Revised Definition of a Small Company 2022

Revised Definition of a Small Company 2022

The Ministry of Corporate Affairs (MCA), on September 15th, 2022, issued the Companies (Specification of Definitions Details) Amendment Rules, 2022. The definition under the Companies Act for Small Companies has now been revised by increasing their thresholds for Paid-up capital and Turnover.

The paid-up Capital and Turnover of the small company shall not exceed Rupees 4 Crores and Rupees 40 Crores, respectively. Revisions to the definition were aimed at simplifying business and reducing compliance burdens for many companies. The current article briefs the Revised Definition of a Small Company as per Companies (Specification of Definition details) Amendment Rules 2022.

Synopsis of MCA Notification

The following amendment has been made in the Companies (Specification of Definition details) Amendment Rules 2022:

- A new clause 2(1)(t) has been substituted in Rule 2, which specifies the Definitions of Small Company.

- As mentioned above, the definition of a Small Company under the Companies Act, 2013 has now been revised by increasing the thresholds for Paid-up capital and Turnover.

- The said amendment is made effective from September 15th, 2022.

The official notification of MCA about the Companies (Specification of Definition details) Amendment Rules 2022 is as follows:

companies-specification-of-definition-details-amendment-rules-2022Small Companies

To provide advantages to small businesses operating as private limited companies, the Companies Act 2013 introduced the concept of small companies. The annual revenue of small companies is lower than that of regular-sized companies. India’s small companies are crucial to generating profits and creating jobs. Consequently, they are the economy’s backbone.

In accordance with the Companies Act, small businesses need not follow a separate company registration procedure, and it is registered as a private limited company. But the Act differentiates a private company from a small company based on its fewer amounts of investment and Turnover.

Click here to get more details on Small Company as per the Companies Act, 2013

The New definition of a Small Company

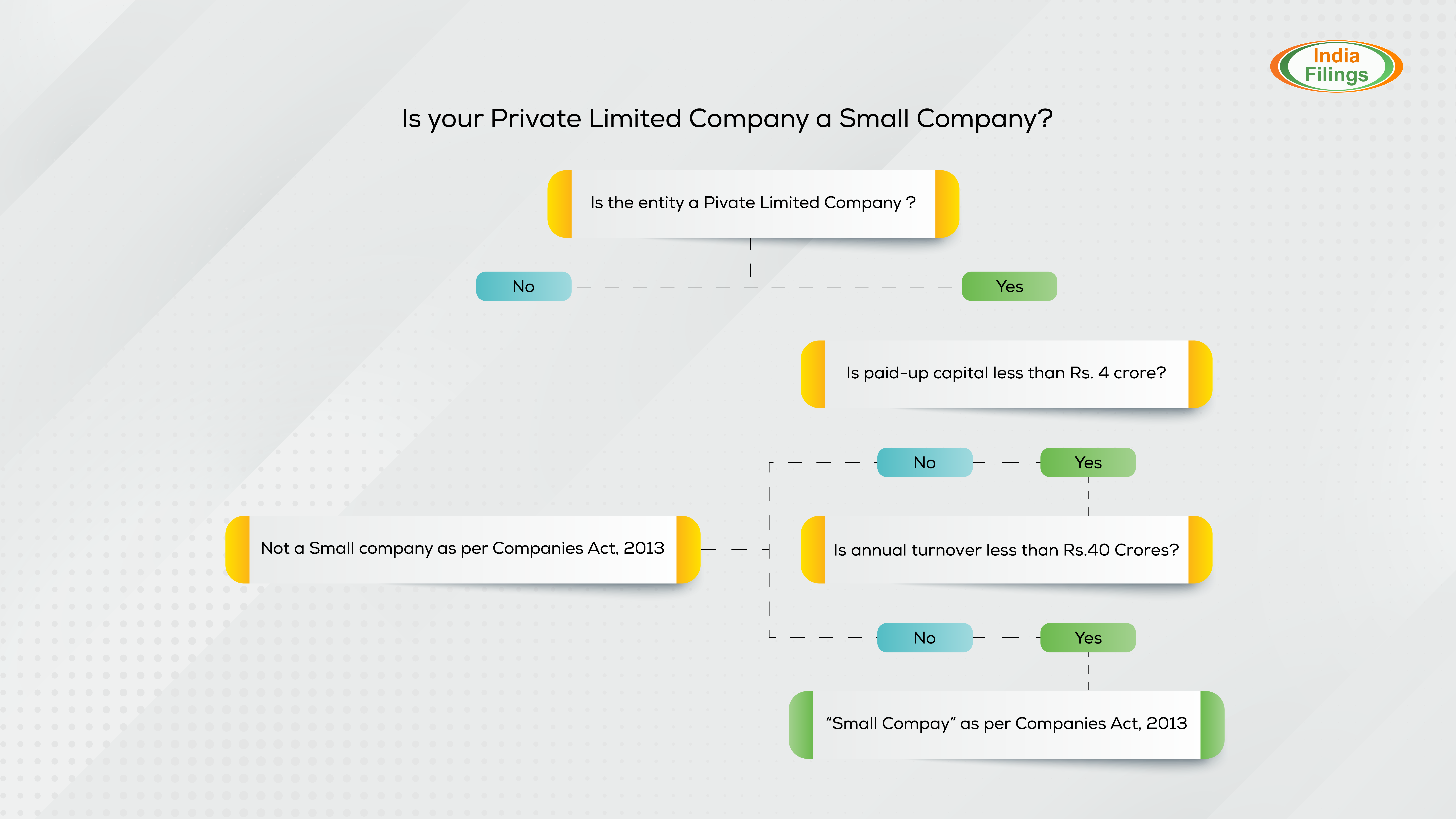

According to section 2(85) of the Companies Act, 2013, a small company means a company that meets the following criteria:

- Condition 1: Paid-up capital of the company should not exceed INR 4 Crores; and

- Condition 2: Turnover of the company should not exceed INR 40 Crores.

However, it is essential to note here that the following companies, even though they meet both of the above conditions, are not eligible to qualify as a small company-

- A public company

- A holding company

- A subsidiary company

- Company registered under section 8

- A company that is governed by any particular act

Nevertheless to mention, as the Amendment is effective from 15th September 2022, the earlier threshold limit of Rupees Two Crores and Twenty Crores for Paid Up Share Capital and Turnover respectively for Preparation of Cash Flow Statement and Reporting under CARO, 2020 for the financial year ended 31st March 2022.

Earlier Definition of Small Companies 2021

The Ministry of Corporate Affairs (MCA) had earlier, vide the Companies (Specification of Definition details) Amendment Rules 2021, revised the definition of small companies by increasing their thresholds for paid up Capital from not exceeding INR 50 lakh to not exceeding INR 2 crore and Turnover from not exceeding INR 2 crore to not exceeding INR 20 crores.

This small company definition has now been further revised by increasing such thresholds for paid-up Capital from “not exceeding Rs. 2 crores” to “not exceeding Rs. 4 crores” and Turnover from “not exceeding Rs. 20 crores” to “not exceeding Rs. 40 crores”.

Comparison of Small Company New Definition with Old Definitions

The amendment proposed in the Companies (Specification of Definition details) Amendment Rules 2022 to the definition of a small company increased the maximum limit of Turnover and paid-up Capital. The boundaries were expanded so that more firms could be covered within the ambit of a small company, making them eligible to get more benefits than a small company provided under the Companies Act 2013.

A simple comparison of the old and new definitions of a small company is explained hereunder:

| Criteria | Old Definition | Old Definition 2021 |

New Definition 2022

|

| Paid-up share capital | Maximum paid-up share capital of Rs.50 lakh | Maximum paid-up share capital of Rs.2 Crores | Maximum paid-up share capital of Rs.4 Crores |

| Turnover | Maximum turnover of Rs.2 crore | Maximum turnover of Rs.20 Crores | Maximum turnover of Rs.40 Crores |

Benefits of Revised Definition of Small Companies

- Small companies are exempted from the essential to prepare cash flow statements as part of financial statements.

- Advantages of preparing and filing an Abridged Annual Return.

- The small company will not be required to have the compulsory rotation of auditors.

- An Auditor of a small company does not need to report on the adequacy of the internal financial controls and its operating effectiveness in the auditor’s report.

- The small company can hold only two board meetings in a year.

- Annual company returns can be signed by the company secretary, or where there is no company secretary, by a company director.

- In addition, small companies are subject to fewer penalties.