Assam Liquor License

Assam Liquor License

Liquor license is a legal permit given by the Commissioner of Excise department to those who want to sell alcoholic beverages for consumption. Liquor license is issued as an endorsement of the pursuit of sale, manufacture, and sometimes even use of the beverage at certain premises. In this article, we look at the purpose, eligibility and procedure for obtaining Assam liquor license in detail.

Know more about Starting a Bar Business in India

Assam Excise Act, 2000

In Assam, the sale and manufacture of liquor are governed by the Assam Excise Act, 2000. The import, export and transport of country spirit are subject to rules and restrictions imposed by Sections 8, 9 and 12 and prohibition made under Section 10 of the Excise Act. The admin of the Excise Department and the Collector of Excise Revenue are under the charge of the District Collector.

Need for Liquor License

Liquor Licenses may specify that a particular store can sell beer and wine or that it can sell hard liquor. In general, a liquor license is issued for only a specific period and must be renewed yearly. All liquor licenses come with specific terms and conditions that the retailer should abide by to maintain the license. The department of alcoholic beverage control within the state typically governs the official issuance of a liquor license.

Know more about GST on Beer & Liquor

Eligibility Criteria

The eligibility of persons who can apply for an excise license in the state of Assam is listed below:

- The individual should be age twenty-one years or above and should be an India citizen or a Person of Indian Origin.

- Any partnership firm containing the partners is citizens of India. And the change in the partnership will not be entertained after the settlement \sf shop or group of shops except legal permission from the Excise Commissioner required.

- The individual should not be a defaulter or blacklisted or debarred from holding an excise license under the provision of Rule 13 of these rules or under the provision of any law made under the Act.

Documents Required

The below listed are the documents to be submitted by the applicant along with the application for grant of Liquor License.

- Copy of the document showing applicant’s rights, title and interest on the proposed site or the land.

- Four copies of the plan of the building which the applicant intends to use and construct his plant and layout plant showing the position of stills, vats and other permanent apparatus along with the list of the storeroom, warehouses connected in addition to that (prepared any technically competent person, not below the rank of SDO, PWD department)

- Project Report, cost-benefit analysis, estimated production and market feasibility

- A copy of fire license or no-objection certificate in this regard from the appropriate authority.

- A copy of clearance from the appropriate authority in the matter of environmental pollution, if necessary.

- No objection certificate (NOC) from the municipal corporation, municipality, town committee, gaon panchayat concerned.

- Whether a criminal court of non-bailable offence ever convicted the applicant

- if yes full particulars thereof

- if not an affidavit of the effect

For Partnership Firms

- Registration certificate

- Partnership deed

- Beneficial owners list holding more than 15% in the firm.

- Address Proof and ID Proof

- Power of Attorney (POA)

- Declaration of Firm’s Partner that who will present in Excise Department.

- Affidavit relating no dues of excise or any other Government Department.

- Affidavit relating applicant partnership firm or candidate has not punished under N.D.P.S., Excise Act, Molasses Act, I.P.C Affidavit relating firm is not blacklisted in any state.

- Sales Tax Registration and Sale tax Clearance Certificate from the concerned Sales Tax Authority where the firm is presently working.

- Three copies of blue Prints of the labelled map of the proposed site and its premises and its inside places. The plan must be certified by the applicant, Enquiry officer, District Excise Officer & Deputy commissioner of the district.

- Enquiry report of Excise Officer.

- No Objection Certificate about Law and Order from proposed area’s S.D.O. Certificate from Enquiry Officer that proposed site is as per tourist rules.

- Any other documents which required by licensing /Sanctioning Authority.

License Fee Applicable

The below- specified shows the charge/ fees for the applying of a new liquor license.

| S. No. | Type of Licence | Production Capacity | Rate Of Licence Fee |

| 1. | Distillery licence | Up to Rs. 30 lakhs LPL | Rs. 20 lakhs per annum. |

| From Rs. 30 lakhs to Rs. 60 lakhs LPL per annum | Rs. 40 lakhs per annum. | ||

| Above Rs. 60 lakhs LPL per annum | Rs. 50 lakhs per annum. | ||

| 2. | Brewery licence | Up to Rs. 80 lakhs BL per annum | Rs. 20 lakhs and Bottling fee Rs. 3 lakhs per annum. |

| Above Rs. 80 lakhs BL per annum | Rs. 30 lakhs and Bottling fee Rs.4 lakhs per annum. | ||

| 3. | IMFL Compounding and Blending | Nil | Rs. 3 lakhs per annum. |

| 4. | Reduction and Bottling | Up to Rs. 30 lakhs LPL per annum | Rs. 3 lakhs per annum. |

| 5. | Additional bottling charges | Each case in excess of Rs. 30 lakhs LPL | Rs. 15 per case of 750 ml or equivalent quantity. |

| 6. | IMFL Bonded warehouse | Bond limits up to Rs. 50 lakhs | Rs. 4,50,000 per annum. |

| Bond limits from 50 lakhs to 1 crore | Rs. 7,50,000 per annum. | ||

| Bond limit 1 crore and above | Rs. 10,00,000 per annum. | ||

| 7. | IMFL Wholesale | Nil | Rs. 5,00,000 per annum. |

| 8. | IMFL ‘OFF’ | For the urban areas | Rs. 2,00,000 per annum. |

| For the rural areas | Rs. 1,00,000 per annum. | ||

| 9. | Beer ‘OFF’ | Nil | Rs. 1,00,000 per annum. |

| 10. | IMFL ‘ON’ 5* and above | Nil | Rs. 4,00,000 per annum. |

| 11. | IMFL ‘ON’ 2* and above but below 5* | Nil | Rs. 2,00,000 per annum. |

| 12. | Beer bar | Nil | Rs. 1,50,000 per annum. |

| 13. | IMFL ‘ON’ Restaurant | For the urban areas. | Rs. 2,50,000 per annum. |

| For the rural areas. | Rs. 1,00,000 per annum. | ||

| 14. | IMFL ‘ON’ in hotels | For the urban areas. | Rs. 2,50,000 per annum. |

| For the rural areas. | Rs. 1,00,000 per annum. | ||

| 15. | Microbrewery in IMFL ‘ON’ hotels or IMFL ‘ON’ restaurant licensed premises only | Nil | Rs. 5,00,000 per annum. |

| 16. | Club ‘ON’ | Nil | Rs. 1,00,000 per annum. |

| 17. | Temporary bar | Nil | Rs. 10,000 per day. |

| 18. | The Late closing licence granted to licensed hotels and restaurants including bars attached thereto | For a hotel duly classified by the Tourism Department as 5 stars and above, for consumption ‘ON’ the premises. | Rs. 3,00,000 per annum. |

| For a hotel duly classified by the Tourism Department as 2 star and above, but below 5 stars, for consumption ‘ON’ the premises. | Rs. 1,50,000 per annum. | ||

| For other hotels for consumption ‘ON’ the premises. | Rs. 75,000 per annum. | ||

| 19. | Retail vend of a foreign liquor license at a Military canteen established under the canteen tenant system. | When the licence is for the supply of liquor to a regiment. | Rs. 10,000 per annum. |

| When the licence is for the supply of liquor to the smaller unit. | Rs. 7,000 per annum. |

Excise Duty Rates

| S. No. | Type of Licence | Brand | Excise Duty | Gallonage Fee |

| 1. | Beer |

Up to 5 per cent Above 5% |

Rs. 39/- cases Rs. 62.40/ cases |

Re. 1 per BL

|

| 2. | IMFL | General | Rs. 280.98/cases | Rs. 2 per BL |

| Regular | Rs. 357.94/cases | |||

| Luxury | Rs. 429.10/cases | |||

| Premium | Rs. 758.56/cases | |||

| Classic premium | Rs. 1657.50/cases | |||

| RUM | Rs. 81/ cases | Rs.1.84 per BL | ||

| WINE | Rs. 45/ cases | Rs. 2 per BL |

Application Procedure for Obtaining Liquor License

The applicants must follow the following steps to obtain a Liquor license by submitting the application form online.

Visit the Official Website

Step 1: Firstly, the applicants have to visit the Excise department of Assam for obtaining Excise license online.

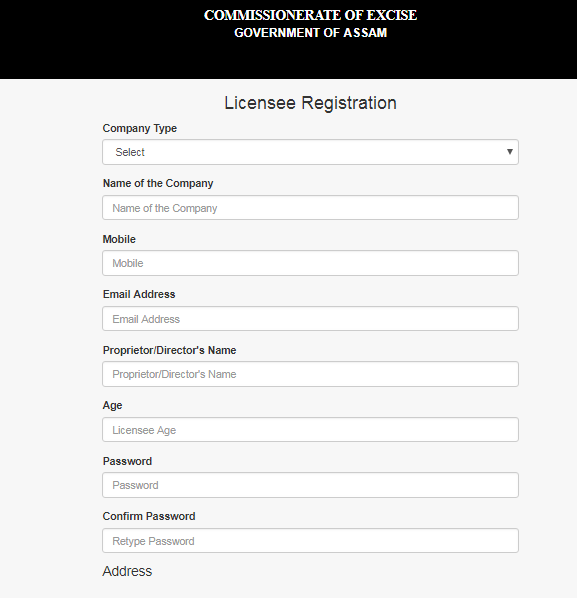

New User Registration

Step 2: You have to click on the “Sign Up (New User)” that is visible on the home page.

Step 3: Now you have to fill all the required information in this registration form. After filling all the required details, you need to tick the declaration box and click on the submit button.

Login to Portal

Step 4: Now you got to log in to the portal using your user id and user password.

Step 5: Login into Excise Department Portal by providing the appropriate username and password on the application.

Application of New Liquor License

Step 6: You have to click on the “New Liquor License” tab that is visible on the home page of the portal.

Step 7: After clicking on the tab, the registration page will be displayed on the screen.

Upload Requested Documents

Step 8: You have to upload the photocopy of the documents (Only pdf/jpg/jpeg files are allowed).

Step 9: After uploading all the documents, ensure to check the button for Declaration and click on the “Save” button.

Make Payment

Step 10: Click on “E-payment” option which is present on the homepage of the portal.

Step 11: Click on Make Payment button to get redirected for the E-challan page.

Step 12: Then select the Bank Name for making the online payment and then click on the “Submit” button.

Step 13: Enter the particular details of your license type and select the challan number and click on “Save and Proceed” button to send permit request.

Submit the Application Form

Step 14: After submitting the Application form, you have to take the print of FORM 3 and attach all the relevant documents signed by the occupier and sent it to L&E Department by post.

Print Acknowledgement Receipt

Step 15: You will receive a message stating “Your application has been registered”. You can also make a print of it by clicking on the ‘Print’.