What is a GST certificate in India?

What is a GST certificate in India?

GST was introduced in India in 2017 as a single-tax system to replace multiple state and central taxes. With the GST, taxes are paid on the value of goods and services, not just the sale of goods. GST applies to all goods and services except those specifically exempted.

A Goods and Services Tax (GST) certificate is a document issued by the Government of India to a taxpayer or entity that has registered under the GST system, authorizing them to start collecting taxes from customers on behalf of the government. The certificate is issued by the Central Board of Indirect Taxes and Customs (CBIC).

The GST certificate is proof of registration under the GST system and is mandatory for businesses to obtain before they can start trading and collecting taxes. It is also used to track the taxes paid by companies.

What is the GST certificate?

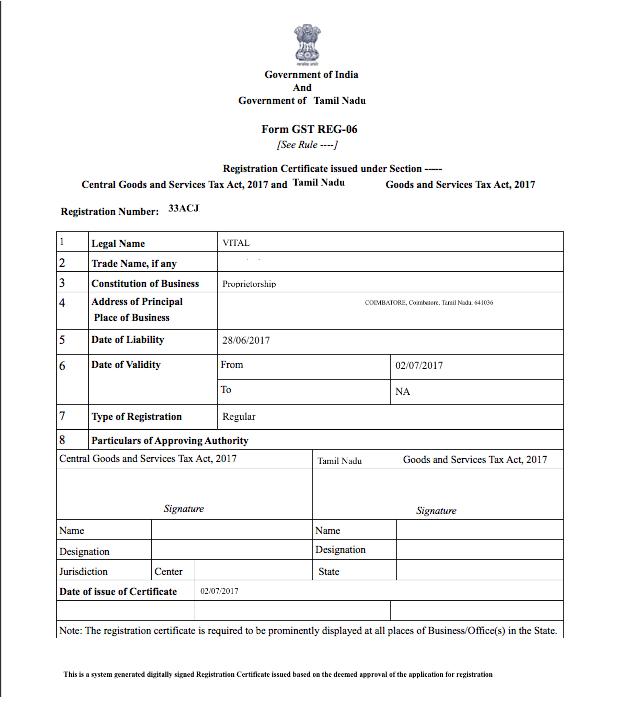

The GST certificate consists of a nine-digit alphanumeric number issued to the registered taxpayer. This number is known as the GSTIN (Goods and Services Tax Identification Number). The GSTIN is unique and is used to identify the taxpayer and their transactions.

The certificate also contains other details of the registered taxpayer, such as the name, address, and type of taxpayer (manufacturer, service provider, etc.). It also includes the details of the taxes paid by the taxpayer, the date of registration and the date of expiry of the certificate.

The GST certificate is valid for one year from the date of issue and needs to be renewed every year. The renewal process involves submitting the taxpayer’s details, such as the turnover, the number of employees, and the type of business. The taxpayer also needs to submit the details of the taxes paid for the previous year.

Below is a sample of a GST registration certificate.

Why is a GST certificate important?

GST certificates are required for businesses of all sizes in India. It is an essential document as it allows companies to collect taxes on behalf of the government and to remain compliant with the law.

In order to obtain a GST certificate, the business must register with the GST portal and provide the necessary documents. These documents include the business’s PAN (Permanent Account Number), bank account details and proof of address. Once the application is approved, the GST certificate is issued.

Once a business is registered for GST, it can collect taxes from its customers at the applicable rate (5%, 12%, 18% or 28%). This collected tax can then be submitted to the government monthly, quarterly or annually.

Overall, the GST certificate is an essential document for businesses in India. It helps them track their taxes and ensure that they comply with the GST regulations. It also allows the Government of India to track the taxes collected from taxpayers and ensure they are being used properly.