New GST Rules for Rent

New GST Rules for Rent

Ministry of Finance vide a Notification No 05/2022- Central Tax (Rate) dated 13.7.2022 has issued the New GST Rules for Rent. As per the New Notification, GST will be applicable on residential property rented to a person registered under GST. But, In case the property is rented to an unregistered person, GST would not be charged and it will be payable as a Reverse charge mechanism (RCM) applicable on that.

GST Changes Related to Transport Sector

Gist of Notification

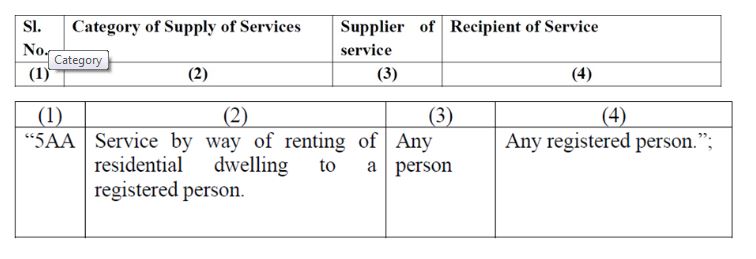

The Government has issued Notification No 05/2022- Central Tax (Rate) dated 13.7.2022, to amend the Notification 13/2017- Central Tax (Rate) by including the Entry 5AA under the Reverse charge mechanism.

As per Entry 12 of Notification 12/2017- Central Tax Rate dated 28.6.2017; Services by way of renting of residential dwelling for use as residence is exempt.

As per notifications 05/2022 (Central Tax Rate) dated 13 July 2022, ‘Service by way of renting of a residential dwelling to a registered person is also taxable. This new applicability will be levied on Reverse Charge Mechanism (RCM) basis and not under a forwarding Charge Mechanism (FCM).

New GST Rules for Rent

- As per the New GST Rules for Rent, which came into effect on 18th July 2022, a tax of 18% is now applicable to residential property rent.

- The tax will be charged according to the reverse charge mechanism (RCM), where the tenant will be liable to pay the

- The new rule only applies if the person/ company has completed the GST registration.

GST Rate for Rent

As mentioned above, If a service provider (with an aggregate income of more than Rs 20 lakh per annum) or a business (with aggregate income by selling products of more than Rs 40 lakh per annum) rents a house, they will be liable to pay the 18 percent tax. However, for this, they must be registered under GST.

Find GST rate for a rental using IndiaFilings GST Rate Finder.

Exemption from Payment of GST

- Businesses with a turnover of less than Rs 40 lakh per annum and salaried individuals are not required to pay the tax.

- If a company rents a home for its employee, there is no requirement to pay any GST.

- Moreover, if both the tenant and the owner are not registered, there is no legal obligation to pay any GST on the rent.

- CBIC also clarified that the salaried individuals, who have taken home on rent or lease, will not be required to pay any such tax

Residential Dwelling Renting for Residential Use

Services by way of renting a residential dwelling to a GST registered person for either residential or commercial purposes shall attract GST and is to be paid under Reverse Charge Mechanism (RCM) in the hands of the GST Registered person who is the recipient of such services. It is irrelevant whether the supplier of rental service of such residential dwelling is registered under GST or not.

- Renting of a residential dwelling to a registered person for use as residence is taxable under RCM i.e. registered person (recipient) is liable to pay tax.

- The renting of a residential dwelling to an un-registered person is exempt from GST

- Renting of residential dwelling for commercial purposes taxable in the hands of supplies under FC irrespective of whether recipient is registered or not

- At any point in time a residential dwelling is rented to a GST-registered person then obligation under RCM is attracted

- Finally, the end of the use of such dwelling unit i.e either as a residence or for commercial purpose use, and the status of the service provides i.e. whether Non-registered or registered are all not relevant.

Refer to the table for details on New GST Rules for Rent

| Tenant | Landlord | GST | ITC |

| Registered under GST | Registered under GST | GST under RCM | ITC can be claimed if the property is taken on rent for the furtherance of business |

| Unregistered | Registered under GST | No GST Taxable | Non Applicable |

| Unregistered | Unregistered | No GST Taxable | Non Applicable |

| Registered under GST | Unregistered | GST under RCM | ITC can be claimed if the property is taken on rent for the furtherance of business |

The official notification pertaining to the New GST Rules for Rent is reproduced below for reference:

New GST Rules for Rent