Income Tax Due Date Extension 2019

Income Tax Due Date Extension 2019

This article clarifies the position about a fake notification, purportedly issued by the Income Tax Department, which assures the deadline for filing income-tax returns has been extended beyond the previously mentioned due date.

Extension Beyond 31st August

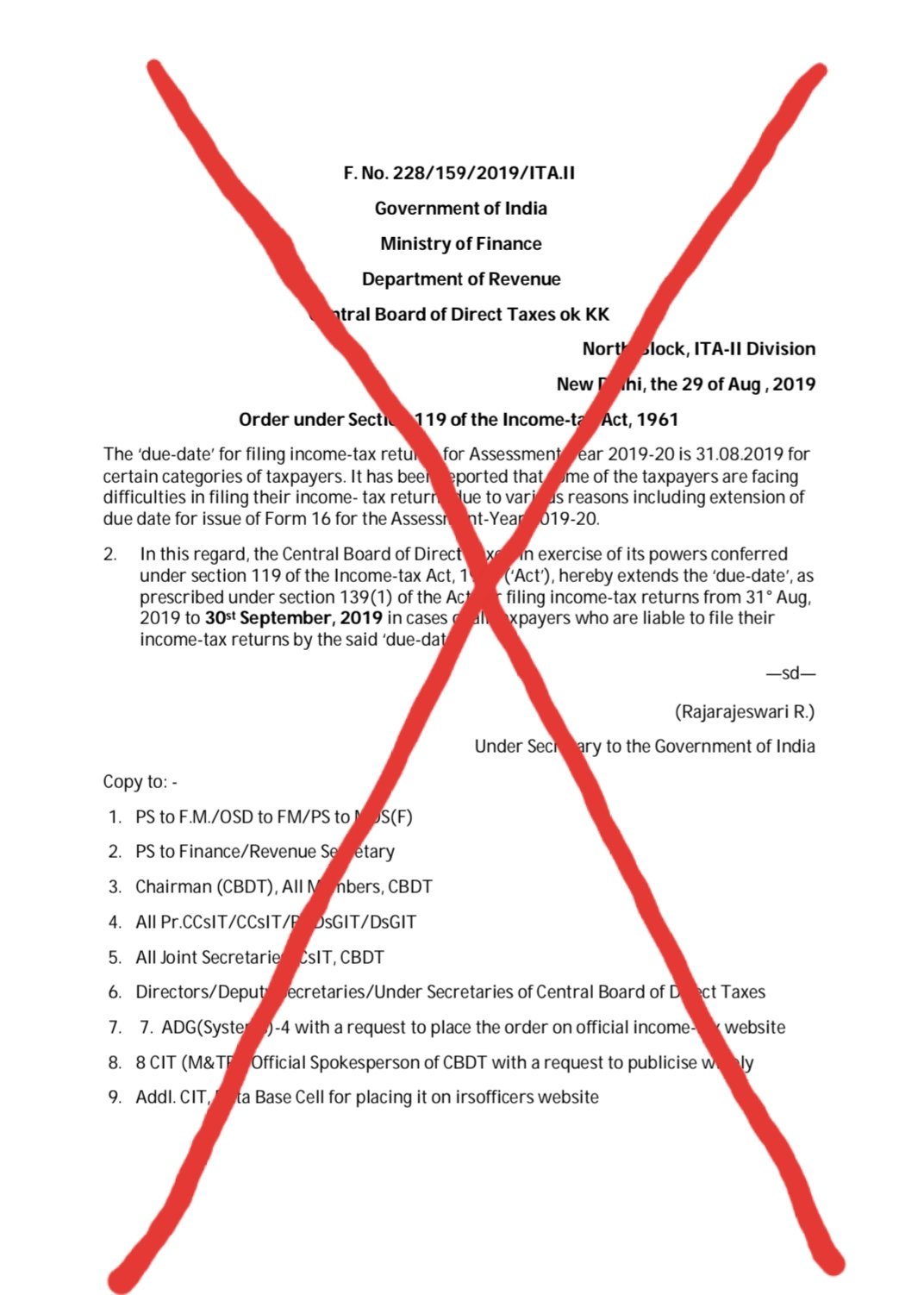

The Income Tax Department for AY2019-20 has not extended the income tax due date beyond 31st August 2019. There is however a fake notification circulating in social media claiming income tax due-date relaxation. The Income Tax Department has clarified that the notification is FAKE. The fake notification circulating on social media is reproduced below for reference:

Earlier Extension

The Income Tax Department has implemented a due date extension for filing FY2018-19 or AY2019-20 income tax returns from 31st July 2019 to 31st August 2019. The announcement for the same was made through the Income Tax Department official Twitter handle as follows:

The categories of taxpayers includes all taxpayers who were liable to file their Income Tax Returns by 31st of July, 2019 & can now file their Income Tax Returns by 31st of August, 2019.

— Income Tax India (@IncomeTaxIndia) July 23, 2019

In addition to the above twitter message, the notification was also released by the Income Tax Department as follows: