How to Register a One Person Company (OPC)

How to Register a One-Person Company (OPC)

One-Person Company registration is a popular choice for entrepreneurs seeking limited liability and a separate legal entity. An OPC is a unique business structure that allows a single individual to operate as a company, providing them with the advantages of limited liability while maintaining complete control over the business. In an OPC, the individual acts as both the director and shareholder, combining the benefits of a sole proprietorship with the legal protection of a private limited company. This article is a concise guide to help you understand the registration process and legal requirements for setting up an OPC. We will explore the eligibility criteria, necessary documents, and the step-by-step process for OPC registration.

Register Now!Introduction to One Person Company (OPC) under the Companies Act, 2013

The Companies Act of 2013 introduced the new concept of One Person Company (OPC), revolutionizing the business landscape. Traditionally, a single individual could not establish a company as it required a minimum of two directors and two members. However, with the advent of OPCs, a single person can establish and manage a company independently.

Previously, if an individual wanted to establish a business, they were limited to opting for a sole proprietorship. However, the OPC framework now provides a viable alternative. According to Section 2(62) of the Companies Act 2013, a company can be formed with just one director and one member, with the director and member being the same person. This allows an individual, whether a resident or an NRI, to incorporate a business that combines the features of a company with the advantages of a sole proprietorship.

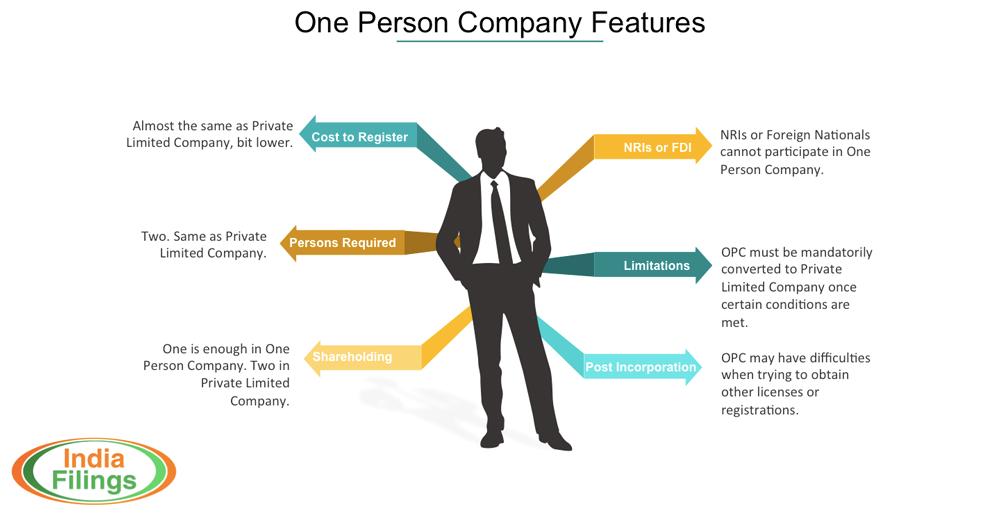

Features of One Person Company (OPC):

Single Ownership: OPC is a company that can be owned and managed by a single person. Unlike other companies, OPC does not require multiple shareholders or directors.

- Limited Liability: Similar to other companies, OPC provides limited liability protection to its owner. The owner’s assets are separate from the company’s liabilities, reducing personal financial risk.

- Separate Legal Entity: OPC is considered a separate legal entity distinct from its owner. It can enter into contracts, acquire assets, and engage in legal proceedings in its own name.

- Perpetual Succession: OPC enjoys perpetual succession, meaning the company continues to exist even in the event of the owner’s death or incapacitation. In such cases, a nominee is appointed to take over the company’s affairs.

- Minimum Requirement: OPC must have at least one director and one nominee. The director and nominee can be the same person. There is no minimum capital requirement, making it easier to start a business with limited resources.

- Less Compliance: OPC has relatively fewer compliance requirements than other companies. It is exempt from specific provisions applicable to private limited companies, simplifying administrative procedures.

- Restricted Business Activities: OPC cannot engage in non-banking financial investment activities or convert into a company with charitable objectives under Section 8 of the Companies Act, 2013.

- Limited Growth Potential: OPC is more suitable for small businesses as it cannot have more than one member at any time. This restricts its ability to raise capital or add more members for business expansion.

- Ownership and Management: The sole member of OPC can also be the director, leading to a blurred distinction between ownership and management. This may result in concentrated decision-making power and potential ethical concerns.

Eligibility Criteria for the Incorporation of One Person Company

Before registering a One Person Company (OPC), it is crucial to understand the eligibility criteria and constraints associated with its incorporation. The Companies Act lays down specific requirements that must be met to ensure the promoter is eligible to register an OPC.

- Natural Person and Indian Citizen: Only a natural person who is an Indian citizen can incorporate an OPC. Legal entities like companies or LLPs cannot establish an OPC.

- Resident in India: The promoter must be a resident in India, which means they should have resided in India for a minimum of 182 days during the previous calendar year.

- Minimum Authorized Capital: The OPC must have a minimum authorized capital of Rs 1, 00,000. It is the amount mentioned in the company’s capital clause during registration.

- Nominee Appointment: During the incorporation of the OPC, the promoter must appoint a nominee. The nominee will become a member of the OPC in the event of the promoter’s death or incapacity.

- Restrictions on Certain Businesses: Businesses engaged in financial activities such as banking, insurance, or investment cannot be incorporated as an OPC.

- Conversion to Private Limited Company: If the OPC’s paid-up share capital exceeds 50 lakhs or its average annual turnover exceeds 2 Crores, it must be converted into a private limited company. This conversion ensures compliance with the regulatory requirements for larger companies.

It is essential to note that an individual can incorporate only one OPC. Additionally, an OPC is prohibited from having a minor as its member.

Advantages of One Person Company (OPC)

- Legal status: The OPC receives a separate legal entity status, protecting the individual who has incorporated it. The member’s liability is limited to their shares, and they are not personally liable for the company’s losses.

- Easy to obtain funds: Being a private company, OPCs have easier access to fundraising through venture capitalists, angel investors, and incubators. Banks and financial institutions also prefer to grant loans to companies rather than proprietorship firms, making it easier to obtain funds.

- Less compliance: OPCs enjoy certain exemptions in compliance requirements under the Companies Act, 2013. For example, they are not required to prepare a cash flow statement, and the company secretary is no need to sign the books of accounts and annual returns.

- Easy incorporation: OPCs can be incorporated with just one member and one nominee, with the member also serving as the director. There is no minimum paid-up capital requirement, making the incorporation process relatively simple compared to other forms of companies.

- Easy to manage: With a single person managing the affairs of the OPC, decision-making becomes efficient and quick. Resolutions can be quickly passed by the member and recorded in the minute book, resulting in smooth company management without conflicts or delays.

- Perpetual succession: OPCs maintain perpetual succession, even with only one member. When incorporating an OPC, the single member appoints a nominee who will assume control of the company in case of the member’s death.

In conclusion, OPCs offer numerous advantages, such as limited liability, ease of obtaining funds, reduced compliance requirements, ease of incorporation and management, and perpetual succession.

Disadvantages of OPC

While One Person Companies (OPCs) offer certain advantages, there are also some limitations and disadvantages associated with this business structure:

- Suitable for Small Businesses: OPCs are primarily suitable for small-scale businesses. The maximum number of members allowed in an OPC is always one. As the business expands and requires additional capital, it cannot bring in more members or shareholders to raise funds. The growth potential of the OPC may be limited due to this restriction.

- Restriction on Business Activities: OPCs are restricted from engaging in certain activities. They cannot carry out Non-Banking Financial Investment activities, including investing in securities of other corporate entities. Additionally, an OPC cannot be converted into a company with charitable objectives, as Section 8 of the Companies Act 2013 outlines.

- Ownership and Management: One of the disadvantages of an OPC is a lack of clear distinction between ownership and management. Since the sole member of the OPC can also be the director, decision-making power rests solely with this individual. This may lead to a situation where the line between ownership and control becomes blurred, potentially resulting in unethical business practices or conflicts of interest.

Considering these disadvantages alongside the advantages is essential when deciding whether to establish an OPC.

Registration of One Person Company

In India, a One Person Company (OPC) is registered using the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) form. This comprehensive form replaces the previous forms required for incorporating a company, including the earlier SPICe form.

The registration process for an OPC involves two parts, as follows:

- Part A: This part of the SPICe+ form is used to obtain approval for the desired company name and to apply for the Director Identification Number (DIN) or Permanent Account Number (PAN) of the proposed director.

- Part B: The second part of the form, known as Part B, includes incorporation-related details. Here, you will provide information such as the registered office address of the OPC, share capital details, particulars of the director, and details of the shareholder.

Documents Required

The following documents must be prepared and submitted to the Registrar of Companies (ROC):

- Memorandum of Association (MoA): This document outlines the objectives or business for which the company is being incorporated.

- Articles of Association (AoA): The AoA lays down the company’s by-laws.

- Appointment of Nominee: Since there is only one director and member, a nominee who will act on behalf of the director must be appointed in case of incapacitation or death. The nominee’s consent, along with their PAN card and Aadhaar card, should be provided through Form INC-3.

- Proof of Registered Office: The proof of the registered office, proof of ownership, and a No Objection Certificate (NOC) from the owner must be submitted.

- Declaration and Consent: The proposed director should provide a declaration in Form INC-9 and their consent in Form DIR-2.

- Compliance Certificate: A declaration by a professional certifying that all necessary compliances have been made.

The SPICe+ form can be conveniently filed online through the Ministry of Corporate Affairs portal. By utilizing this streamlined process, the registration of an OPC can be completed efficiently and effectively.

To register a One Person Company (OPC) in India, you can follow the online registration process through the MCA portal by following these steps:

Step 1: Obtain a Digital Signature Certificate (DSC)

Obtain a Digital Signature Certificate (DSC) for the proposed director and shareholder of the company. The DSC is used for electronically signing documents.

Step 2: Obtain Director Identification Number (DIN)

Obtain a Director Identification Number (DIN) for the proposed director of the company. The Ministry of Corporate Affairs (MCA) issues this unique identification number.

Step 3: Name Reservation

Apply for name reservation through the MCA portal by submitting Form SPICe+ (Part A). Choose a unique name for your company, ensuring it doesn’t resemble any existing company or trademark.

Step 4: Prepare MOA and AOA

Prepare your company’s Memorandum of Association (MOA) and Articles of Association (AOA). These documents outline the company’s objectives and internal regulations.

Step 5: File the Forms

To file the necessary forms with the Ministry of Corporate Affairs (MCA) for OPC registration, the following documents will be attached to the relevant forms:

- SPICe+ Form: This is the main form for OPC registration and includes Part A and Part B. The following documents will be attached to this form:

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Declaration and Consent of the proposed Director (Form INC-9 and DIR-2, respectively)

- Declaration by the professional certifying compliance

- Proof of Registered Office (ownership proof and NOC from owner)

- Appointment of Nominee (Form INC-3 along with PAN card and Aadhaar card)

- Other relevant documents, as required by the MCA

- SPICe-MOA: This form contains the Memorandum of Association (MoA) outlining the company’s objectives.

- SPICe-AOA: This form contains the Articles of Association (AoA), which lays down the company’s by-laws.

- Additionally, the Digital Signature Certificate (DSC) of the Director and the professional certifying compliance will be uploaded along with the forms.

It’s important to note that the Pan Number (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) will be generated automatically at the time of incorporation of the company. Separate applications for obtaining PAN numbers and TAN are not required.

The forms will go through the approval process after attaching all the necessary documents and uploading them to the MCA site. Once approved, the Pan Number and TAN will be generated, and the Certificate of Incorporation will be issued, finalizing the OPC registration process.

Step 6: Certificate of Incorporation

Once the ROC approves your application and verifies the compliance requirements, they will issue a Certificate of Incorporation. This certificate signifies the successful registration of your One Person Company.

Timelines for OPC registration

The timelines for OPC registration can vary, but generally, the process takes around ten days, subject to departmental approval and response times from the respective departments.

Register Now!Current Changes Related to One-Person Company

The Companies (Incorporation) Amendment Rules, 2023, introduced by the MCA, emphasizes that the nominee name for the owner of a One Person Company (OPC) must be mentioned in the memorandum of the OPC. The declaration of nominee details and nominee’s name must be submitted in the Form No. INC-32 (SPICe+). As per the Companies (Registration Offices and Fees) Rules, 2014, both the form and applicable form must be filed with the Registrar during the incorporation process. The company’s e-memorandum and AOA should also submitted during that time.

Post-Incorporation Formalities for OPC

After incorporating a One Person Company (OPC), certain compliance formalities need to be fulfilled, similar to those of a private limited company. One such formality is related to the registered office of the company. If the notice regarding the registered office was not filed during the incorporation process, it must be filed within 30 days after the incorporation.

To file the notice of situation for the registered office, the following documents are typically required:

- Lease Deed or Rent Agreement: A copy of the lease deed or rent agreement for the registered office premises, along with the relevant rent receipts.

- Utility Bills: Copies of utility bills (e.g., electricity bill, water bill, etc.) that is not older than two months, serving as proof of the address of the registered office.

- Proof of Ownership or Permission: If another entity or person owns the registered office and is not taken on lease by the company, proof should be provided to demonstrate that the company is authorized to use that address as its registered office.

It is essential to ensure that these post-incorporation formalities are completed within the prescribed timelines to maintain compliance with the regulations.