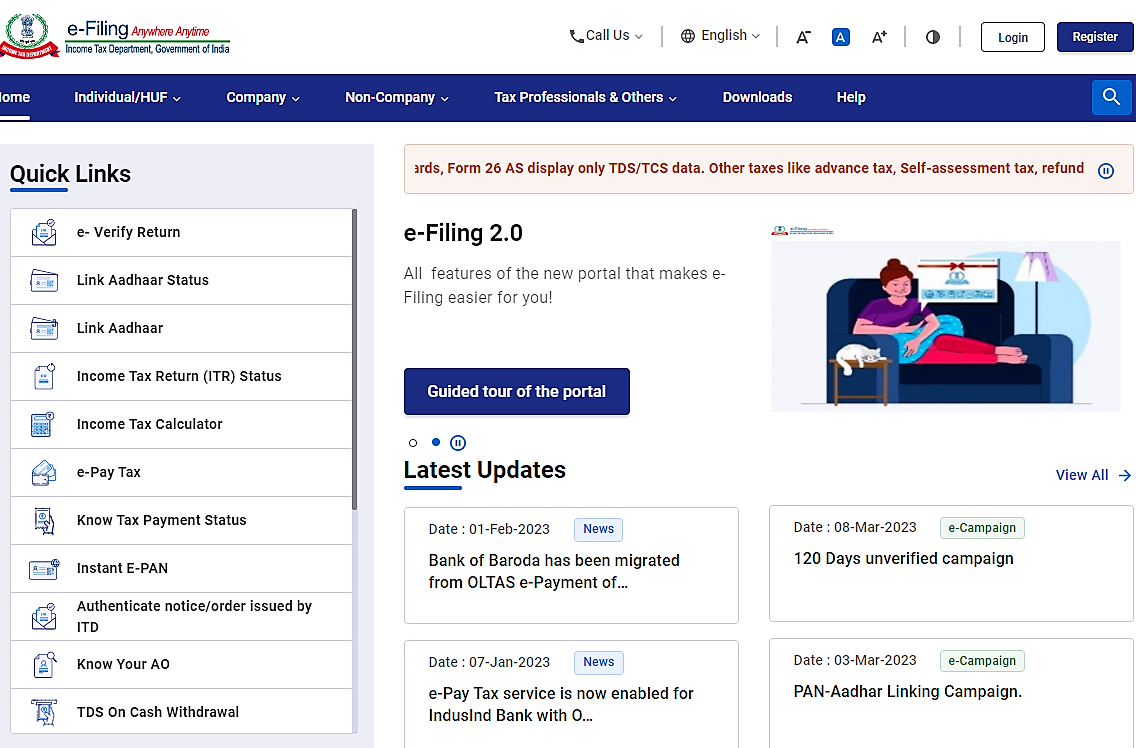

- Visit the official website of the Income Tax Department of India

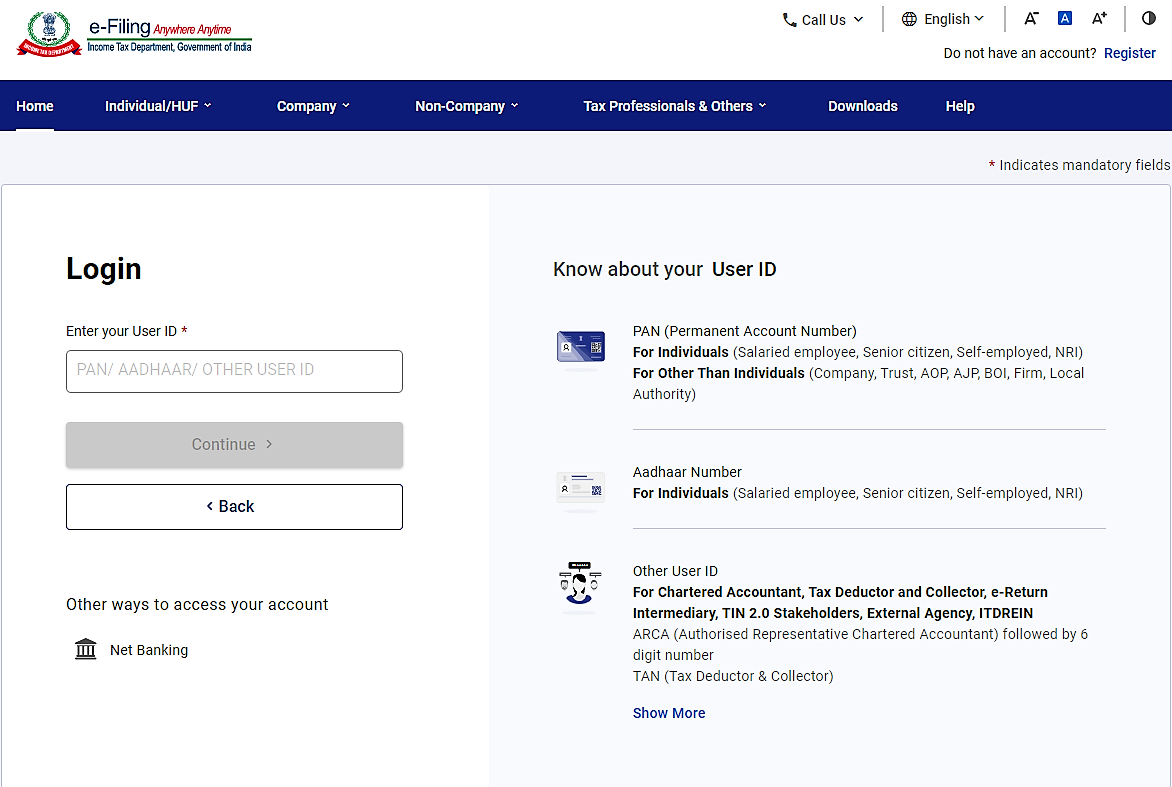

- Log in with your registered user ID and password.

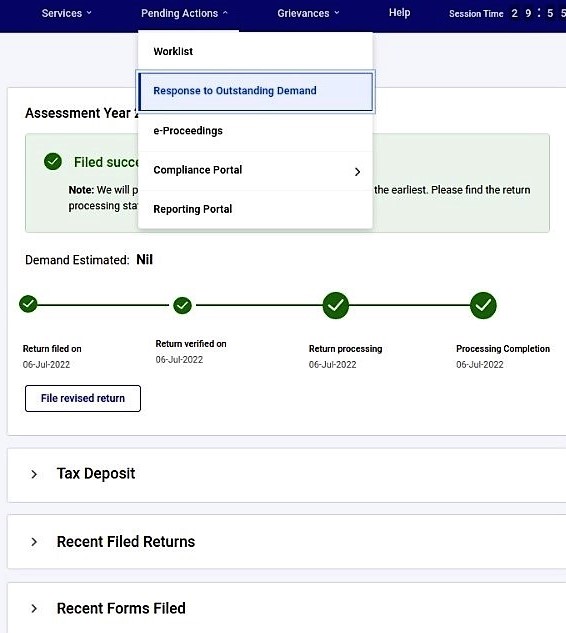

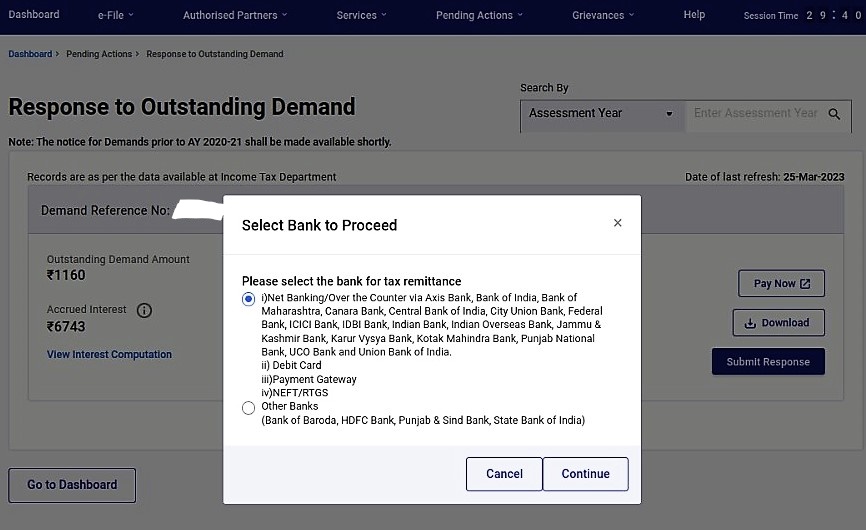

- Under ‘Pending Actions’, select ‘Response to Outstanding Demand’.

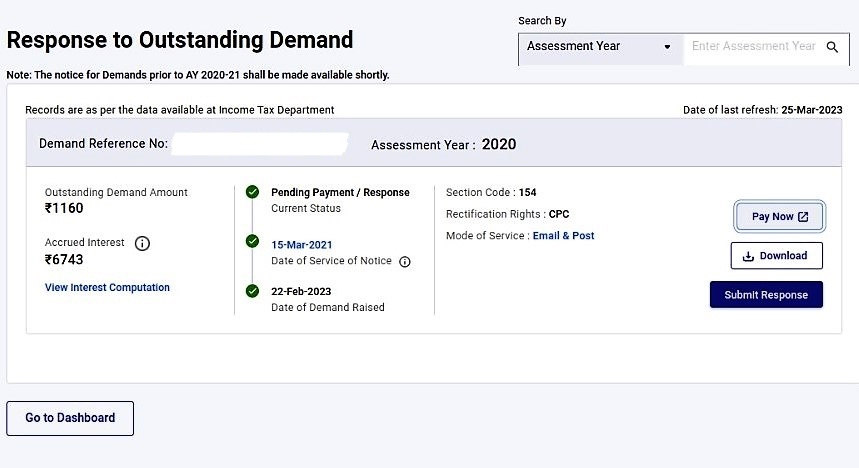

- Click on ‘Pay Now’.

- Select your Bank option and click on ‘Continue’.

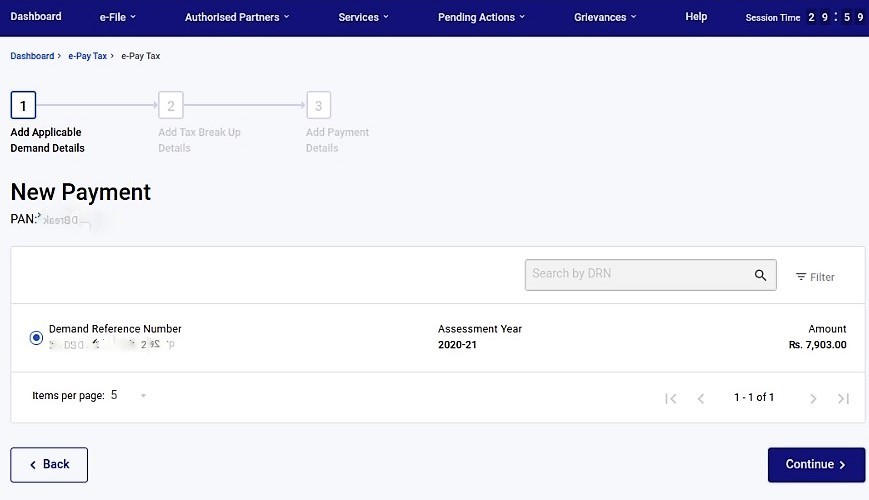

- Click on ‘Continue’.

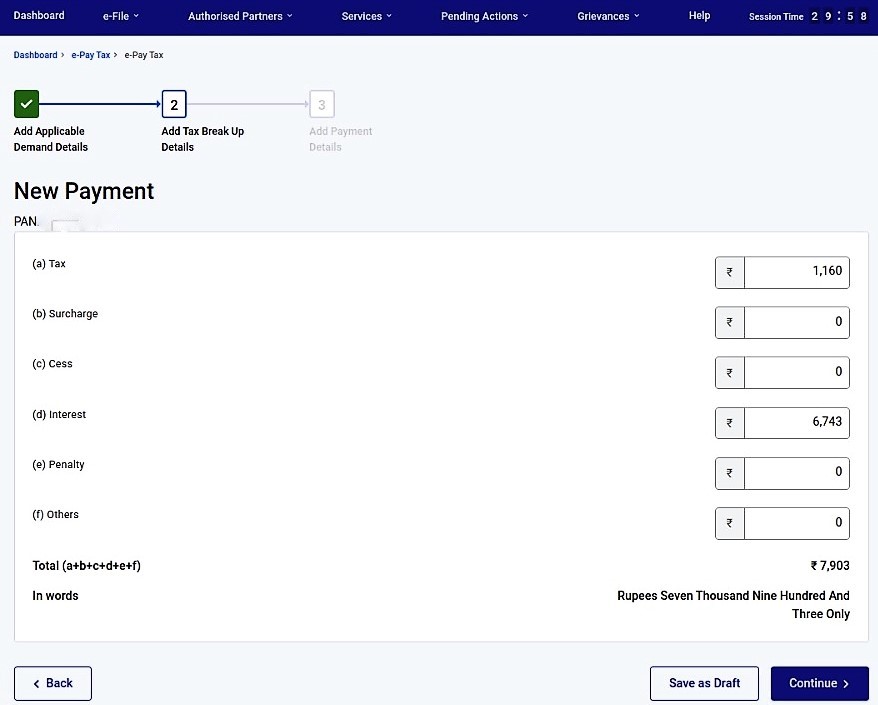

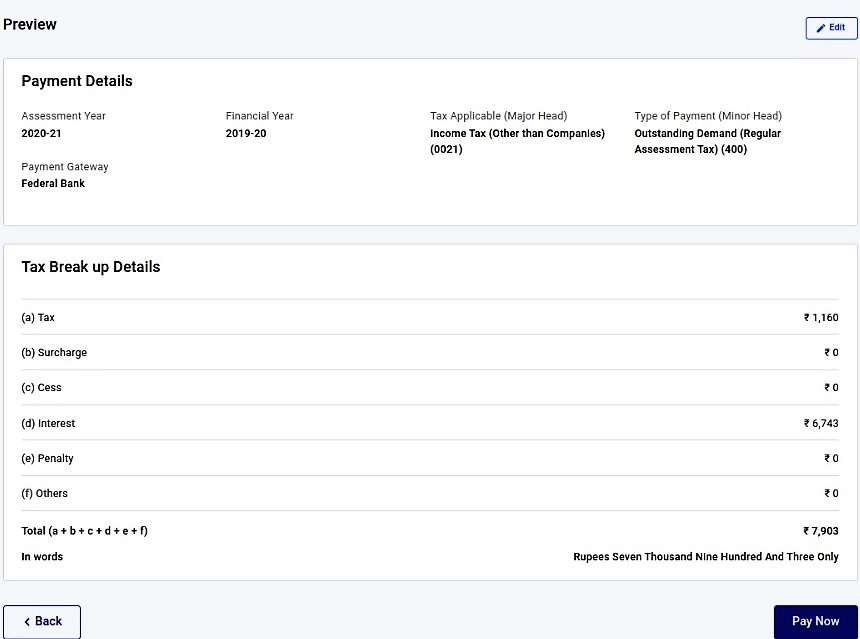

- Check your dues and click on ‘Continue’.

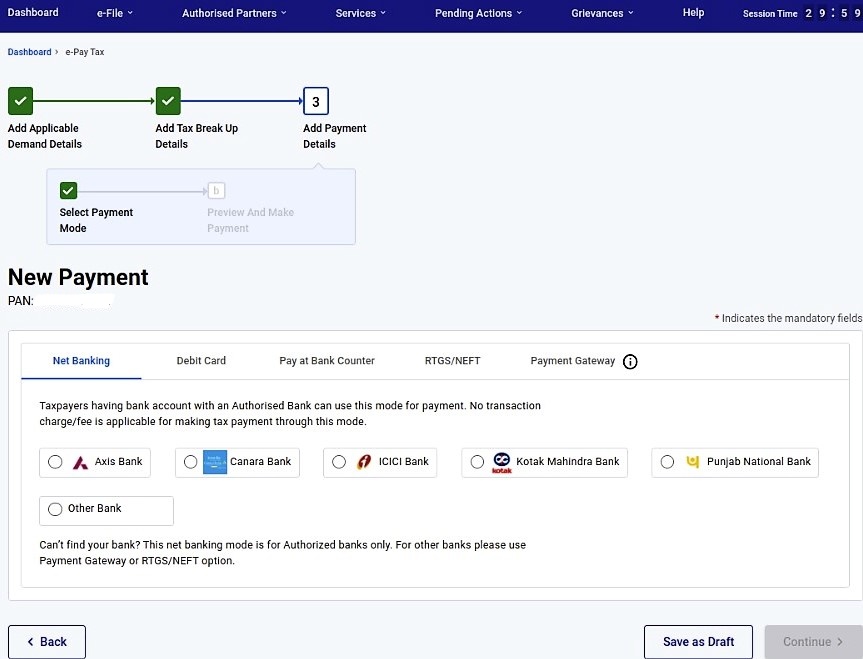

- Select the payment mode from the available options and click ‘Continue’.

- Check the payment details and click on ‘Pay Now’.

- Once the payment is successful, you will receive an acknowledgement.

- Download and save the acknowledgement for future reference.

Latest Update on the Pay Later Option for Income Tax Filing

The Income Tax e-filing portal has recently rolled out a ‘Pay Later’ option, allowing you to complete your tax filing process before making any tax payments. You can pay taxes after you are done filing. For additional information, please refer to our guide – Pay later option for the Income tax return filing.

IndiaFilings provides a comprehensive solution for filing your Income Tax Returns (ITR) and other ITR-related services. With IndiaFilings, you can avoid tax demands, pay your returns timely, and receive the best quality service at the most competitive prices. So go ahead and visit IndiaFilings to get your ITR done, and rest assured that all your tax-related needs are taken care of.