Kotak Mahindra Farm Equipment Loan

Kotak Mahindra Farm Equipment Loan

Kotak Mahindra Bank (KMB) is offering loans to purchase farming equipment under farm equipment loan scheme. Under the Farm Equipment Loan Scheme, farmers can avail the loan facility for buying a tractor or any farming equipment which can be used for agriculture. Also, this scheme provides life insurance coverage Kisan Suraksha for the eligible farmers through its insurance vertical. In this article, we look at the KMB Farm Equipment loan scheme in detail.

Benefits of the Scheme

The benefits of the KMB Farm Equipment loan Scheme are given below:

- The farmers will get loan benefits for purchasing farming equipment such as new and old tractors, harvesters for agricultural/commercial purpose.

- The farmers will get a grant of up to 90 per cent value of the equipment.

Eligibility Criteria

To avail the Farm Equipment Loan from KMB, the farmer has to satisfy the below-listed criteria:

- The farmer should have a minimum of 3 acres of land in his name.

- The farmer should have a minimum of 2 years of experience in the field.

- Should have stayed in the same residence for at least 2 years

Documents Required

The following are the documents to be furnished along with application form:

Pre Sanction document

-

- Identity proof- Voter ID card/PAN card/Passport/Aadhaar card/Driving License etc

- Address proof: Voter ID card/Passport/Aadhaar card/Driving license etc

- Agricultural Land Proof – if available

- Proof of Signature verification

Pre Disbursement document

-

- Fully executed loan documents

- Original Invoice of the tractor purchased from the dealer

- Receipt of Margin Money from the dealer

- Insurance pledged to Kotak Mahindra Bank

Quantum of Loan

KMB Farm Equipment loan scheme enables hassle-free credit to the farmers as they can avail loan up to 90% of the tractor value.

Rate of Interest

The rate of interest will be calculated as per the extant guidelines of the bank. The sanctioning branch will provide the details once the loan is approved.

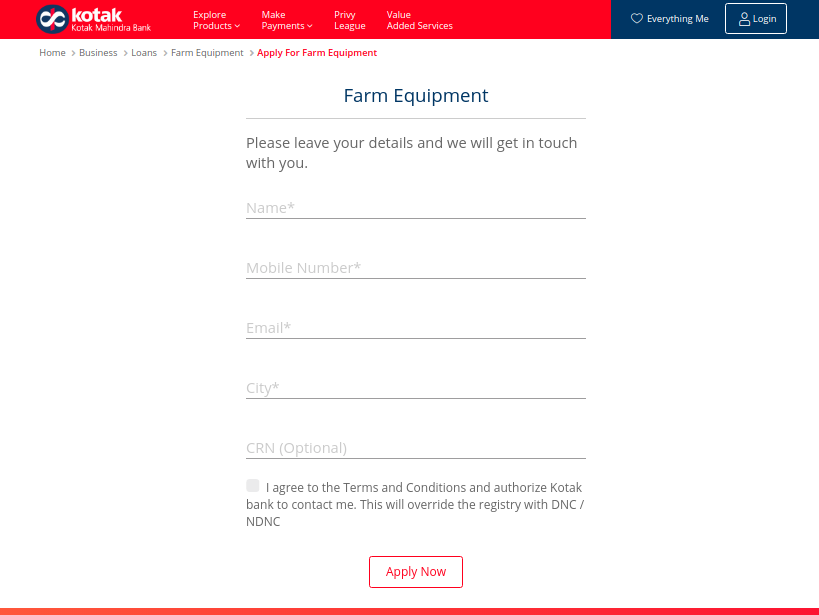

Application Procedure for KMB Farm Equipment loan

The borrower can directly visit the branch or fill an online application form. Make the application form with the necessary details such as applicant name, contact number, email id, CRN number and submit your application by clicking the “Apply” button. The concerned branch will verify the documents and details provided for processing your loan application.

Also, Know about KMB Crop Loan Scheme