Guwahati Property Tax

Guwahati Property Tax

Property tax is a primary source of revenue for the Guwahati Municipal Corporation (GMC). This form of tax is to be paid annually by the property owners to the municipal corporation of the jurisdiction in which the property/ land is located. The system of taxation has been made mandatory by the Government for anybody who owns property in Guwahati. In this article, we look at the various aspects of Guwahati property tax in detail.

Eligibility Criteria

Any individual who owns a property or land in Guwahati Municipal Area has to pay property tax to Guwahati Municipal Corporation (GMC).

Calculation of Property Tax

Property taxes are derived from a percentage of the assessed value of the property. Property taxes are calculated using the value and location of the property or land. The tax assessors will value the property or land and charge an appropriate rate from the landowners using the standards set by the government authorities.

Documents Required

The applicant will have to submit a copy of the assessment order or receipt of the latest property tax paid payment while making the payment of property tax.

Procedure for Paying Property Tax – Online Method

The applicants of Guwahati must follow the below-mentioned steps to make the Property Tax payment online.

Visit the GCM portal of Guhawati

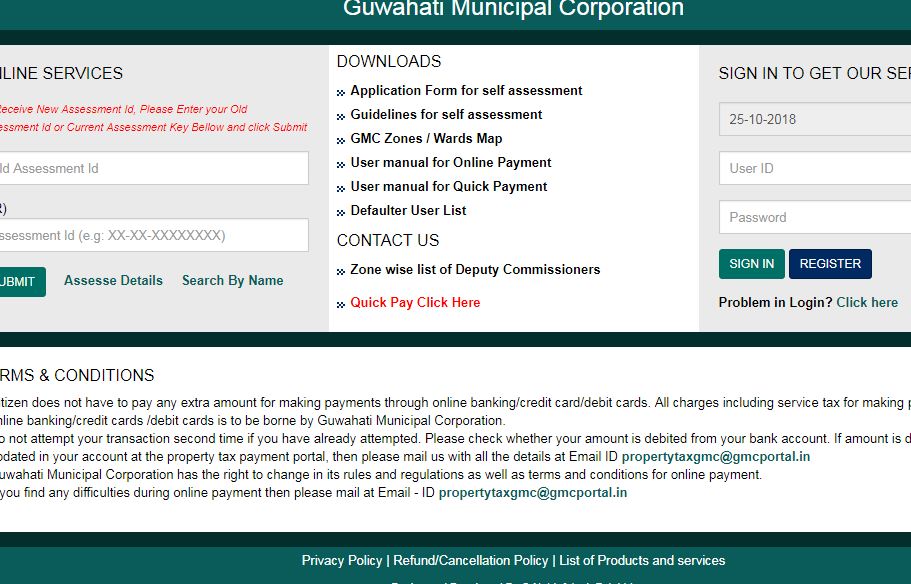

Step 1: The applicant must visit the official website of Guwahati Municipal Corporation (GCM) to make the property tax payment.

Step 2: After which, the user must click on the ‘Online Property Tax System’ link to navigate to the online property tax payment portal.

New User Registration

Step 3: The applicant will be taken to the payment portal page where one needs to log in to the GMC portal with his/her username and password.

Step 4: If the user is new to the GCM portal, he/she has to register in the portal to avail the property tax payment services.

Step 5: In the registration page, the applicant is required to enter the “Holding Number” and “Zone”, after which the contact details such as the mobile number and e-mail address must be given.

Step 6: Once entering all the details in the registration page, click on the register button to receive your user id and password to your registered e-mail address.

Login to portal

Step 7: The applicant has to click on the ‘Bill Box’ button to view the bill details.

Step 8: After which he/she needs to click on the ‘Online Payments’ option that will redirect you to the new page.

Step 9: Then enter your Bill number and click on the ‘Go’ button.

Make Payment

Step 10: Now, check the checkbox against the quarter bill or arrear bill for which the payment can be made. Then you need to click on the “Pay Now” button.

Step 11: The user will receive the bill details, which can be viewed by clicking on the “Confirm” button to make the payment.

Step 12: The user will be redirected to the payment gateway, upon which he/she has to choose the desired payment option (debit card, credit card, internet banking).

Step 13: The following details must be filled prior to making the payment.

- UBL name

- Collection date

- Collection centre

- Payment mode

- Bank details

Step 14: Then, the user needs to fill out all the necessary payment details.

Step 15: Click on the “Make Payment” button to make the payment online.

Step 16: After making payment, a receipt of the same will be generated as an acknowledgement slip for the amount made.

Alternate Method for the Property Tax Payment

Step 17: If the user wishes to opt for the “Quick Pay” option, then click on the “Quick Pay” button.

Step 18: Enter Bill Number and click on the “Go” button.

Step 19: Check the checkbox against the arrear bill or quarter bill for which the payment has to be made, and click on the “Pay Now” button.

Step 20: After making the payment, a receipt will be automatically generated. The applicant can make a print of it for future reference.

Penalty for Non-Payment of Property Tax

The Guwahati Municipal Corporation (GMC) will bear the transaction charges on behalf of the citizens for using the online Property tax payment portal. No additional charges will be levied. Non-payment of property tax can impose a hefty penalty in the hands of the landowner. Late payments towards property tax may attract interest at the rate of 5 to 20 per cent on the payable sum, depending upon the relevant policies.