How do I know if I have an Income Tax Notice?

How do I know if I have an Income Tax Notice?

When a taxpayer files an Income Tax Return (ITR) with the department, the department processes the return. It may issue a notice to the taxpayer, which could be an Intimation or scrutiny. A tax notice can be of various types due to various reasons. It may issue a notice to the taxpayer, which could be an Intimation or scrutiny. A tax notice can be of various types due to various reasons.

Types of Income Tax Notice

Section 143(1) Intimation of the return

When an ITR is filed, the Income Tax Department processes it electronically and notifies the assesses in three instances:

- Tax liability to be paid;

- Refund to be determined;

- There is no demand or return, but the amount of loss may increase or decrease.

What to do if you receive a notice u/s 143(1)

If there is no difference in the returns, no action is necessary. If a refund is required, it will be transferred to the specified bank account when the return is processed. Request a new refund if necessary. Tax debt must be settled within 30 days if it exists.

Section 139(9) Defective Income Tax Return

The department will issue a notice under Section 139(9) to ratify the error if it discovers any defects, inaccuracies, or missing information in the return filed.

What to do if you receive a notice u/s 139(9)

If your return is determined to be defective, under 15 days of receiving the notice, you must update your return to fix the issues the Income Tax Department has identified. If you cannot make the necessary changes to your ITR within 15 days, you can ask for an extension by writing to your local AO.

Section 142(1) Inquiry Notice before Assessment

When a return is filed and during the assessment period, the assessing officer is of the opinion that additional details and documents should be requested. The assessing officer may then do so, and the assesse is required to provide it.

What to do if you receive a notice u/s 142(1)

The assessee must provide the necessary documents under inquiry as soon as they receive the notice from the IT department. The taxpayer is given a justifiable chance to respond to any material that has been requested.

Section 143(2) Scrutiny Notice

In the event that the AO believes that there is a need to conduct scrutiny after receiving the document in accordance with the notification sent under section 142 (1), the AO may issue the notice under section 143. (2). The AO seeks to ensure that the assessors have not committed any of the following offences:

- Understated their income;

- Claimed excessive loss;

- Paid lesser taxes.

What to do if you receive a notice u/s 143(2)

Provide supporting documentation for your claims, such as records of your income and expenses, together with your online response to the notice issued under Section 143(2). The AO will issue an assessment order after reviewing all the evidence, stating the total amount of tax due or refund due to the assessee based on the supplied proof.

Section 156 Notice of Demand

The AO must give the assesses a notice of demand that includes the amount payable when any interest, tax, penalty, fine, or other sum is due in relation to a decision that has been made.

What to do if you receive a notice u/s 156

This notification outlines the payment amount that will be due in the event that the assessing officer issues a demand for tax, interest, a penalty, a fine, or any other amount in according to the 1961 Income Tax Act. Within 30 days after receiving the notification, the assessee must pay the amount stipulated in the notice.

Section 245 Notice of Intimation

The term “inter-adjusted” refers to transactions in which the assesses must claim a refund after paying an amount to the government. It’s an intimation to the assesses.

What to do if you receive a notice u/s 245

Check all the information in the Intimation u/s 245 as soon as you receive it, along with the deadline (usually 30 days), because if you don’t act, the outstanding demand as of that date will be taken into account for adjustment against your return.

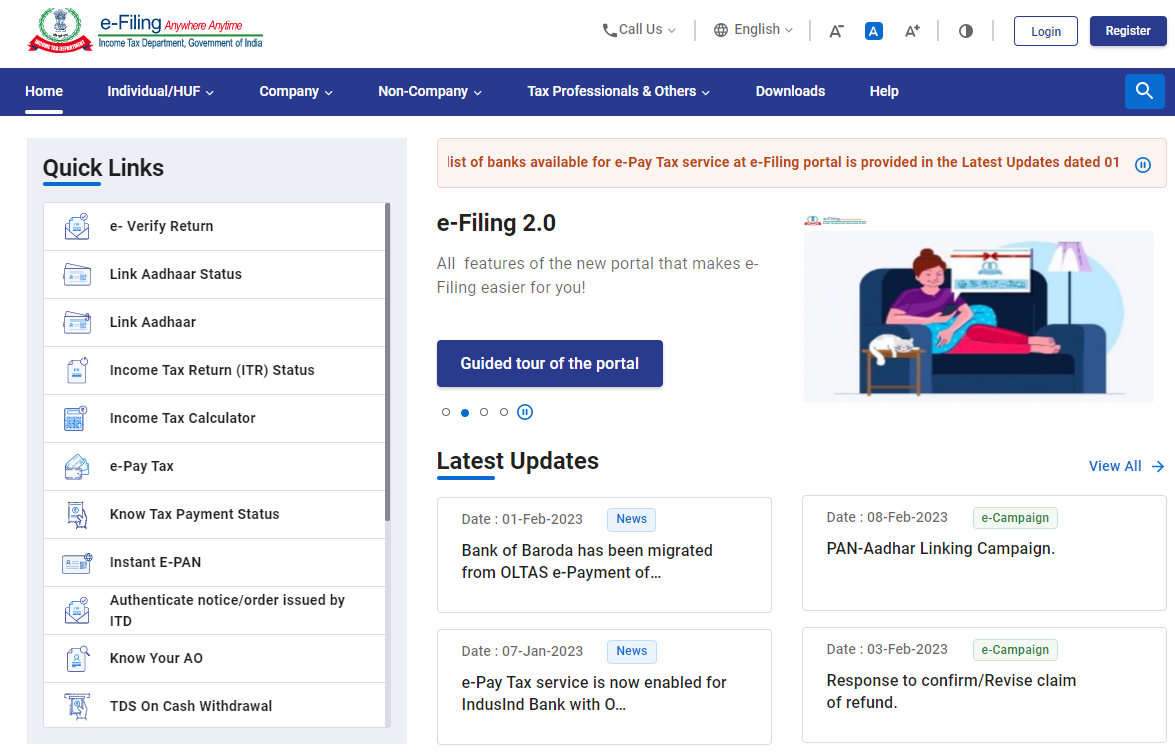

Check if you have Income Tax Notice Online

The following steps comprise of logging in to your account, 3 different methods of checking if you have a notice and how to check if you have a demand notice.

- On your Dashboard open the Official e-filing portal

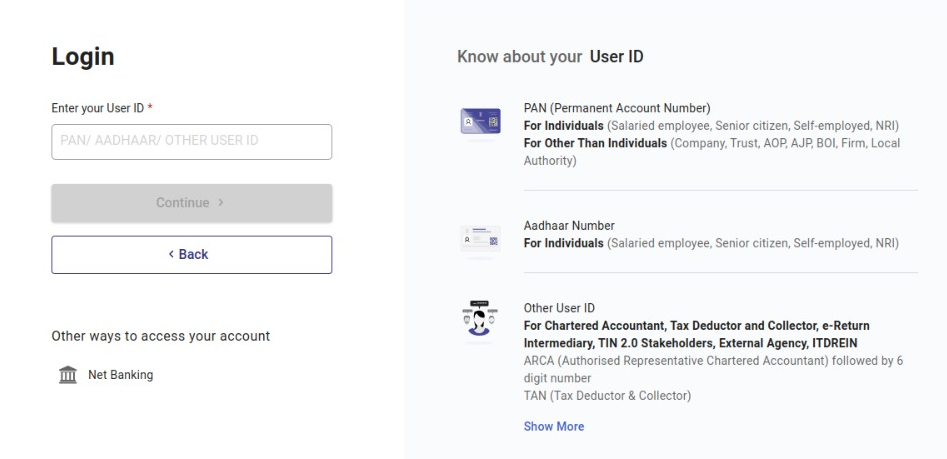

- Log in or sign up using your PAN/AADHAAR/USER ID

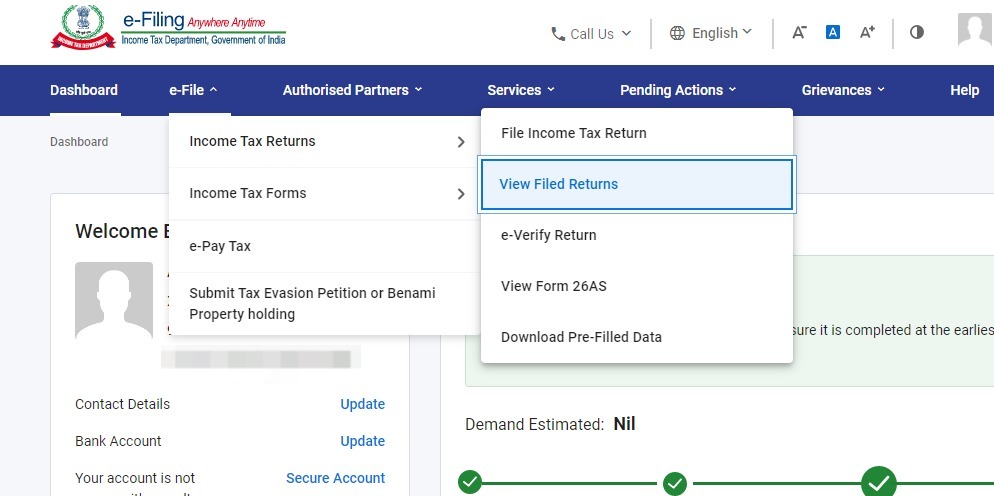

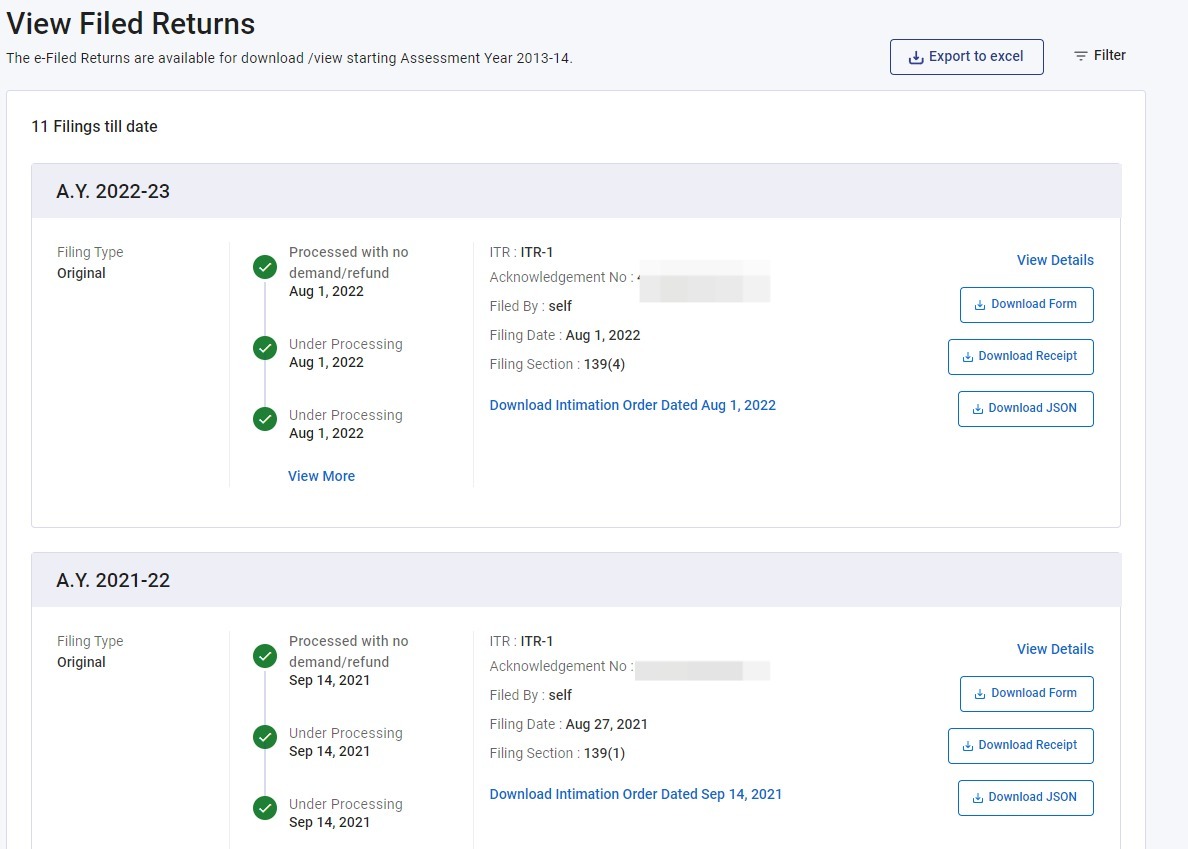

1. On the menu bar, select e-File and under Income Tax Returns, select View Filed Returns

- Under View File Returns, any notice for your returns are visible

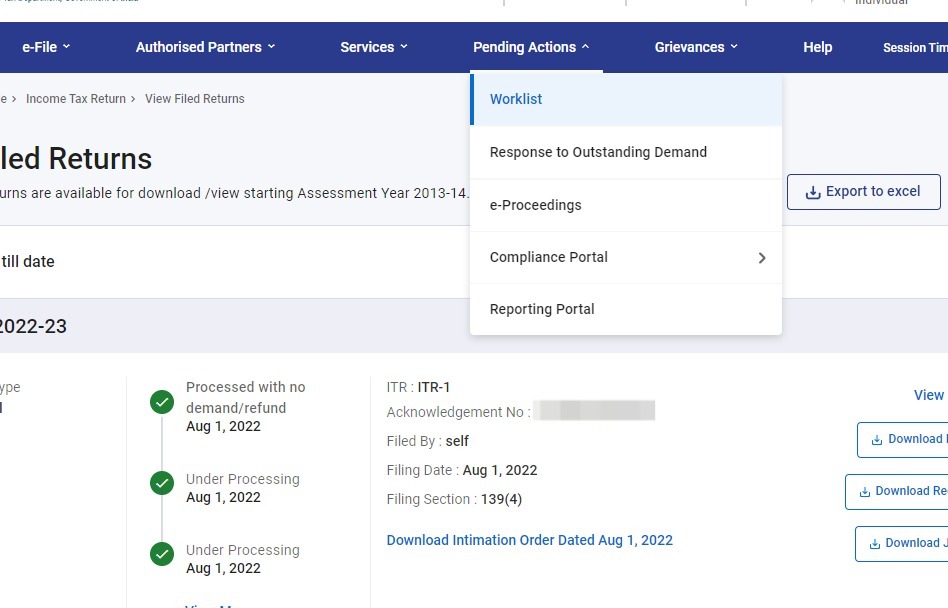

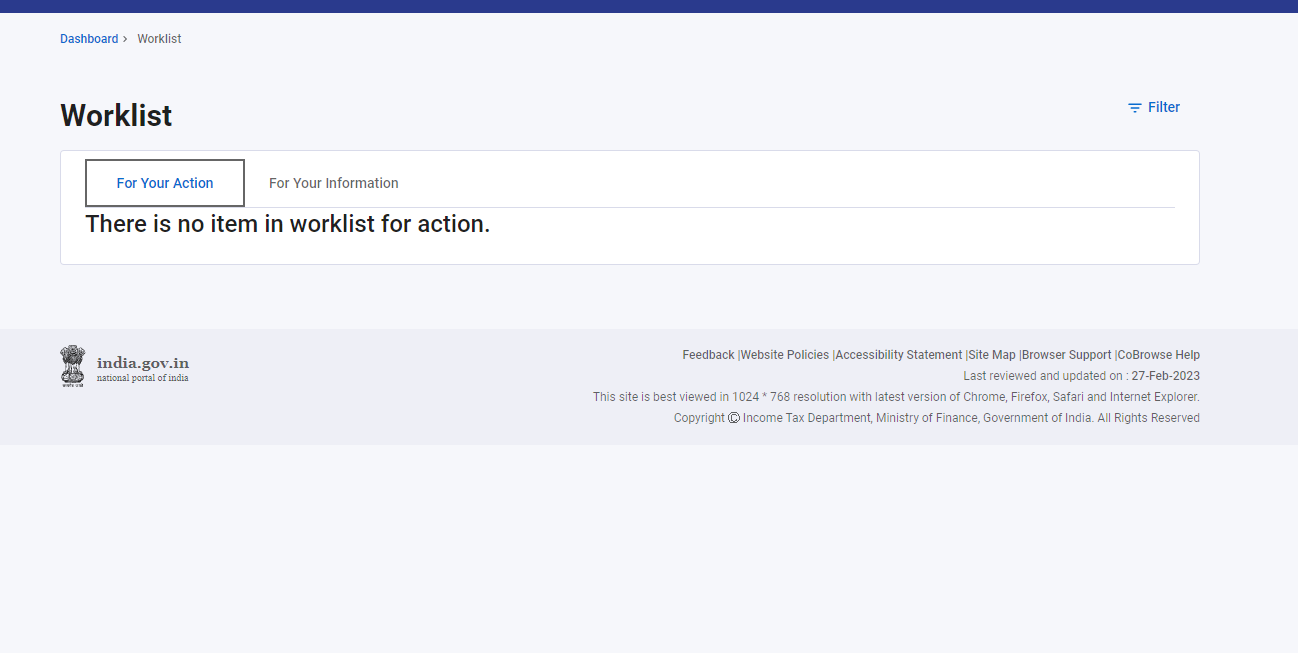

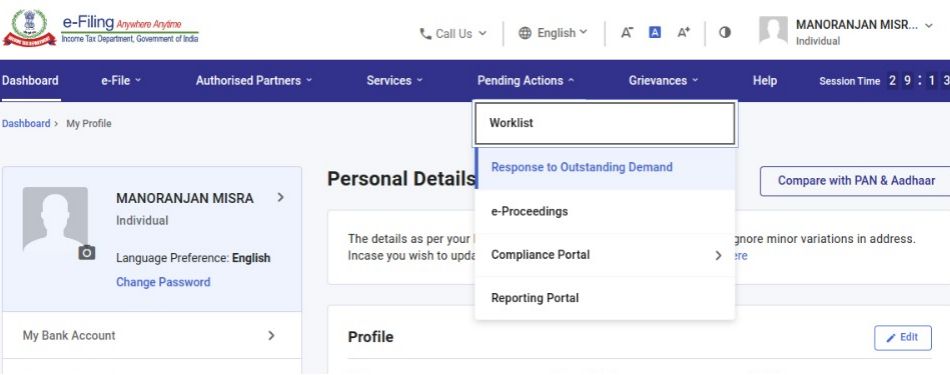

2. On the menu bar, select Pending Actions and click on Worklist

- Any notices sent to you will be visible in the worklist

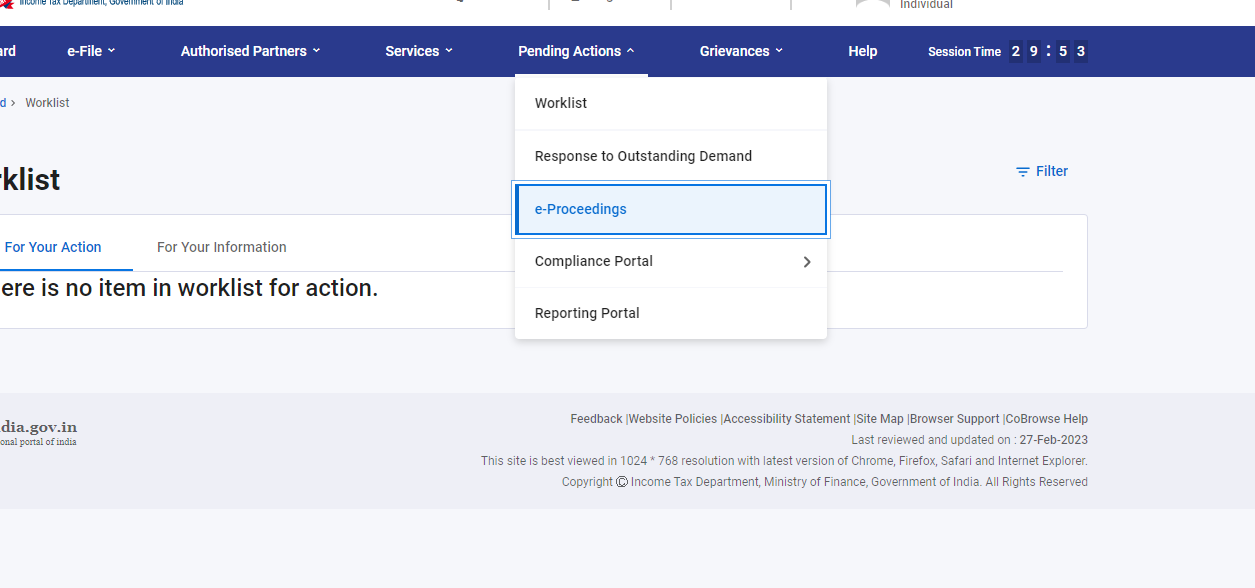

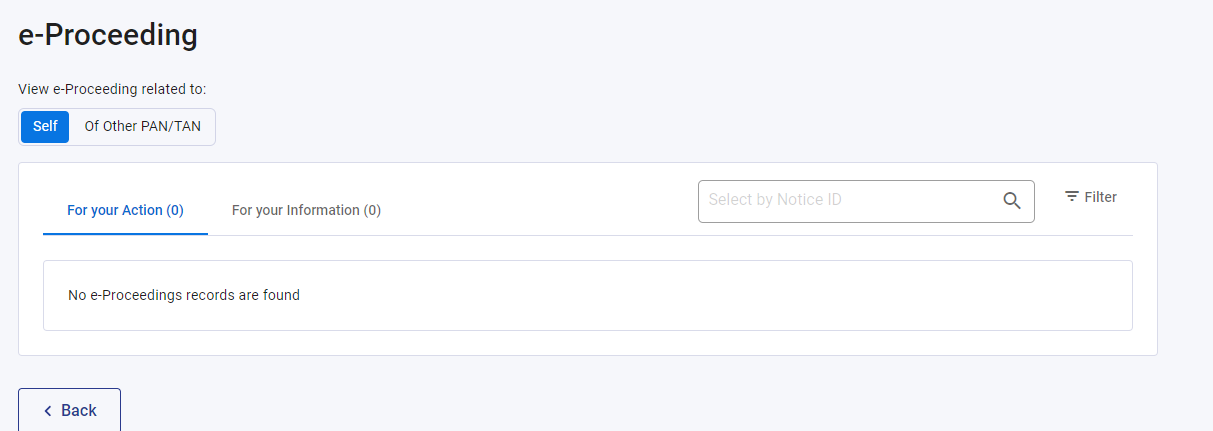

3. On the menu bar, select Pending Actions and click on e-Proceedings

- Any notice sent to you will be visible under e-Proceedings.

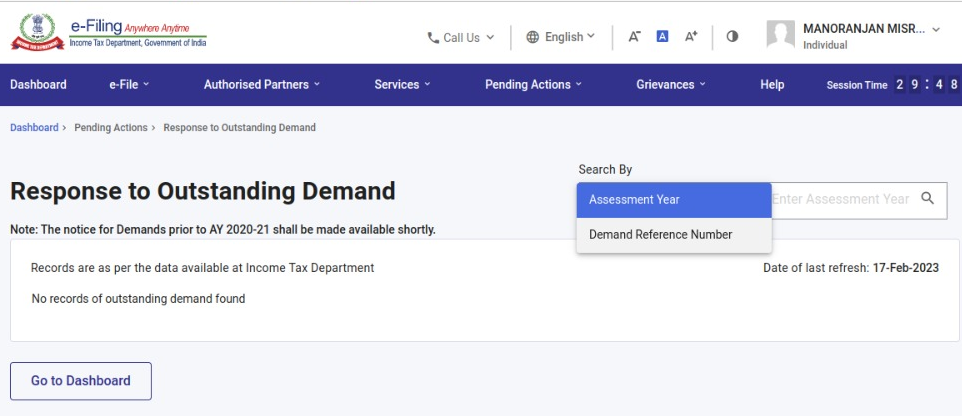

4. On the menu bar, select Pending Actions and click on Response to Outstanding Demand

- Any demand under your account will be visible on this page

Visit IndiaFilings to seek guidance regarding your Income Tax Notice Response.

1. On the menu bar, select e-File and under Income Tax Returns, select View Filed Returns

1. On the menu bar, select e-File and under Income Tax Returns, select View Filed Returns

2. On the menu bar, select Pending Actions and click on Worklist

2. On the menu bar, select Pending Actions and click on Worklist

3. On the menu bar, select Pending Actions and click on e-Proceedings

3. On the menu bar, select Pending Actions and click on e-Proceedings

4. On the menu bar, select Pending Actions and click on Response to Outstanding Demand

4. On the menu bar, select Pending Actions and click on Response to Outstanding Demand

Visit IndiaFilings to seek guidance regarding your

Visit IndiaFilings to seek guidance regarding your