Nidhi Company Registration

Nidhi Company Registration

Nidhi Companies in India are created for cultivating the habit of thrift and savings amongst its members. Nidhi companies are allowed to borrow from their members and lend to their members. Therefore, the funds contributed to a Nidhi company are only from its members (shareholders). Nidhi companies are minute when compared to the banking sector and are mainly used to cultivate a saving amongst a group of people. To learn more about starting a Nidhi Company in India, you can also refer to the article “Starting a Nidhi Company” found in the IndiaFilings Learning Center. In this article, we mainly look at the nuances for registration of a Nidhi Company in India.

Nidhi Company Overview

Nidhi Companies are registered Limited Companies involved in taking deposits and lending to their members. The activities of a Nidhi Company does fall under the purview of Reserve Bank of India, as it is similar to an NBFC. However, as Nidhi Companies ONLY deal with shareholder-members money, RBI has exempted Nidhi Companies from the core provisions of the RBI and other regulations applicable to an NBFC.

Restrictions on Nidhi Company

The following are some of the restrictions a Nidhi Company is subject to under Nidhi Rules, 2014. As per Rule 6 of Nidhi Rules, 2014, a Nidhi Company shall NOT:

- carry on the business of chit fund, hire purchase finance, leasing finance, insurance or acquisition of

securities issued by any body corporate; - issue preference shares, debentures or any other debt instrument by any name or in any form whatsoever;

- open any current account with its members;

- acquire another company by purchase of securities or control the composition of the Board of Directors of any other company in any manner whatsoever or enter into any arrangement for the change of its management, unless it has passed a special resolution in its general meeting and also obtained the previous approval of the Regional Director having jurisdiction over such Nidhi;

- carry on any business other than the business of borrowing or lending in its own name: Provided that Nidhis which have adhered to all the provisions of these rules may provide locker facilities on rent to its members subject to the rental income from such facilities not exceeding twenty per cent of the gross income of the Nidhi at any point of time during a financial year.

- accept deposits from or lend to any person, other than its members;

- pledge any of the assets lodged by its members as security;

- take deposits from or lend money to anybody corporate;

- enter into any partnership arrangement in its borrowing or lending activities;

- issue or cause to be issued any advertisement in any form for soliciting deposit: Provided that private circulation of the details of fixed deposit Schemes among the members of the Nidhi carrying the words “for private circulation to members only” shall not be considered to be an advertisement for

soliciting deposits. - Pay any brokerage or incentive for mobilising deposits from members or for the deployment of funds or for granting loans.

Nidhi Company Registration

To start a Nidhi Company in India, the first step is to incorporate a Limited Company, under the Companies Act, 2013. Hence, it requires a minimum of three Directors and seven shareholders to start the Limited Company incorporation process. During incorporation of the Nidhi company, care must be taken to ensure that the object of the Limited Company mentioned in the Memorandum of Association is that of cultivating the habit of thrift and savings amongst its members, receiving deposits from, and lending to, its members only, for their mutual benefit.

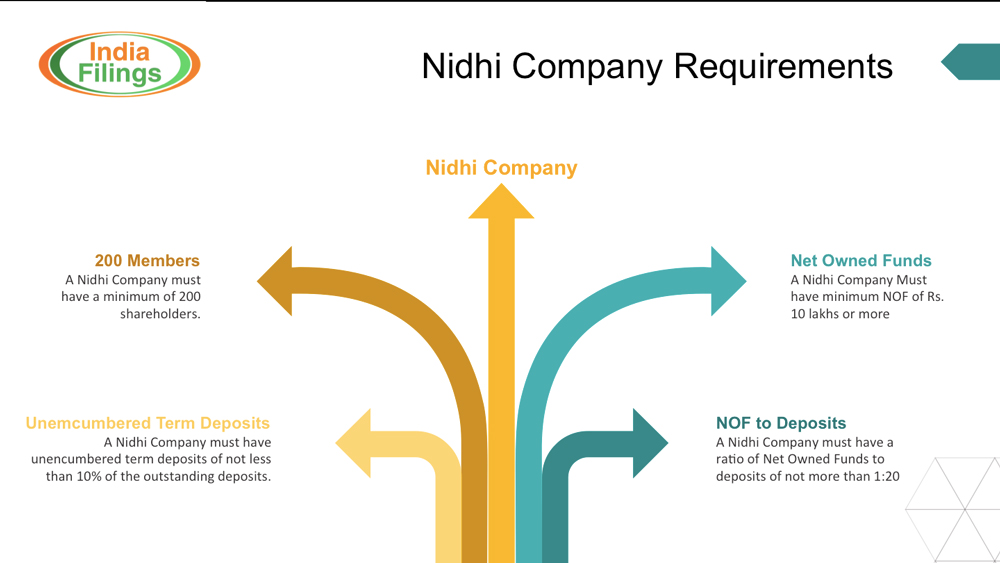

Post incorporation of the Limited Company, within a period of one year from the commencement, the Nidhi Company must meet all of the following criteria:

- not have less than two hundred members (shareholders);

- Have Net Owned Funds (NOF) of ten lakh rupees or more;

- Have unencumbered term deposits of not less than ten per cent of the outstanding deposits; and

- Have a ratio of Net Owned Funds to deposits of not more than 1:20.

“Net Owned Funds” means the aggregate of paid-up equity share capital and free reserves as reduced by accumulated losses and intangible assets appearing in the last audited balance sheet.

If the Nidhi Company satisfies the above conditions required for operating as a Nidhi Company, the company shall within ninety days from the close of the first financial year after its incorporation and where applicable, the second financial year, file a return of statutory compliances in Form NDH-1 duly certified by a practising CA/CS/CWA along with the requisite fees.

In the case at the end one year from commencement the Nidhi Company is not able to meet the above requirement, the Company may within thirty days from the close of the first financial year, apply to the Regional Director in Form NDH-2 for extension of time.

If even after the second financial year the Nidhi Company is not able to meet the requirements for a Nidhi Company, then the Nidhi Company shall not accept any further deposits from the commencement of the second financial year till it complies with the provisions for operating as a Nidhi Company and be liable for penal consequences.

Nidhi Amendment Rules, 2020

As per notification from the Ministry of Corporate Affairs on 3rd February 2020, the amendment to existing rules was released where the stakeholders are advised to use the revised and latest forms by the Nidhi companies and they are:

- Form No.NDH-1 – Return of Statutory Complainces

- Form No.NDH-2 – Application for extension of time

- Form No.NDH-3 – Return of Nidhi Company for the half year ended

The revised rule is applicable from 10th February 2020 and the notification can be accessed below:

Nidhi-Amendment-Rules-2020

For Nidhi Company Registration, visit IndiaFilings.com.