GST Registration Validity Extension

GST Registration Validity Extension

Normal GST registration certificate provided to regular taxpayers does not have a validity period and does not expire unless cancelled. However, the GST registration for casual taxable persons and non-resident taxable persons are issued temporarily with an expiry date. In this article, we look at the procedure for obtaining the GST registration validity extension.

All persons who are classified as casual taxable persons and non-resident taxable persons are mandatorily required to obtain GST registration, irrespective of the annual aggregate turnover. Further, the application for GST registration for a casual taxable person must be made at least 5 days before the commencement of business. GST registration application for casual taxable persons/non-resident taxable persons can be made using FORM GST REG-01. The registered taxpayers intend to extend the period of registration specified in the registration application.

Casual Taxable Person

A casual taxpayer has to apply for enrollment at least five days before the commencement of business. Persons running temporary businesses in fairs or exhibitions or seasonal businesses would fall under casual taxable persons under GST.

Non-Resident Taxable Person

According to the GST law, the taxpayers who undertake transactions involving the taxable supply of goods and services or those who have no fixed place of business or residence in India have to take registration.

Validity Extension

Casual Taxpayer or Non-Resident Taxpayer may apply for the extension of the registration period for a maximum of 90 days. The validity of the registration of a Casual/Non Resident Taxpayer can be extended only once.

Pre-conditions for Extension

The pre-conditions for applying for an extension of the registration period by a Casual/Non Resident Taxpayer are:

- An applicant who has a valid and active GSTIN having the type of registration as “Casual” or “Non-resident” Taxable Person.

- Prepare the extension application before the expiry of the validity of registration granted earlier.

- The taxpayer has to pay the amount in advance against the Estimated Tax Liability, for the period for which the extended registration is sought for, in his Electronic Cash Ledger.

- The taxpayer has furnished all returns due till the date of filing extension.

Online Application Procedure

Casual Taxable Persons or Non-Resident Taxpayers can follow the below steps to apply for GST registration validity extension:

Visit GST Portal

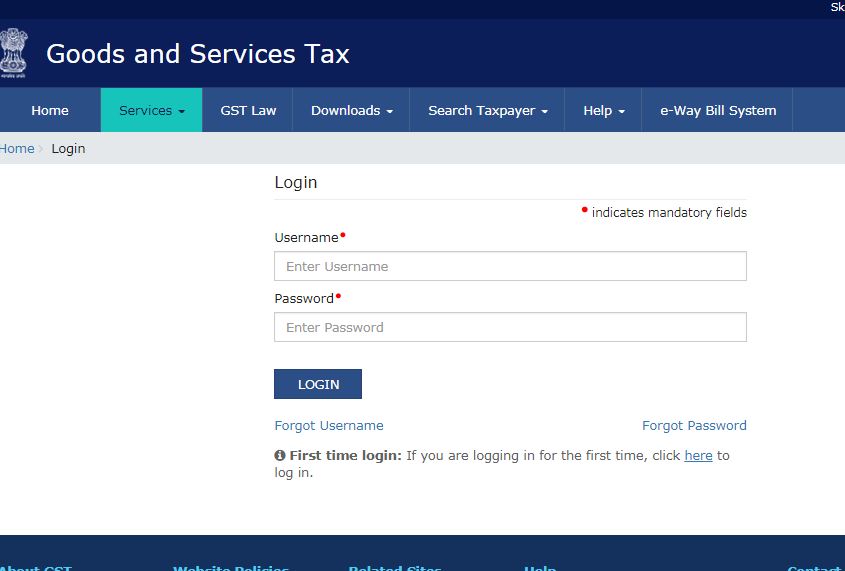

Step 1: Firstly, the taxpayers have to visit the Goods and Services Tax portal for the Extension Registration.

Step 2: Click on the ‘Login’ button to access the username and password page.

Step 3: Enter the correct ‘Username’ and ‘Password’ credentials along with the captcha in the required field and click ‘login’.

Step 4: Click on the Application for Extension of Registration period by Casual/ Non-Resident Taxable person link under the services tab that is visible on the home page.

Step 5: The Extension of Registration Period form with various tabs is displayed. There are two tabs as Business Details and Verification. Click each tab to enter the details.

Provide Business Details

Step 6: The Business Details tab displays the information for the registration of the registration period.

- Select the period for which requires an extension for using the calendar.

- In the Turnover Details section, enter the estimated turnover and Net Tax Liability for the extended period.

- Click on the “Generate Challan” button to pay the estimated tax liability.

The user could create multiple challans for payment of advance tax if the payment transaction failed using the challan created earlier.

Step 7: Once the payment is done, it will display the payment details.

Step 8: Click the “Save and Continue” button. A blue tick will appear on the Business Details section indicating the completion of the business details.

Verification Details

Step 9: This verification page displays the details of the verification for authentication of the details submitted in the form.

- Select the Verification checkbox.

- In the Name of Authorized Signatory list, select the name of the authorised signatory.

- In the Place field, enter the place where the form is filed.

- Click the Submit with DSC or Submit with EVC button.

In Case of DSC:

- Click the Submit with DSC button.

- Then click the Proceed button.

- Select the certificate and then click the “sign” button.

In Case of EVC:

- Click the Submit with EVC button.

- Enter the OTP that is sent to an email address and mobile number of the Authorized Signatory registered at the GST Portal and to validate OTP, click the Validate OTP button.

Step 10: The success message will be displayed, and the acknowledgement will be sent for completion in the next 15 minutes on the registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on the e-mail address and mobile phone number.

Check/ Track Status of Application

To know the status of the Extension application, Login to the Goods and Services Tax portal. Then click on the services tab that is visible on the home page. After that click on the Track Application status command from the Registration option to view the status.