Gujarat Minority Certificate

Gujarat Minority Certificate

Gujarat minority certificate is an essential document for people who belong to the minority communities. In Gujarat, it is well known as Religious Minority Certificate. The National Commission for Minorities Act, 1992 defines that minority community is a smaller group representing less than half of the predominant population, i.e. it’s a community which is numerically less than fifty per cent of the total population in India. In this article, we look at the procedure for obtaining the Gujarat Minority Certificate in detail.

National Commission for Minorities Act

The National Commission for minorities act was launched in the year 1992 by notification of Central Government. The government has notified six religious communities as given below as minority communities. When the Central government listed these communities as a minority it appears that numerical criterion was taken into consideration.

Minority Community

The list of the minority community in Gujarat is listed below:

- Christian

- Muslim

- Sikh

- Buddha

- Parsi

- Jain

Benefits of Obtaining Gujarat Minority Certificate

As stated above, minority certificate mainly helps those who belong to the minority community in availing the following advantages.

- Relaxation of upper age limit for applying to certain Government jobs, Minority certificate is mandatory

- Minority certificate is useful for waiving off a part or the whole of the admission fees admission to schools and colleges

- Quotas in educational institutions

- To avail reservation of seats in the Legislatures

- To get a reservation in Government Service

- To obtain scholarships in school/college

- For availing Government Subsidies

- To apply for Government Schemes

To avail these privileges, a citizen of Gujarat belonging to a minority community must be in possession of a valid Gujarat Minority certificate.

Applicable Fee

For processing Gujarat minority certificate, a service charge of Rs.20 needs to be paid.

Prescribed Authority

The Gujarat Minority Finance and Development Corporation is the concerned department for the issuance of Gujarat minority certificate. The applicant requesting for the minority certificate have to apply to the Tahsildar of the concerned district which is the competent authority.

Documents Required for Gujarat Minority Certificate

The following documents have to be furnished for obtaining Gujarat Minority Certificate.

Residence Proof – Any one of the following

- Ration Card

- True Copy of Electricity Bill.

- True Copy of Telephone Bill.

- True Copy of Election Card.

- True Copy of Passport

- First Page Of Bank PassBook/Cancelled Cheque

- Post Office Account Statement/Passbook

- Driving License

- Government Photo ID cards/ service photo identity card issued by PSU

- Water bill (not older than three months)

Identity Proof Attachment (Any One)

- True Copy Income Tax PAN Card.

- Any Government Document having citizen photo

- Photo ID issued by Recognized Educational Institution

- Caste Proof (Any One)

- Panchami

- Declaration before Talati (Service Related)

- Oath Letter

- Certificate on School Letter pad for Religious Minority

Proof needed In Service Attachment

- Income Certificate

- Certified copy of village registration number 7/12, number 8-A & Number 6 for which land is assumed

- Certified copy of village reg. number 7/12, number 8-A & Number 6 for which property is sold

- The affidavit attached with the application.

- Panchnamu regarding of place status

- Applicant Answer

- Panchnamu

Applying through Jan Seva Kendra

Procedure for applying Gujarat minority certificate through Jan Seva Kendra is explained in detailed step by step procedure below:

Step 1: Applicant needs to visit the nearest Jan Seva Kendra for applying the Gujarat minority certificate.

Submit an Application

Step 2: The applicant has to submit an application in prescribed format along with documents for minority certificate at Jan Seva Kendra. Provide personal details, the purpose of applying for Minority Certificate, aspects of education, and all other information.

Application FormFee Payment

Step 3: Pay the applicable fee to the Jan Seva Kendra operator for processing minority certificate and issue the same. Get acknowledgement slip with application number from Jan Seva Kendra operator. Note this application number for future reference.

Minority Certificate Processing

Step 4: The request for minority certificate will be processed online through Gujarat Directorate of Minorities department. Minority certificate application status will be updated through SMS to the registered mobile number.

Step 5: The concerned authority will process the minority certificate online, and after successful verification, the prescribed authority will approve the minority certificate request and take action for issuing Gujarat Minority certificate.

Once the request for this certificate is accepted, an SMS will be sent to the registered mobile number as the application has been approved.

Gujarat Minority Certificate Online Application Procedure

Procedure to apply for Gujarat Minority certificate is explained in detail below:

Access Digital Gujarat

Step 1: Go to home page of Digital Gujarat webpage. The list of the location of Jan Seva Kendra will be displayed on the homepage.

Step 2: Applicant can select his location and proceed further with the application. The applicant can search his/her area by directly typing into the text box.

Login to Portal

Step 3: If you are already registered user of this portal you can use the “login” link from the home page to log in and apply Gujarat Minority certificate.

Step 4: When you click on the login link you will be navigated to the Login page, enter the credentials and click on the “Login” button.

New User Registration

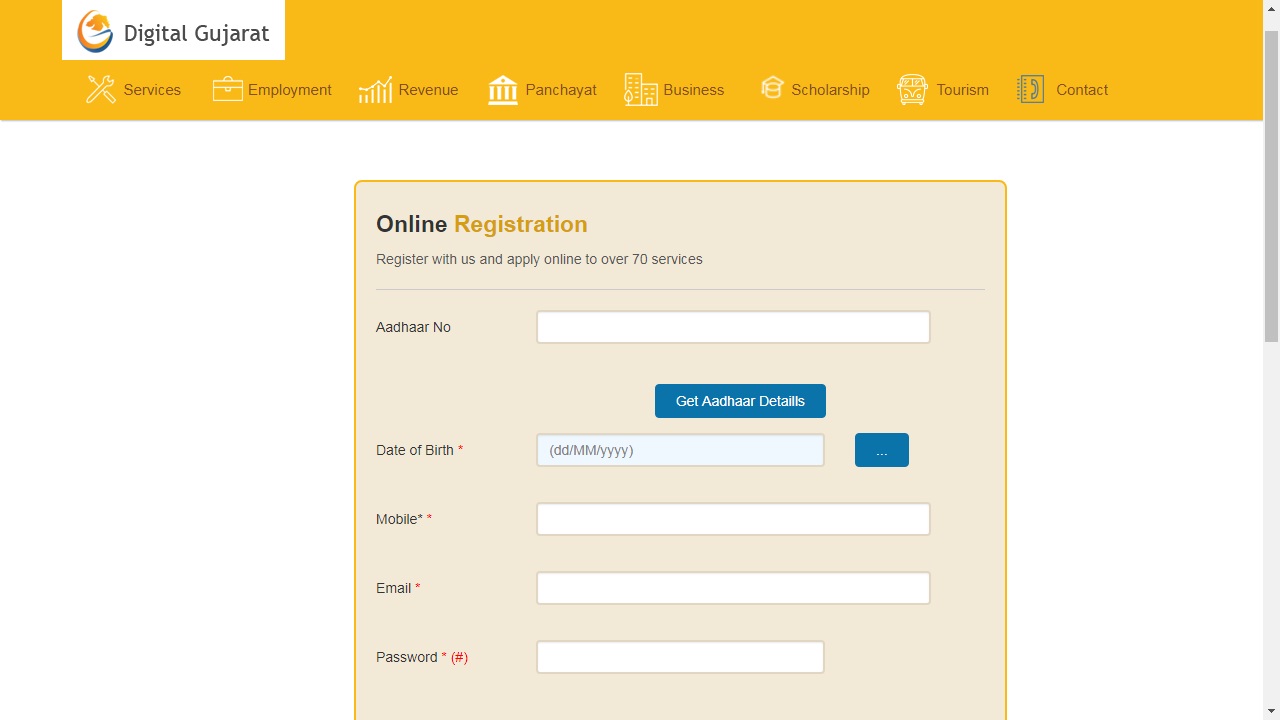

Step 5: If you are a new user to this portal, then click on Click For New Registration (Citizen) option, it will redirect you to user registration page.

Step 6: When you click on this option, you will be navigated to the Online Registration page.

Step 7: For new user registration, User has to enter all the fields, after entering details, click on the save button to finish the registration process.

Step 8: After completion of first stage registration, the applicant will receive a one-time password (OTP) the mobile to verify the mobile number.

Step 9: After entering the one time password in the text box, click on the confirm button. After mobile number verification, you can proceed with the second stage of registration.

Step 10: After you enter the other details click on the update button to save the information. On completion of the second stage of registration, you will be redirected to the citizen profile page.

Step 11: Enter all other details and update your Profile.

Process with Minority Certificate Service

Step 12: If you are a registered user then you can log in to the portal and click on the New Service option which will take you to the page of services offered by this Common Service Portal.

Step 13: Select Religious Minority Certificate from services menu. List of supportive documents required will be displayed.

Step 14: To proceed with the application, click on “Continue to Service” button.

Step 15: A small window will show your service Request ID and Application Number, Click on “Continue” button.

Provide Details

Step 16: Provide all details for Gujarat minority certificate. After entering details, click on save and next button.

Step 17: In the next page, you will have to attach the copy of all the supporting documents as mentioned above.

Step 18: After uploading the documents successfully you will have to select the checkbox of declaration and click on the “Submit” button to submit the minority certificate application.

Make Payment

Step 19: After successful submission of your application you can take the print of minority certificate application form and proceed further with the payment. There are two payment options:

- Using E-Wallet

- Using Gateway

Step 20: Select the payment option and click on the “Send OTP” Button to make payment. A onetime password will be sent to your mobile.

Step 21: After entering the one-time password click on the “Confirm” Button to complete the payment process.

Step 22: After a successful payment, a receipt will be generated, and the task will be redirected to the concerned authority login.

Note: Kindly keep this reference number; it can be used for further reference.

Status of Application

After successful submission of application, the applicant doesn’t need to visit nearest Jan Seva Kendra /ATVT centre to verify the document. The applicant will get an SMS for the status of Gujarat Minority certificate application.

Get Gujarat Minority Certificate

Once the concerned authority approves the request, the minority certificate will be digitally signed. The approved document will be forwarded through registered mail ID.

Gujarat Minority certificate will be dispatched through courier from Jan Seva Kendra to applicant’s address if the delivery type is speed post local or non-local.

If the delivery type selected as manual mode, then the applicant has to collect the minority certificate from JSK where you have applied for Minority Certificate.

Know more about Minority Certificate in Kerala