Small Industries Development Bank of India

Small Industries Development Bank of India

The Small Industries Development Bank of India, or commonly known as the SIDBI, began operations in the April of 1990.

It was governed by the Act of the Indian Parliament and focussed on promoting and uplifting the Micro, Small and Medium Enterprises (MSME) Sector.

The Reserve Bank of India/ RBI is the regulatory for the SIDBI. This article talks about the various essential aspects of the SIDBI that includes the basic functions to the process of a loan application.

SIDBI

The Small Industries Development Bank of India/ SIDBI was formed under the Department of Financial Services in the Ministry of Commerce.

SIDBI primarily focusses on the development of the MSME Sector along with the promotion of energy efficiency and cleaner production.

The bank plays a vital role in helping micro, small and medium enterprises acquire necessary funds in order for them to grow, develop, market and commercialize their products and technologies.

SIDBI also takes the initiative to offer various schemes and creates financial products and services that are tailor-made to meet an entrepreneur’s need for their business.

SIDBI was vested with the duties of administering the Small Industries Development Fund, as well as the National Equity Fund, both of which were earlier operated by the Industrial Development Bank of India (IDBI).

SIDBI also assists other financial institutions such as small finance banks, non-banking financial institutions and other banks to stretch out a helping hand to the MSME Industrial Sector.

Mission

The following is the mission of SIDBI.

To facilitate and strengthen the flow of credit to MSMEs and to address financial, as well as developmental gaps, in the MSME eco-system.

Vision

The following is the vision of SIDBI.

To emerge as a single window that meets the financial and developmental needs of the MSME sector. To make the Sector robust, vibrant and globally competitive. To position SIDBI as a most-preferred brand and a customer-friendly institution. To enhance shareholder wealth and to uphold the highest corporate values through the latest technology.

Functions

The following are the functions of the SIDBI.

- Provides financial assistance to institutions and banks that have financed the MSME Industries.

- Discounts and Re-discounts bills.

- Offers monetary assistance to micro and small industries in order to market their products in the international market.

- Offers provisions for initial capital to entrepreneurs and provides loan assistance at a concessional rate of interest for a long duration.

- Offers assistance in setting up of non-core services such as plants and marketing of the same for the small scale industries.

- Factors and leases assistance to set up technologically-sound machinery for MSME Industries.

- Offers provisions for venture capital to upcoming ventures with the aim to promote self-employment.

- Offers improvisation for departments where an MSME may lack functioning.

Benefits

The following are the benefits of being a part of SIDBI.

- Custom-Made: The loans designed by SIDBI are as per the needs of its customers. SIDBI helps people by funding their businesses that do not necessarily fall in the normal category.

- Loan Size: SIDBI alters loans as per the size of the customer’s enterprise. Therefore, Micro, Small and Medium Enterprises may receive various loans that are custom-made suit their business.

- Rates: SIDBI has collaboration with a variety of banks and financial institutions, even on an international level, such as KfW, World Bank and Japan International Cooperation Agency. This enables its customers to avail concessional rates of interest.

- Assistance: Along with loans, SIDBI also ensures to offer expert support and advice on anything their customer requires. Relationship managers go the extra mile with their customers who are entrepreneurs to make the right decisions and to provide assistance throughout the loan process.

- Collateral-Free: Entrepreneurs may get up to INR 100 Lakhs without even offering any collateral. This is achieved through the Fund Trust for Micro and Small Enterprises (CGTMSE).

- Risk and Growth Capital: Entrepreneurs may acquire sufficient capital that is required to grow without diluting the ownership of the company.

- Venture and Equity Funding: SIDBI has a wholly-owned subsidiary known as the SIDBI Venture Capital Limited that provides growth capital in the form of equity; through venture capital funds that are focussed on MSMEs.

- Government Subsidies: Takes advantage of various schemes that have been offered by the Government to avail concessional rates and related terms. SIDBI has a broad understanding and extensive knowledge of loans and schemes that exist for the betterment of their customer’s business.

- Transparency: The process and rate structure that is set by SIDBI is exceptionally transparent and do not comprise of any hidden charges.

Business Domains

Typically, two kinds of assistance are offered to the MSME Sector by the SIDBI. They are Financial Assistance and Non-Financial Assistance.

Types of Financial Assistance by SIDBI

The following are the types of financial assistance that are offered by SIDBI to the MSME Sector.

- Business Loan

- Working Capital and Risk Capital Loan

- Renewal and Enhancement of existing working capital loan

- Machinery, Equipment, DG Sets procurement loan

- Micro Finance

- Receivables Finance

Moreover, SIDBI offers unique facilities to industries that deal with the Energy Sector and promotes cleaner production techniques.

Types of Non-financial Assistance by SIDBI

The following are the types of non-financial assistance that are offered by SIDBI to the MSME Sector.

- Consultation Services

- Collaboration with CRISIL; offers Crisidex Index to various industries.

- Promotion of Micro Industries

- Skill and Technology Development Programs

- Guidance to Startups

Accredited Consultants

SIDBI, along with its accredited consultants, offer a wide array of essential services for loans such as the following.

- Offers guidance to existing and new entrepreneurs.

- Spreads awareness amongst entrepreneurs about the multiple schemes available from SIDBI and other commercial banks for their benefit.

- Educates MSMEs on the benefits and subsidies that are offered under various Government schemes.

- Provides debt counselling for applicants who request for loans.

- Prepares a Basic Information Memorandum (BIM) for all their customers to sanction their loans.

- Helps to resolve the queries raised by banks.

Loan Application Process

The following are the steps required to obtain a sanction for loans from SIDBI:

Step 1: Visit the official page of SIDBI.

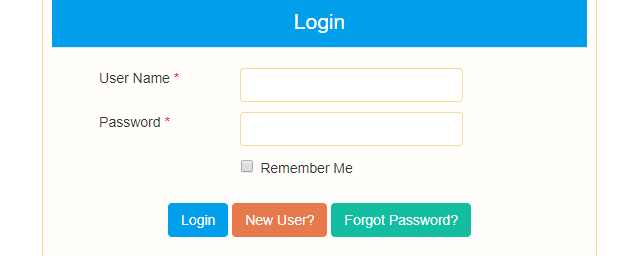

Step 2: Navigate to the Login section and select the Applicant tab.

Step 3: Under the Applicant tab, click on the option of New User.

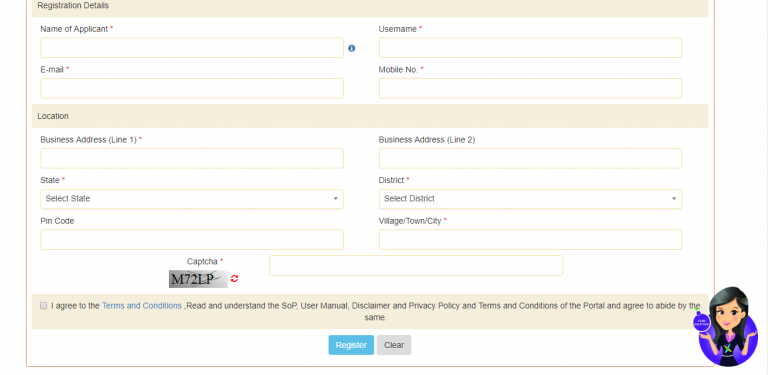

Step 4: Once the option of New User is clicked, the next page will inquire about the scheme that you wish to apply for and the expected loan amount.

Note: Along with the above fields, there would be an option to Assess your Scheme Suitability. Here, one may review the loan schemes under which they are eligible to avail.

Step 5: The next step would be to fill the application form with mandatory information that would include personal and business details of the applicant.

Step 6: After the application is completed, click on the Register icon.

Step 7: An email which comprises of your Username and Password would be sent to the email address that you submitted.

Step 8: Log in to the portal with the new credentials.

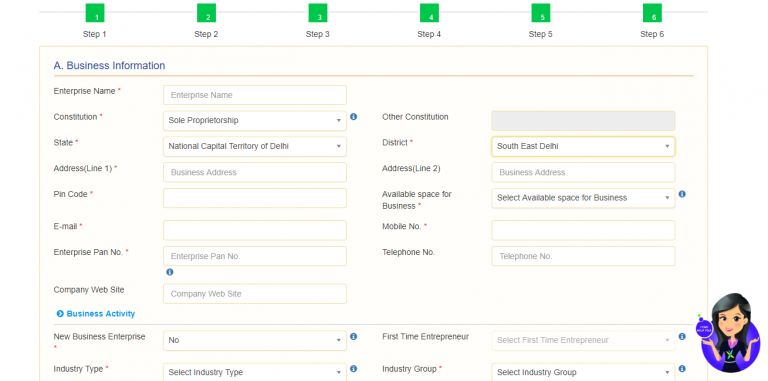

Step 9: After logging in, a new form requesting information based on your business activities would appear.

Step 10: Once all the inquired information has been submitted accurately, Click on the Validate tab.

Step 11: Once this is complete, you may apply for loan schemes that your financial profile is eligible to avail.

Many new business schemes have been introduced over the past few years. One of the main aims of SIDBI was to maintain their financial lenders and their customers through an economic balance.

Any individual may easily understand different schemes and apply for the same in an instant with the help of SIDBI.

The Small Industries Development Bank of India is a one-stop platform to every financial business solution that an entrepreneur may be searching for.